- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Capital gains tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains tax

Hello,

my husband and I bought our first home in March of 2020. He got a new job and we are in the process of selling our home to relocate three hours away.

Being that we only lived here for 1.5 years I know we will have capital gains, but we are trying to research our exemption options.

How do we file exemptions for relocating for employment, and how much deduction is that for the total amount?

Are there any rules where we have to buy our next home in a certain amount of time to not pay the capital gains?

thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains tax

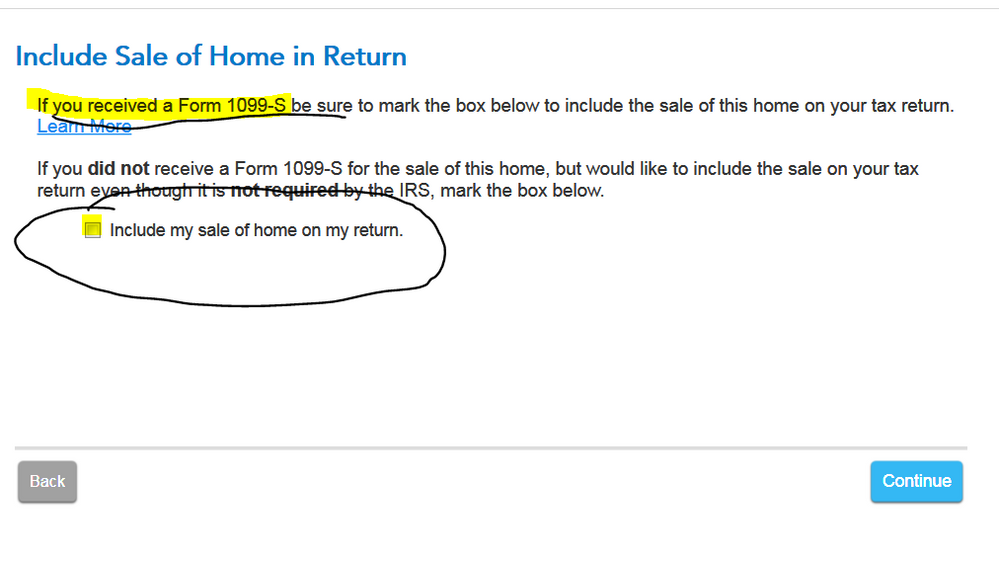

A partial exclusion for change in employment is handled in the home sale section of the interview so just follow the interview screens carefully. Most important is that you indicate you got a 1099-S at the closing and click on that box ...

To report the sale of a primary personal residence -

- Click on Federal Taxes (Personal using Home and Business)

- Click on Wages and Income (Personal Income using Home and Business)

- Click on I'll choose what I work on (if shown)

- Scroll down to Less Common Income

- On Sale of Home (gain or loss), click the start or update button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains tax

Rollover of your capital gain into your new home - that option was taken out of the Tax Code a long time ago.

How much profit do you have after 18 months?

Don't forget to adjust for closing costs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains tax

For work-related moves see https://www.irs.gov/publications/p523#en_US_2020_publink100073097

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

oreillyjames1

New Member

Cindy10

Level 1

user17538342114

Returning Member

abcxyz13

New Member

cm-jagow

New Member