- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Capital gains section asking for info from 2019

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains section asking for info from 2019

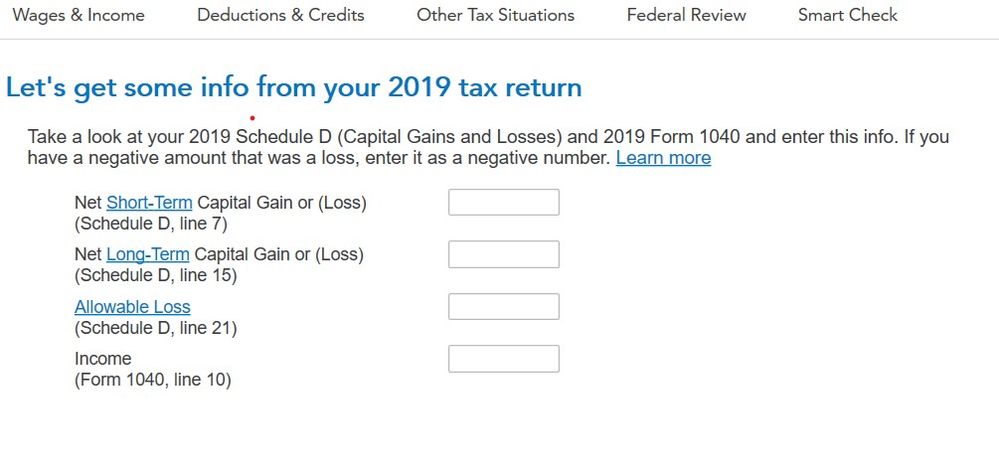

I am working on capital gain section in 2020 taxes (see picture). It is asking for info from 2019 return, but my 2019 return did not have a schedule D, do I just use $0?

Also, what was 1040 line 10 ? AGI? taxable income?

We filed a 1040-SR (senior) and the line numbers do not seem to match.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains section asking for info from 2019

If you did not have a Schedule D in your 2019 return, just leave the boxes blank.

In 2019, line 10 of the 1040 was the Qualified Business Income Deduction. Here is the link for the 219 1040 in case you need to refer to it again: 2019 1040,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains section asking for info from 2019

thanks

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

LMurray1

Level 2

miscles86

New Member

ame12158

New Member

davidtoole123

New Member

samarth2222

New Member