- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Capital Gains from private stock sale, no 1099B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains from private stock sale, no 1099B

received lump sum of a private stock sale in 2021 from a stock investment made in 1988. I received no 1099-B as the company accountant stated as "no tax documents are needed when there is a sale/purchase of privately held stock"

I received the income in the from of a bank transfer to my personal bank account.

I don't know the process of how to capture this income on my TurboTax, Self Employed software / tax return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains from private stock sale, no 1099B

when you get to the capital gain selection in Turbotax and it asks if sold any investments in 2021 answer yes. when it asks if you got 1099-B answer no. check i'll enter one at a time. a drop-down should open where you can enter all the necessary info.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains from private stock sale, no 1099B

THanks for your answer, however, I never saw the questions i was to see, nor did I ever get questioned as to not providing 1099-B. Maybe I was in the wrong section in trying to put in my lump sum income. Maybe it was Capital Gains? I dont think I ever saw that. I just tried to look for 1099-B part anywhere.

Maybe I'll just start over

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains from private stock sale, no 1099B

what version are you using and if using desktop are you using the step-by-step mode or forms mode?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains from private stock sale, no 1099B

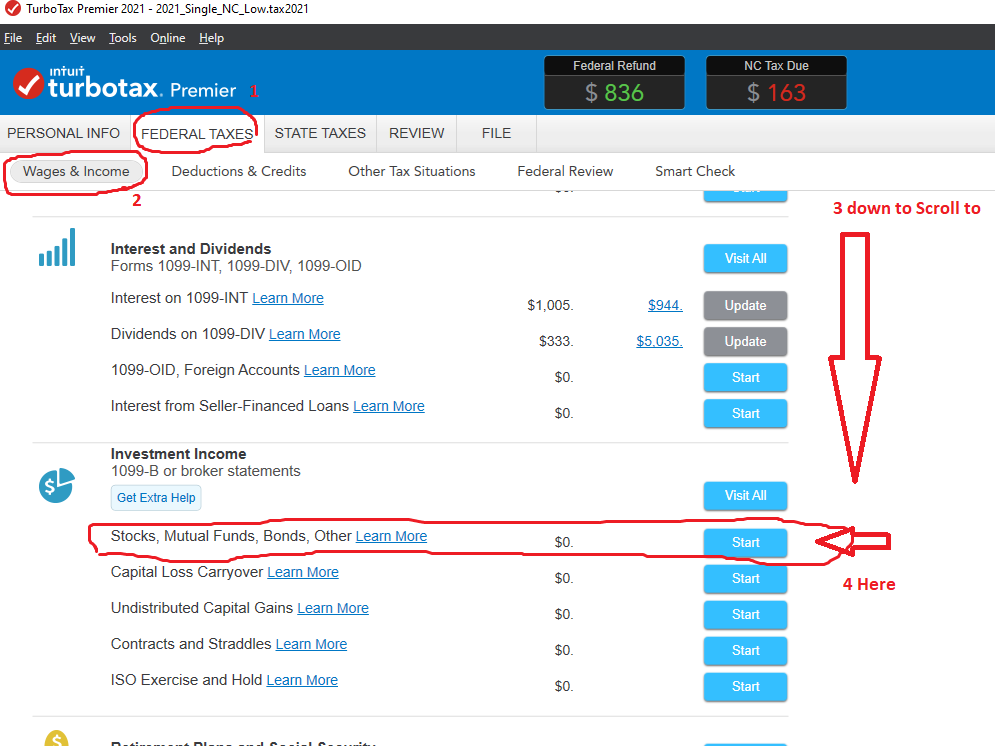

I found the way in using desktop....but someone would have to walk you thru, step-by-step if you are using Online software

(I've been using this program for over 20 years, and the Online entry of yoru situation, seems all buggered up to me):

_____________________

For Desktop software, you would start here:

__________________________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

fcp3

Level 3

Moonlight

Level 2

taxgirlmo

Returning Member

kfsj

Returning Member

jschoomer

Level 3