- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: CA Franchise 1099 Lacking Boxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA Franchise 1099 Lacking Boxes

I have a 1099-G refund from the CA Franchise Tax Board. It's very simple and does not have all the boxes that TT is asking information for. In fact, it only has two boxes numbered, #2 & #3, the taxable year and the amount of the tax refund. Am I just supposed to smartly 'wing it' the best I can to follow the TT questionnaire? Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA Franchise 1099 Lacking Boxes

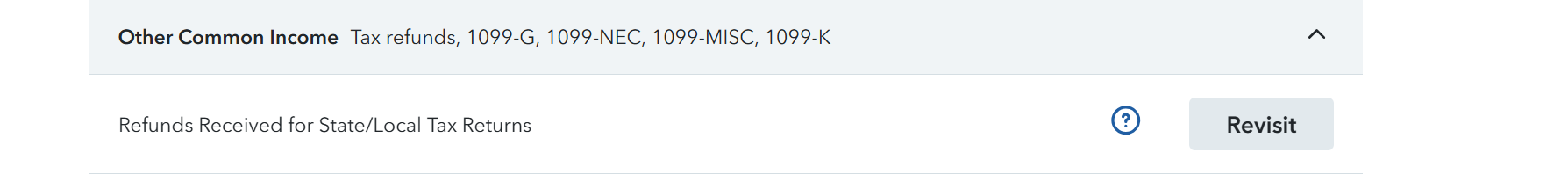

Look for Refunds Received for State/Local Tax Returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA Franchise 1099 Lacking Boxes

Thanks but maybe I wasn't clear. When I go into that part of the TT questionnaire, it eventually leads me to a question asking about what is in Box 5. There is no Box 5 on this 1099-G. There is only a Box 2 and 3. Right now it says I won't have to pay taxes on it, but I need to do the rest of my income before proceeding.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA Franchise 1099 Lacking Boxes

Are you entering it in the right place? There are several different places to enter a 1099G. A state refund goes under

Federal

Wages & Income

Scroll down to 1099-Misc and Other Common Income

You might need click on Show More to expand the section

Then it's the first line for Refunds Received for State/Local Tax Returns - Click Start

You do not want the next line that says Other 1099G Income

On the first screen check YES - Received a State Refund.

But you might not need to enter it at all.

Is it for a state tax refund you got in 2024 for your 2023 or prior state return? Is the amount in box 2? You may not need to enter it. Did you take the Standard Deduction on that year federal return?

A State Tax Refund is taxable if you itemized deductions on that prior year's federal return and took a deduction for state income taxes instead of the sale tax. You got a deduction benefit for it so now you have to include it as income. If you took the standard deduction it is not taxable and you don't need to report it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA Franchise 1099 Lacking Boxes

Thanks again. I have been using the State and Local Tax Refund path.

No, I itemized last year, not standard deduction.

And oh, just discovered that the Box 5 it's talking about is from my 2023 Schedule A! Sorry about that.

I have a bit of work to do on my income. I think it's best to back off of this for the time being so all the other numbers can be used by TT for any decision making.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CA Franchise 1099 Lacking Boxes

As for whether it's taxable, right now it says it's not. I have read that it depends on the difference in the tax you paid and the standard or itemized deduction (?) or something weird like that. <shrug> But don't get me to lying. Once all my income is done, I will see what is says.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RyanK

Level 2

bowtieextremist

New Member

Lonestar

Level 4

iiisee

Level 2

cook-edward86

New Member