- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: bugs with qualified tuition expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

bugs with qualified tuition expenses

turbotax 2019 seem to have problems with qualified tuition expenses and programs for earners where education expenses are normally phased out.

When phased out, turbotax shows $0 in these categories in the deductions summary.. including the 1098-T category.. but let's you enter data anyway. Ok so far...

So I entered my 1098-T information for my dependents including the data from the 1098-T from the school and other qualified expenses like books. turbotax takes it...

First time through the wizard, when asked about having a 1098-Q form for distributions I selected NO.. and completed most of the fed tax process.

Later, I returned and used the step by step guide to pick the category for 'ESA and 529 qualified tuition programs' and entered my 1098-Q details. (I had simply incorrectly answered the question previously in the step-by-step wizard.

This distribution was to me, not to the school, but was used all for qualified expenses. (the distribution was for $5k, the 1098-T for the beneficiary had tuition expenses over $14k)

This distribution should have no taxable impact to me because it was all for qualified expenses and the 1098-T shows there were at the least... tuition expenses in excess of the distribution amount.

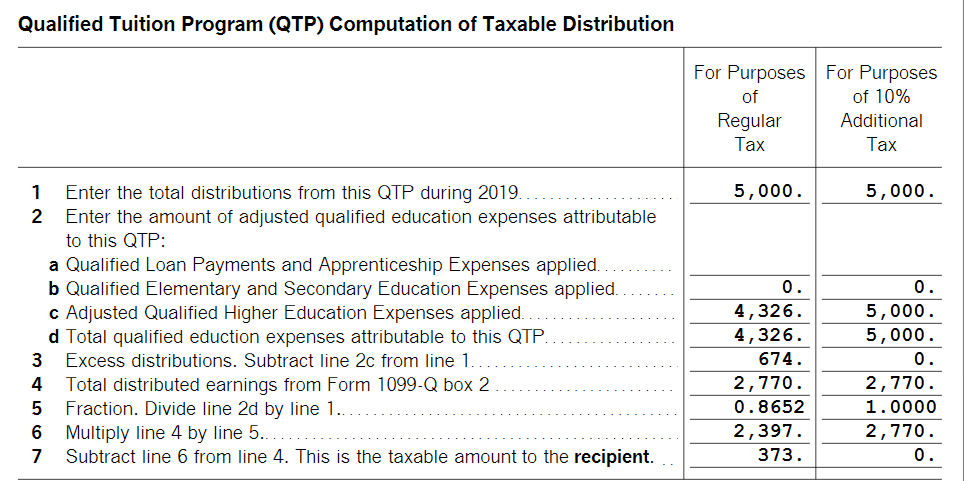

However after adding the 1099-Q, turbotax boosted my owed taxes. Going to the forms view, I viewed the 1099-Q form, and in the worksheet portion, it had these numbers

Here we can see on line 2c, it only has 4326 as my 'adjusted qualified higher expenses applied'. This number has no backlinks when you click on it. I have no idea where it was picking this number from. Like I said, my 1098-T has tuition expenses far in excess of this. After trying forever to find IRS instructions that may match this worksheet (none I could find)... I was giving up.. but I went back to step-by-step, and then went back into the 'expenses and scholarships' section to see if this number existed anywhere.

The wizard walked me through the questions about my dependents, I did not add any new forms or change any answers... it showed my 1098-T items and other expenses entered.

But this step by step is weird and doesn't always ask about the same child first (I have two dependents with 1098-Ts).. but if you get to the end, it does show a table with both kids and the ability to edit entries about them.

After going through this wizard again (WITHOUT changing anything)... the 1099-Q form changed automatically and it changed to a 1099Q 'summary' showing the correct 5000 in qualified expenses.

Without going through the wizard again... turbotax wanted me to pay taxes on an incorrect amount.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

bugs with qualified tuition expenses

this topic of 1099Q, 1098T and AOTC is quite complex.

in TT there is an 'auto analyzer' that launches to assess the best treatment for your educational expenses. that is probably why the numbers changed.

Note that if you are confident that the qualified expenses exceed the 1099Q / Box 1, then there is no need to even post the information into TT. Look at the instructions on form 1099Q closely - it states that you are responsible to determine if there is taxable income and if not, there is no reporting requirement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

bugs with qualified tuition expenses

I am having the same problem with 2020. How did you solve it?

Incorrect amount of adjusted qualified higher education expenses applied

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

bugs with qualified tuition expenses

If your entire1099-Q distribution was used for Qualified Education Expenses, you don't need to enter it in your return.

Save it for your records.

Click this link for more info on Form 1099-Q.

If your 1098-T has a larger amount in Box 1 for Tuition than in Box 5 for Scholarships, enter it in your return to qualify for Education Credits.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

bugs with qualified tuition expenses

I realized that I did not have the distribution code as 1 distributions and had none. Once I changed the distribution code at the bottom to 1 distributions, it came out as nontaxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

bugs with qualified tuition expenses

Thank you. I will remember that I do not need to enter 1099-Q next time if I get this issue again as we have more education expenses than distribution out of the plan.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

xiaochong2dai

Level 3

anonymouse1

Level 5

in Education

anonymouse1

Level 5

in Education

currib

New Member

bgoodreau01

Returning Member