- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

So what happens if you do all those things and it still doesn't give you those options? I have done everything suggested here but do not see the option for UBIA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

it may depends on the way you answered your questions. Try this approach to see if this will trigger that question.

- After entering the Box 20 code Z and leaving the amount blank.

- Press continue

- Next question asks you about the partnership, Make sure you check the box that says all my investment in this activity is at risk

- Next question asks we see you have Section 199A income. Be sure you check the first or second box.

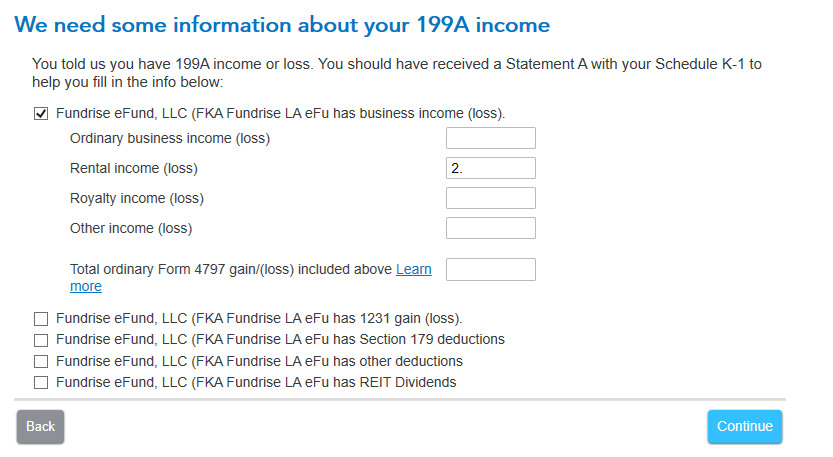

- Next question mentions We need some information about your 199A income. The second to the last box should be checked that says XX has UBIA of qualified property. This is what the screen looks like.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

this solved my problem I'd been pulling my hair (whats left) out over for 2 days. thank you!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

This worked. No more errors. I think there is a bug in the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

That did not work for me. Going back through step by step erased all my information on the K-1

Does anyone know what form it is on?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

If your K-1 information is no longer entered, you can follow these steps to re-enter your information:

- Sign in and open your return by selecting Pick up where you left off under a section.

- Search for K-1 and select the Jump to link at the top of the search results.

- This will take you to the Schedules K-1 or Q screen.

- Answer Yes and follow the prompts. You may be prompted to upgrade to Premier, if you're not already using it.

- We’ll ask some questions about your K-1, and then you’ll enter the data from the form.

@JimThompson

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

on the "You need some more information about your 199A income/Loss section" I couldn't find property rental income/loss selection for 2023.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

Can you clarify which version of TurboTax you are using? Online or CD/Download?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

I figured it out how to find the partnership rental income. Click on the partnership business income/loss and check on one of the drop down menu. the ERROR message disappear as soon as I entered the information in the dropdown menu. Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

I am using the CD/Desktop version and have the same issue. When asked to "Enter Box 20 info" I've selected "Z" and tried both leaving Box 20 blank and entering a positive value - makes no difference. After entering a positive value I progress through the next screens selecting "...activity at risk" and "income comes from the partnership that generated this K-1", then select the second box in the "Need some information about you 199a income" and enter a positive number in the LLC 1231 gain box. When I run the review it shows "Z" and the amount I entered, but gives me the error "Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A". Looking at the Form View I see the entry I made in Sections A and B but not in any further Sections.

Welcome any help from the Community. The only way I am able to get around this issue is to not select Box 20. If I have a positive number do I even need to select this Box?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

A 1231 gain or loss does not qualify for QBI because it is considered a capital gain and not ordinary business income. Check to see on Statement A if there is ordinary income to report as this qualifies for QBI.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

Thanks Dave. I checked with the accountant who prepared the K1 and he agrees that as a section 1231 gain this income is not QBI eligible. The LLC held land which was sold in 2022. There was no ordinary income associated with the sale or included in Statement A. With this information can you help me understand how information should be entered so that TT no longer flags this as an error?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

Yes, clear the Box 20 field because you have no Code Z (QBI) information. Any Section 1231 gain should be in Box 10 on your K1 which will carry to the appropriate section of your tax return.

Be sure to clear the information, not just remove the checkbox for an entry in Box 20.

This should clear the error for you. Please update here if you have more questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

Thank you, this finally solved a problem I spent hours on. But the key is not only do not NEED to enter an amount, YOU (MAY) NEED TO LEAVE IT BLANK!

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17604719363

Returning Member

Edge10

Level 2

statusquo

Level 3

pjm96moore

New Member

tbarber

New Member