- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

I see I'm not the first person to ask this question but I can't find an answer that seems to fit.

I have a K-1 from Sunoco LP. Box 20 Code Z = $-583. Box 20 Code AH = STMT.

The attached statement looks like this...

I can't for the life of me figure out how to map these codes and amounts to the Section 199A worksheet..

Any help would much appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

Under wages & income, bring up the k-1 for review.

Cycle thru the screens until you reach the screen with the

header "Enter box 20 info". Verify that code Z with the descriptor and the amount are entered.

Then cycle thru several more screens until you reach the one with the header "Any qualified business Income (QBI) carryovers?" If there any verify that they are entered.

The next screen states "We see you have section 199a Income". Normally, the top line should be marked.

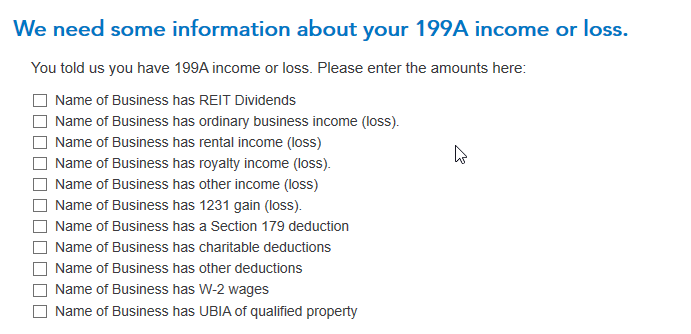

The next screen header "We need some info about your 199A income."

This screen works with Statement A. So if its blank, click on the "show relevant form" button at the bottom. As you make entries on the screen, you will see them entered into

Statement A.

Then cycle thru until the end.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

I am getting the same error and I appreciate your efforts to help answer this question. However, when I attempt to scroll through the screens after entering line 20 data, I don't see the same questions you reference. I am using the Premier version of turbotax. Am I missing something? Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

While I didn't find the same initial questions, that last part of your advice did the trick. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

I tried following the above instructions but it only took me to the beginning of the K-1 form, which didn't help. So through trial & error I Zoomed into "Code Z Section 199A", selected SunocoLP, and ended up at the worksheet you see here. I entered 0 into Ordinary Business Income, and when I ran the error check it gave me a clean bill of health.

I still don't see any connection between the supplemental statement that Sunoco sent me and the entries here, but as long as it works... 😉

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

The supplemental statements will usually include information that should have been entered here. if there were none, you can either put a zero like you did or not recording anything in Box 20 (including the code) since this was a irrelevant entry. Be sure to check those statements though just to make sure.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

I included a screenshot of the supplement in my initial post. Since Sunoco labeled them all with code AH, I entered them into AH as well. Does this look right?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

Follow these instructions:

Here is the order that should appear in your return in Box 20

- if there is a AH, select AH in the drop down and leave the $ blank.

- Next screen is a screen that says enter Box 20 AH amounts

- You will enter these as other description enter below Don't worry about only having 4 spaces. As you make your entries beyond the 4th box, additional boxes will appear.

Certain items (generally labeled "Other") on your K-1 may need to be entered in several different places in TurboTax. Consult the instructions that were included with your Schedule K-1. Look at all your supplementary statements that came with your K1. Pay particular to anything referring as Statement A or scan through your statements to see if there is a reference to Box 20 and how the information should be recorded. Then follow the directions that I gave you above to record the information listed on the statement.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

Thanks, DBinSD! I did see the QuickZoom button for 20 Z. However, clicking on it has no response what so ever. This must be a TurboTax bug and they need to fix it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

If for some reason our QuickZoom button for box 20 code Z is not working, just scroll down on the K-1 Partner form (Forms mode) to Section D1. There you will see the line items to enter the information from your "Section 199A Statement/STMT" associated with your box 20 code Z. Note that you don't have to enter an amount in box on the box 20 code Z line, just the code Z. Then scroll down to Section D1.

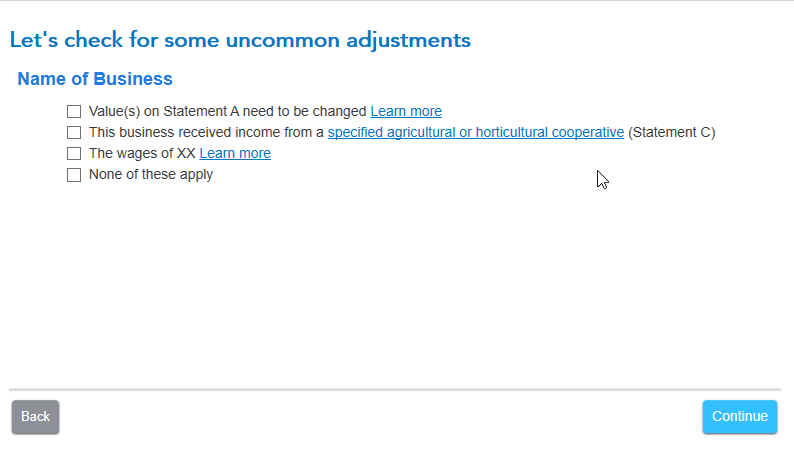

You can also enter your box 20 code Z information in the "Step by Step" interview. Enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount there. Continue on, and you'll find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement or STMT that came with your K-1. The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1 Section 199A Statement/STMT:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 20 Code Z has been selected but no Section 199A income has been entered on Statement A

Thank you DBinSD. I ran into this issue because I have no OBI from the rental, just a rental loss, but the turbotax interview does not place the 0 in section D for me, leading to a review error that is hard to figure out. Placing the 0 for OB1 corrects the Code Z error. Last year I changed code Z to code AH to fix the issue, and I feel better this year with the OBI correction.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

astan2450

New Member

dave-j-norcross

New Member

anth_edwards

New Member

tcondon21

Returning Member

ellenbergerta

New Member