- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Accidentally filed Non-Filer, how to fix

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

This FAQ site may also answer your questions.

https://www.irs.gov/coronavirus/economic-impact-payment-information-center

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

Hey! They same exact thing happened to me. I filled the Non-filers thinking I needed to it in order to get the stimulus check, and now I can't file my taxes. Anyways, what did you choose to do? Did you just mail the 1040? How did you make the notation for 1040X? Where did you get the IRS address? Did you consult with someone else about this? I would appreciate your response! Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

Hi, I have accidentally filed the non-fillers form and now I have filled a new 1040 filer form from turbo tax. Also, I am attaching a 1040X form for amendment. But, I am confused about how to file a 1040X form. I have already filled out the basic details and part III that is the explanation, how to complete the rest of the details.

On another hand, does writing a cover letter instead of a 1040X form is acceptable by IRS and a good option.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

Hello, welcome to the non flier mistake maker page lol. You'll find many other pages like this one, many of them much longer.

This is a mistake many folks have made so dont feel bad.

I'm actually taking a different approach; I'm gonna wait and see if some sort of remedy may be made available to us since there are so many people piling up with this same mistake.

Besides, last time I looked the irs isnt processing paper anyway.

Would be unfortunate to mail in your returns and then the irs actually does issue guidance allowing us to efile once again.

But listen to the experts here. I'm just offering up a welcome and layman's insight.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

As of right now, I have not found a for sure answer. Ive been told that if you filed the nonfiler form then you wouldn't be able to file taxes normally for 2019. That I have to print out and mail in an amended tax return. However the IRS website says it's still not processing paper returns at this time so I haven't done anything with that.

I still have not received the stimulus check either, so I do think I have slowed down the process even tho my nonfilers form wasn't accepted. I left it alone after finding out that I didn't need to file it being on SSI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

What if i filed my taxes in march and then turned around and file a non filer in April cause i wanted to change my bank info? So now my taxes are still process and the non filer was rejected. What do i do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

Since the nonfiler form was rejected, it was never processed or received. This means that your bank information wasn't updated, but your tax return also wasn't changed or interrupted.

You may still be able to change your bank information for your economic impact payment if your payment has not been processed or has been returned. You can check here for the status of your payment and potential options to update payment information: IRS Get my Payment Tool.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

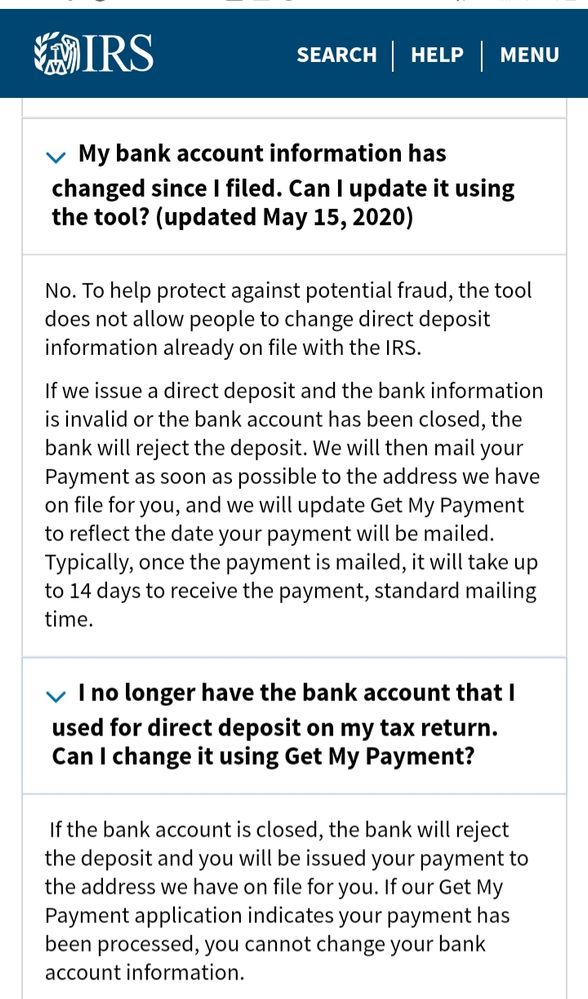

Just an add-on fyi to Susan's response, the irs FAQ on this issue was updated today. From their website faq:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

Hi, this was my previous question :I filled non filer form thinking that it was for people who didn't filed tax in 2018 as I was in need of stimulus due to job loss. I found that my husband filed jointly in 2018 and I was dependent. Also, came to know that he already filed our tax for this year in March which I thought he will file in the month of May, my bad. Now IRS accepted my non filer form. I need to let them know we already filed for 2019 and need to cancel this?

After I posted this, many told me that my non filer form must be deleted by IRS. But today, I found out that they are depositing my stimulus amount on 20th May using my non filer form. Please let me if there will be any problem in my 2019 tax return which is already in processed..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

@Priya1409 I have similar situation as you do. But my mailed tax return hasn't been processed yet (at least haven't heard back from it). I got the stimulus check deposited two weeks ago, too. I think for now the best choice is just wait for IRS's feedback. I'll wait for their decision on my real tax return and then take actions as needed, as suggested by multiple CPAs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

My only choice is to wait and see.

Accountants have told me the same thing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

I'm no expert but I wholeheartedly agree. Mailing paper right now is pointless and they may offer up some solution shortly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

Priya, you dont mention how your husband files, be it efile or paper. If hes already efiled or had his paper return processed then you're both golden for now. It may become an issue later on if ur husband claimed you as a dependent for 2019 and you successfully filed for and are receiving a stimulus check, but it will probably be ages from now after things have returned to normal, if ever.

Or, they may never catch it. It's a simple mistake LOTS OF PEOPLE HAVE MADE without malice or ill intent. It wont be viewed as "trying to get over" or anything like that.

My suggestion is ENJOY THAT $1,200 GAAAAAL! lol

But I'm no expert. Listen to these other folks who are(and then enjoy that cash, hahahaha)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

- Hi, it is e filed.. For 2019, it is filed as married filing jointly in the month of Marche 2019.. But for last year for 2018 tax return, I was not working so he filed me as dependent under him..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Accidentally filed Non-Filer, how to fix

That's why it's not fair how the IRS is handling this.

People's income and situation can vary greatly between the two years.

Depending on which year's taxes they use is how they'll decide if you're eligible.

I'm guessing, but if it was me, if I didn't receive it this year, I would file for it in next year's taxes (2020).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Maverick1984

Returning Member

wmendoza00

New Member

ashley923herrera

New Member

matthew-n-mccall

New Member

bjw5017

New Member