- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: ACA Help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ACA Help

I have 2 questions.

First, an apology for the long post but I've been chasing my tail trying to get an answer. Even from TurboTax professional I chatted with.

Some background:

I retired in May 2023 and got a healthcare plan from healthcare.gov. I have 2 children and am a widower. My son is an adult and disabled and gets Medicare/Medicaid and my daughter is an adult but is a full-time college student. Both kids have part time jobs and file their own returns. I can only put my daughter on the healthcare.gov plan because my son can't since he already receives Medicare/Medicaid.

I usually claim my son as a dependent but with his SSDI and income on the MAGI, I owe a lot back to the govt on my return based on our actual household income in 2023 for our ACA premium help. If I don't claim him as a dependent my understanding is I don't add his income and SSDI to the household income for the ACA premium subsidy which lowers the amount of ACA subsidy I have to pay back on my return.

1. Is that ok that I don't claim him and remove his income from MAGI? Anything I'm missing here? Can I claim him in the future?

2. Does my daughter who I will claim as a dependent need to do anything with her return re: the 1095-A? Does she answer no to having healthcare via ACA? Or yes? If yes does she need to enter any 1095 info on her return? I am the recipient of the ACA plan and she is a "covered individual". She paid nothing for the plan. TurboTax keeps telling her she should enter 1095 info or certify she didn't receive a 1095 on her return because she answered yes to having healthcare.gov plan and to allocate the %, etc..

Then on the review of her federal info it generates an error saying the recipient SSN (me) claims her as a dependent and to delete the 1095 from her return. Sooooooo confused...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ACA Help

A household, for purposes of determining eligibility for premium tax credits, includes any individuals whom you list on the federal tax form. That includes yourself, your spouse, and dependents. Dependents include children who meet certain requirements:

- U.S. citizen or resident of the U.S, Mexico or Canada

- Live with you for more than half the year

- Under age 19 at the end of the year (or under age 24 if a full-time student); a child is considered to live with the taxpayer while he or she is temporarily away from home due to education, illness, business, vacation or military service.

- Doesn’t provide more than 50% of his or her own support

If your daughter is 24 or older, she could only be your dependent if she meets the gross income test; for 2023, she would have to have earned no more than $4,700 to qualify.

Your son could be a dependent if he is considered fully disabled, but he has SSDi and Medicare/Medicaid and you don't have to claim him as a dependent.

If you don't claim your adult children as dependents, then they won't be part of your "tax household" for purposes of calculating the Premium Tax Credit.

Therefore:

1 - Yes, you can remove your son from your tax return. If the situation changes, you can claim him in the future if he qualifies as a dependent.

2 - See this TurboTax help article regarding your daughter's situation. Choose the scenario that applies as to whether and how to enter 1095-A information on her return. If she is your dependent, and has so indicated on her return, TurboTax will advise "Since someone is claiming you on their 2023 taxes, you don't have to complete Health Insurance".

See also this IRS article for more information about the Premium Tax Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ACA Help

Thank you. My daughter is 21 so she fits the criteria for a dependent.

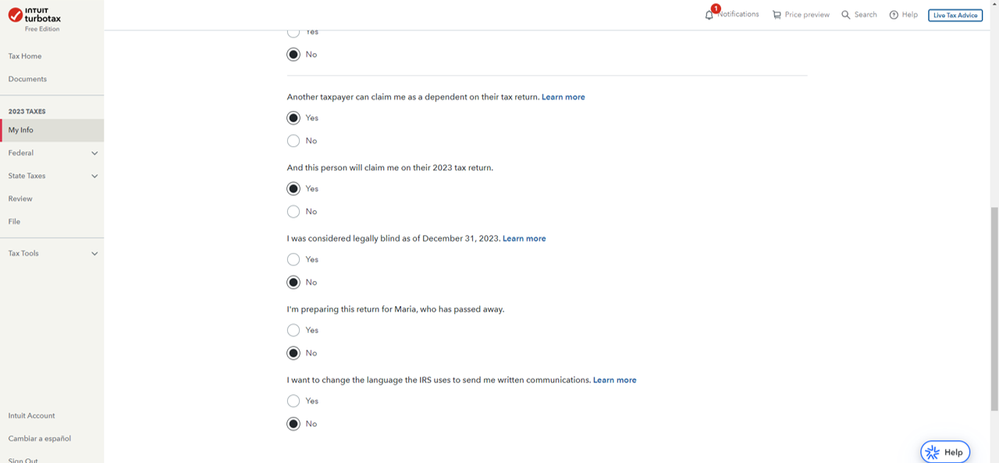

I thought we followed your instructions on her return but we'll try again. She checked the boxes on her return noting she is being claimed as a dependent AND she is being claimed for 2023 at the beginning of filling out her taxes.

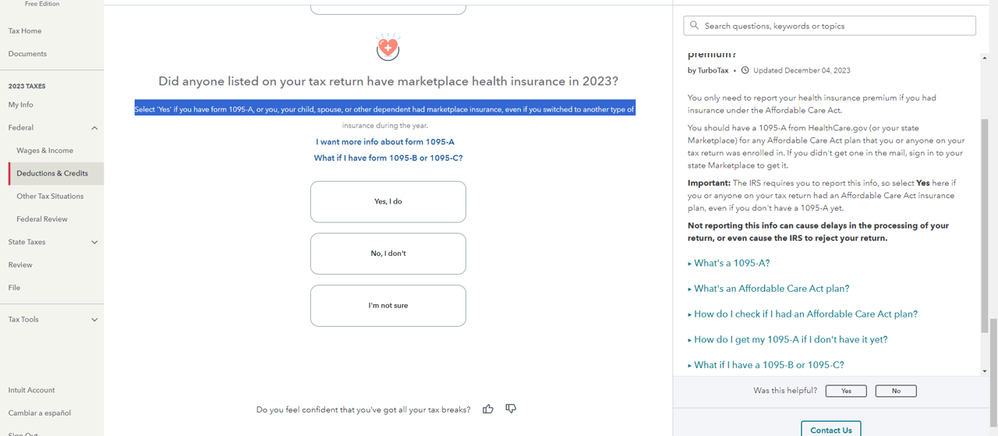

But later she is asked if her or anyone in the house got insurance from the ACA marketplace. She answered yes and we went down the rabbit hole of her entering a 1095, %allocations, etc. or her needing to certifying she didn't get a 1095..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ACA Help

If she was being claimed as a dependent and indicated in the MY INFO section so then none of the 1095-A section would need to be filled in ... in fact that section should not have been presented at all. Return to that section and remove any entries you have made incorrectly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ACA Help

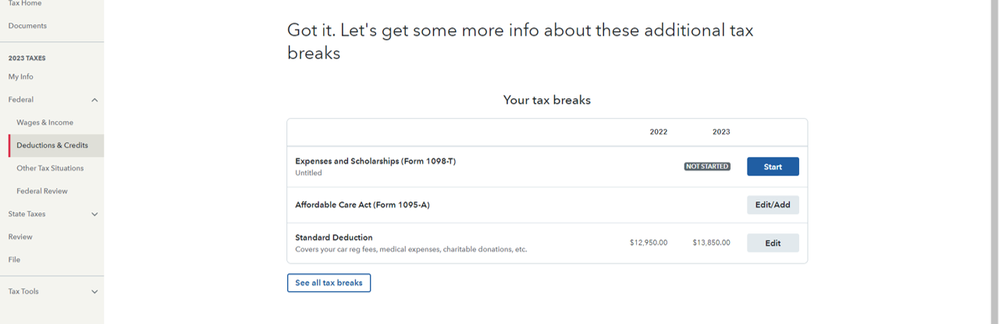

Well, we tried again and same result. I have screenshots attached. What should she answer when it comes to the 2nd screenshot if she is my dependent. Should she answer NO here to not be presented with the screens to enter a 1095???

Screenshot 1 is the info section with her being claimed as a dependent for 2023.

Screenshot 2 asks if you had insurance via ACA. NOTE THE INSTRUCTIONS and it saying did YOU receive a 1095 OR (pay attention to the OR) YOU, your child, spouse, or other dependent had marketplace insurance. I think this is an incorrect statement and should be fixed. Shouldn't that say YOU only if you are not claimed as a dependent or something like if you are claimed as a dependent on another taxpayers return answer NO to this question.. If you answer yes I do on this screen you go to the rabbit hole on a 1095 or certification you didn't receive one.

Screenshot 3 is the rabbit hole I mentioned.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

ACA Help

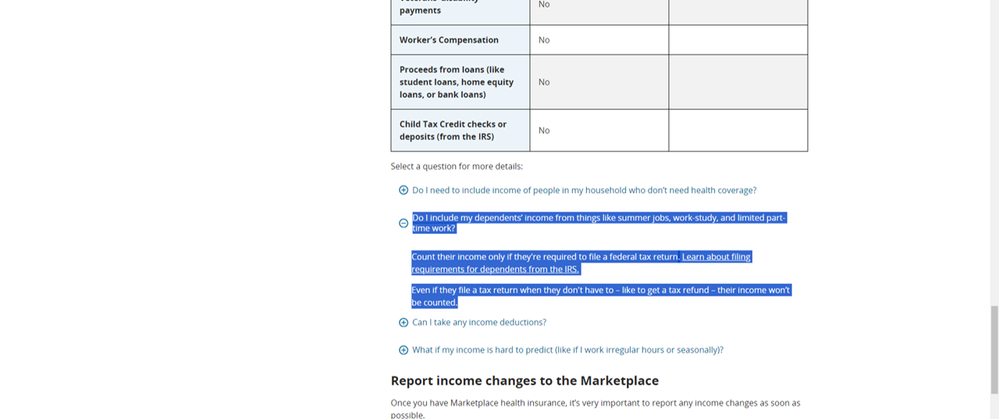

Just for clarification: Just because you declare them as dependents, does not mean they are part of the "tax household" and that their income/disability benefits should be included in MAGI for a Premium Tax Credit for ACA.

Right from healthcare.gov website Healthcare.gov: (See highlighted text)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

GingerE

New Member

GlowormR49

New Member

bgix

Level 1

dwitkow08873

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill (OBBBA)

user08181992

Level 1