- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 2019 tax refund sent to old address and return check to IRS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i file tax 2020 even i dont have any income or W2 to claim my Recovery Rebate credit.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i file tax 2020 even i dont have any income or W2 to claim my Recovery Rebate credit.

If you have no taxable income at all, you will have to list at least $1 of taxable income in order to e-file your return. You can list $1 of “other income“ or of bank interest income. This will not cause a problem with the IRS and will not increase your tax or affect your rebate payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i file tax 2020 even i dont have any income or W2 to claim my Recovery Rebate credit.

Yes, you can.

Stimulus payments were advances on the Recovery Rebate Credit.

If you didn't receive the full amount for your first or second-round stimulus payments, we'll help you claim the Recovery Rebate Credit when you file your taxes this year.

We'll make sure you get the money you qualify for by double-checking the amount and quantity of stimulus payments you received.

Here’s how:

- Enter all of your federal return information as you would normally. During the Federal Review, we’ll check if you meet eligibility requirements for the stimulus payment. If you meet the requirements, you'll see a It looks like you qualified for the stimulus, did you get any payments? screen. We'll ask a few questions about any payments you've already received and then let you know if the Recovery Rebate Credit applies.

- If you need to make any changes to your stimulus credit responses, search for stimulus and select the jump-to link at the top of the search results to return back to the section. Enter your updated info and Continue.

It’s important that you enter the correct amount of each stimulus payment you received. The first stimulus payments were made between April and September of last year, while the second round of payments were delivered during January and February. You can find the exact amount,

- On your IRS letter-Notice 1444 and/or 1444-B which were mailed to you with the headline, “Your Economic Impact Payment Has Arrived” and were signed by the president. Or,

- By visiting IRS.Gov and creating or accessing your account. Or,

- In your bank statements. You might be able to search your online statements for deposits made by the IRS or US Treasury.

Additional information:

- Eligibility rules for the Recovery Rebate Credit

- Why am I not getting the Recovery Rebate Credit for my child or dependent?

- Why isn't the stimulus question showing when I'm trying to claim my Recovery Rebate Credit?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i file tax 2020 even i dont have any income or W2 to claim my Recovery Rebate credit.

If you have no taxable income at all, you will have to list at least $1 of taxable income in order to e-file your return. You can list $1 of “other income“ or of bank interest income. This will not cause a problem with the IRS and will not increase your tax or affect your rebate payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i file tax 2020 even i dont have any income or W2 to claim my Recovery Rebate credit.

my brother file 2019 tax return on turbo tax and its was approve IRS send checks to old address. and the check was return to IRS, its hard to call IRS no one answer, until now he dont get the money can he file it again this 2020. and he don't get the first and second stimulus . what we need to do

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can i file tax 2020 even i dont have any income or W2 to claim my Recovery Rebate credit.

First complete the current year tax return and make sure to indicate on the return that zero stimulus was received. The 2020 return was intended to reconcile your payments and will be part of your refund. You can do that by following the steps below.

In TurboTax Online, to claim the Recovery Rebate credit please do the following:

- Sign into your account and continue from where you left off

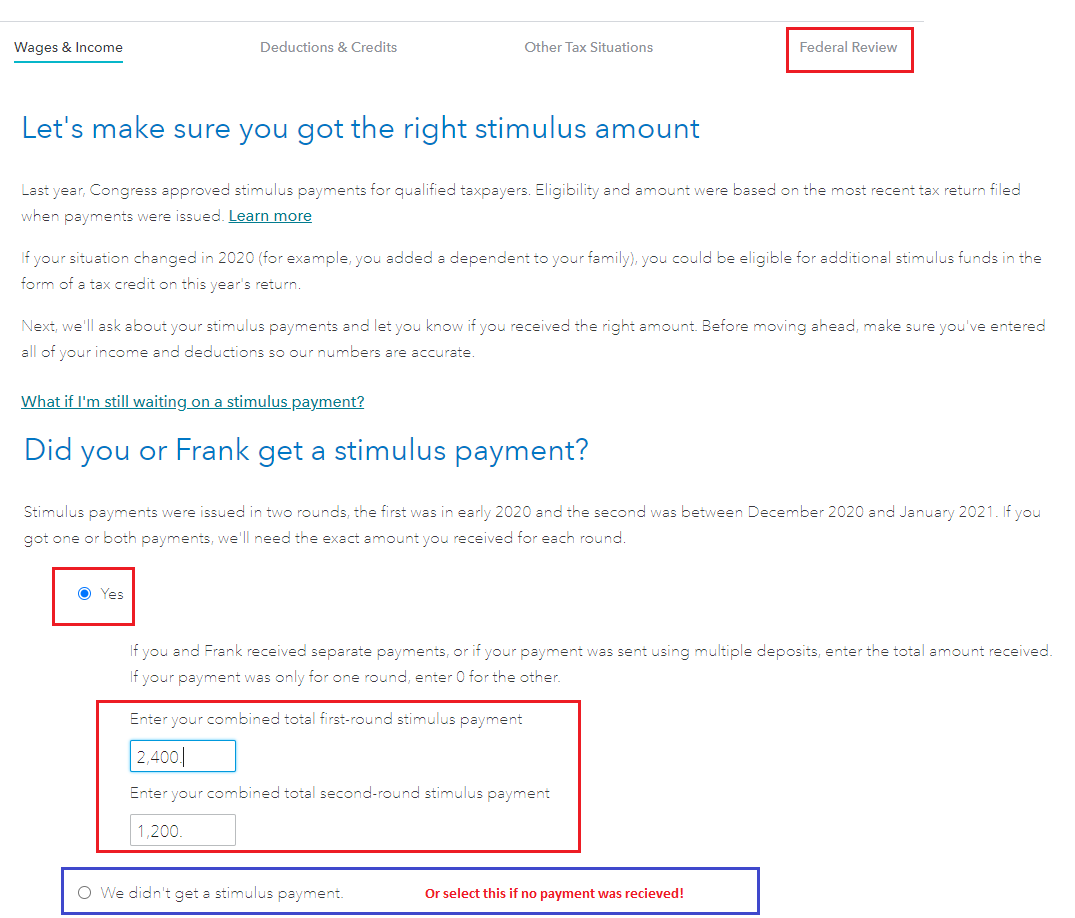

- Click on Federal in the left-hand column, then on Federal Review on the top of the screen

- On the next page titled Let's make sure you got the right stimulus amount, click on Continue

- Follow the interview

- TurboTax will determine whether you are entitled to any additional stimulus

- Any stimulus amount remaining due to you will show as a credit on line 30 of your form 1040.

- See the image below.

Next, you can complete the change of address for the IRS and include a statement that your brother is waiting for his refund to be reissued.

- Methods to change address with IRS

- Use Form 8822 - Where to file is included in the instructions with the form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JENNYKOBERNIK

New Member

Kiwi

Returning Member

easytrak2002

New Member

bagator1

New Member

savannahlilg05

New Member