- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

First complete the current year tax return and make sure to indicate on the return that zero stimulus was received. The 2020 return was intended to reconcile your payments and will be part of your refund. You can do that by following the steps below.

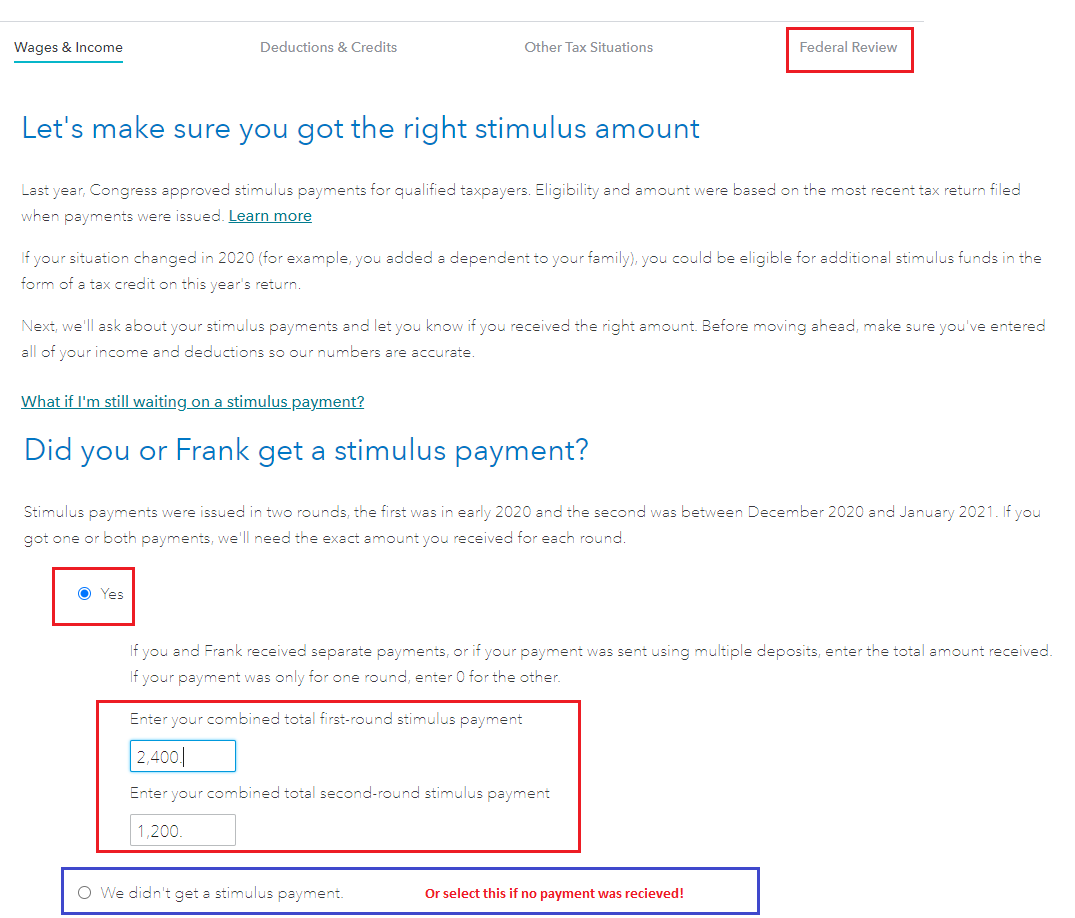

In TurboTax Online, to claim the Recovery Rebate credit please do the following:

- Sign into your account and continue from where you left off

- Click on Federal in the left-hand column, then on Federal Review on the top of the screen

- On the next page titled Let's make sure you got the right stimulus amount, click on Continue

- Follow the interview

- TurboTax will determine whether you are entitled to any additional stimulus

- Any stimulus amount remaining due to you will show as a credit on line 30 of your form 1040.

- See the image below.

Next, you can complete the change of address for the IRS and include a statement that your brother is waiting for his refund to be reissued.

- Methods to change address with IRS

- Use Form 8822 - Where to file is included in the instructions with the form.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 24, 2021

5:24 AM