- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 2016 HSA contribution refunded in 2019 due to insurance error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

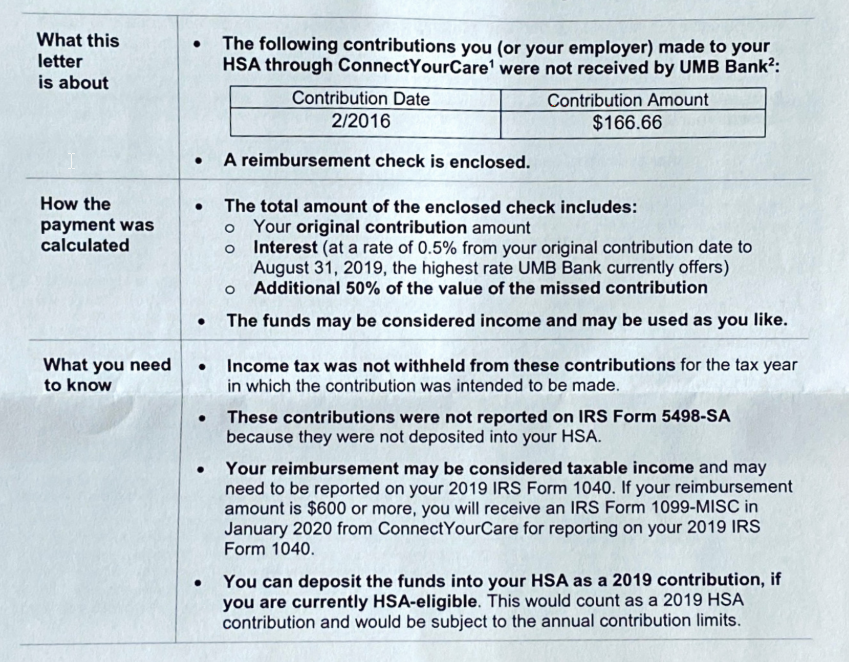

I had HSA account in 2016. Due to insurance error one contribution did not go thru.. Just last year August 2019, I received a check. Check is actual contribution amount + interest calculated for the last few years + 50% of the contribution money.

How do I handle this?

Back then, I received my 5498-SA without accounting for this error because the Insurance company realized the error in 2019. The insurance mail says, they took out the money from my pay check but never deposited into HSA account. So that money was lingering all these years. Also, refunded amount is <$600, so they do not want to give me a 1099-MISC. Do I amend my 2016 tax or should account this in my 2019 tax? Please help.

See attached picture of the mail from insurance.

Below is the text in the mail:

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

To start with, the 50% bonus, which sounds like an apology amount, is taxable income in the year you received it. This would be “other income“ which is at the bottom of the income page under “other uncommon income.“ The interest income is taxable income in the year you received it, and would be listed under interest income. Report it as interest that does not have a 1099-INT.

Now, you are going to have to help me clarify the situation with the base amount of $166.66. Was this amount included in the HSA contributions recorded in box 12 of your W-2 with code W for that year? What is this amount included on the form 5498-SA from the bank?

Assuming that this money was recorded as an HSA contribution by your employer, then it was not part of your W-2 box 1 taxable wages. So it’s taxable now in some form, although I’m not exactly sure how to handle that part of the payment. I’ll ring for a smarter person than me, while you answer those two questions. @dmertz

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

Your 2016 tax return probably should have been amended prior to the April 18, 2020 expiration of the statute of limitations for the IRS to be able to assess the tax on the under-reported income. Since this statute of limitations has expired, I think the IRS is required to send the payment back to you if you do amend. The IRS had the opportunity to detect the discrepancy and assess the tax because the amount in box 1 of your 2016 Form 5498-SA (taking into account any amount in box 3 of your 2015 Form 5498-SA) was less than what you claimed on Form 8889, but they failed to do so before the expiration of the statute of limitations.

The roughly $86 of interest and 50% compensation for the lost tax-savings potential needs to be included as ordinary income on your 2019 tax return. I would do that as Opus 17 described. I probably would not include the $166.66 on the 2019 tax return, but don't take that as tax advice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

Thanks for responding @Opus 17 and @dmertz

I verified my 2016 W2 shows exactly that amount less i.e. $166.66 in box 12

I am trying to find where to get 5498-SA form, however, looking at my 2016 HSA transactions and statements, they do show as if the money was credited to the account. Please let me get back with a definitive answer from 5498-SA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

Just finished the call and requested 5498-SA, they say it will take few business days to receive in mail.

However, adding up, contributed numbers in HSA statements for 2016, the numbers do agree with whats in W-2.

@Opus 17 just want to clearly answer your questions, see below.

>>Was this amount included in the HSA contributions recorded in box 12 of your W-2 with code W for that year?

->No, not included.

>>What is this amount included on the form 5498-SA from the bank?

No.

In conclusion, the $166.66 amount is not included in box 12 of W2 nor in 5498-SA. So, that money was basically taken out of my paycheck and lingering all these years with ConnectYourCare.

Looking forward for your help. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

The explanation that you received with the check indicates that the $166,66 was not included on the Form 5498-SA, so I based my reply on that. Had they deposited the $166.66 into the HSA in February 2016, it would have been included in box 2 of the 2016 Form 5498-SA. If the deposit was supposed to be part of your 2015 HSA contribution, it would also have been reflected in box 3 of your 2015 Form 5498-SA.

To really understand what contributions were reported as contributions for 2016, you need your 2015 and 2016 Forms 5498-SA. The amount contributed for 2016 is the sum of the amounts in boxes 2 and 3 of the 2016 Form 5498-SA minus any amount in box 3 of your 2015 Form 5498-SA. These forms would have been mailed to you (assuming that some amounts were deposited in or for 2015 and 2016).

Forms 5498-SA are available in your Wage & Income transcript from the IRS. Your 2016 Wage & Income transcript should still be be available for online download, but I think you would have to obtain your 2015 Wage & Income transcript by mail (although processing of mailed transcript requests is temporarily suspended):

https://www.irs.gov/individuals/get-transcript

It seems that your HSA administrator and HSA trustee are two different entities, with the HSA administrator providing the statements but the HSA trustee providing the Forms 5498-SA. What matters is what the HSA trustee reports and apparently your HSA statements were incorrect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

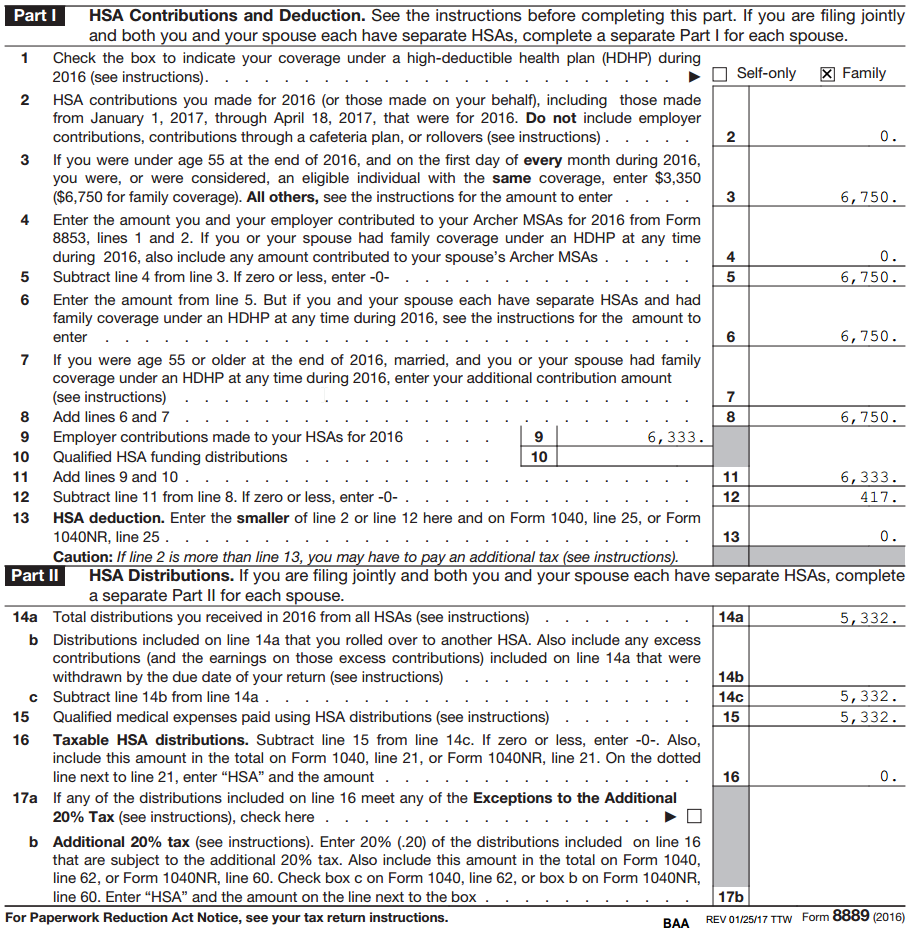

I have my 2016 tax forms in pdf. Please see screenshot below of FORM 8889. Page 2 of the same form has no numbers in it.

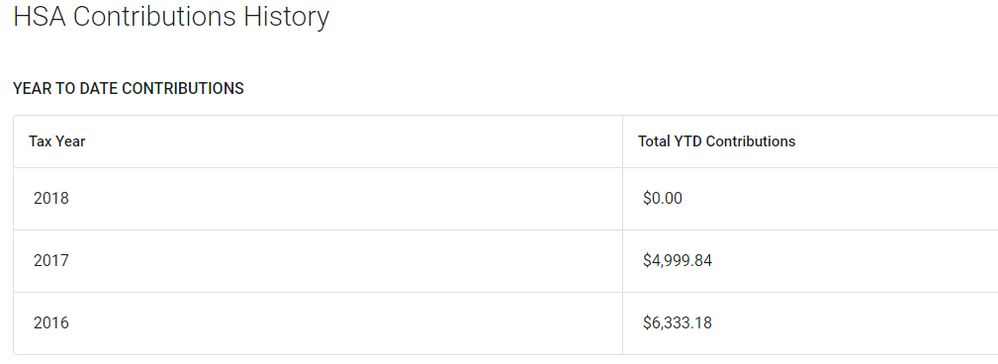

Also, please see contributions per year from my HSA administrator(ConnectYourCare) but not the actual bank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

Are you sure that the $166.66 not deposited was not reflected on your 2016 W-2 in the amount in box 1 and the amount with code W in box 12? The $6,333 that is present on Form 8889 line 9 (the code W amount) is suspiciously $167 short of a nice round $6,500, but that could just be a coincidence. If your 2016 W-2 did not have the $166.66 excluded from the box 1 amount and included in the code W amount, you already paid taxes on the $166.66 when you filed your 2016 tax return. The letter is not clear on this, stating only that "income tax was not withheld from this contribution." Still, I would expect your 2016 W-2 to reflect the sum of your 2016 pay stubs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

I ran a report of all HSA transactions in 2016 from my ConnectYourCare account and then filtering out transaction type='Credit' I SUMMED up all contributions made to the account and the sum comes to be

| $6,499.84 |

So, ConnectYourCare thought I contributed that amount but just last year they realized $166.66 was with them lingering.

My W2 box 12 shows correctly the amount that actually got deposited into HSA. So, W2 is right and I am hoping 5498-SA from actual bank(UMB) would be right. I spoke with customer rep from the UMB bank, she confirmed adding up numbers from their statements agrees with whats on W2.

The only entity here that is in error is ConnectYourCare, they're the one's who managed my HSA account.

Box 1 in W2 is independent of this error right? In other words, this error from ConnectYourCare could not have influenced this value?

I could call ConnectYourCare and ask them explanation for "Income tax was not withheld for this contribution."

Does my understanding, if true, sound like all I need to do is report the 50% apology money + interest money i.e. $86 as income in my 2019 taxes? And that my 2016 taxes need not be amended?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

Correct. Since the amount shown with code W in box 12 of your W-2 is only $6,333.18, the $166.66 that did not get deposited into the HSA would not have been excluded from the amount in box 1 of your W-2, so the $166.66 has already been taxed properly on your 2016 tax return. The only amount that needs to be included in income on your 2019 tax return is the roughly $86 that is the sum of the interest and the compensation for lost tax savings.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

@dmertz wrote:

Correct. Since the amount shown with code W in box 12 of your W-2 is only $6,333.18, the $166.66 that did not get deposited into the HSA would not have been excluded from the amount in box 1 of your W-2, so the $166.66 has already been taxed properly on your 2016 tax return. The only amount that needs to be included in income on your 2019 tax return is the roughly $86 that is the sum of the interest and the compensation for lost tax savings.

There is still something very odd here unless I missed it from reading too fast.

UMB only credited you with $6333, and your W-2 says you contributed $6333, but CYC thinks you contributed $6500?

My next question is what happened on your paychecks? And box 1 of your W-2? Were you really out $166 in 2016?

Because if, during one pay period in 2016 the money was not withheld from your paycheck, and you got a larger check that week, then you already received the money so the $166 in 2019 is new taxable money. (That's the simplest way that UMB and the W-2 would match, if the withholding was just missed all around.) If the money was withheld from your paycheck, then I don't understand how box 12 from your employer matches the bank instead of CYC. I just can't wrap my head around how UMB and your employer have the right figure in box 12 if your employer withheld the money from all your checks. The employer should have been tracking your paychecks and I would expect they would make their W-2s up using their own figures rather than the bank's figures.

You don't have access to your final pay stub from 2016 do you? If your employer withheld the money from your check as planned, I would expect that your final pay stub of the year would show cumulative $6500 in contributions and be different from the W-2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

Good points @Opus 17

UMB only credited you with $6333, and your W-2 says you contributed $6333, but CYC thinks you contributed $6500?

CYC transactions show $6499.xx

My next question is what happened on your paychecks? And box 1 of your W-2? Were you really out $166 in 2016?

The money was taken out of paycheck, so I am sure I did not receive a larger check.

I called CYC yet again, had a rather clear conversation. The customer rep, says $166 was withheld as pre-tax, therefore that amount, since it is valid HSA contribution, could be used now

1. For medical expenses and not be taxed

2. Could be used for HSA ineligible expenses, and then have to be as taxable income in 2019.

She recommended to go for #1 and have a medical expense receipt stapled to the letter for audit purposes.

She also said just like you and @dmertz said, to account and report $86 as additional income in 2019.

From her explanation, I am inferring that Box 1 of W-2 does not include $166. She was very clear that income tax was not withheld for $166 in 2016, because the money was "intended" as HSA contribution.

If the money was withheld from your paycheck, then I don't understand how box 12 from your employer matches the bank instead of CYC. I just can't wrap my head around how UMB and your employer have the right figure in box 12 if your employer withheld the money from all your checks.

CYC had the money $166 with them all these years, not accounted for. UMB reported what they actually received i.e. $6333.xx and my W2 Box 12 code W shows the same amount. I can ask my payroll whether they input value in Box 12 based on UMB input or whether they do their own calculation. From what it appears, it seems like they went with what UMB would've reported.

You don't have access to your final pay stub from 2016 do you? If your employer withheld the money from your check as planned, I would expect that your final pay stub of the year would show cumulative $6500 in contributions and be different from the W-2.

I do not but I asked my payroll if she can get those. Will update here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

@tax052020 wrote:

CYC had the money $166 with them all these years, not accounted for. UMB reported what they actually received i.e. $6333.xx and my W2 Box 12 code W shows the same amount. I can ask my payroll whether they input value in Box 12 based on UMB input or whether they do their own calculation. From what it appears, it seems like they went with what UMB would've reported.

It doesn't really matter at this point. What is curious to me is that your employer withheld $6500 from your pay, but put $6333 on your W-2 in box 12. Somehow the bank provided the correct contribution amount and that overrode the employer's own records and the CYC records when it came to preparing the W-2. It's very curious.

Pay tax on the interest and bonus payment and forget about the rest. I wouldn't even consider it needed to prove you spent that $166 for medical expenses since (a) you probably paid income tax on it already in box 1 of your 2016 W-2, and (b) even if you didn't, it's past the statute of limitations.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

I think the person that you spoke to that indicated that the $166.66 could be treated as if it had been contributed to the HSA is completely wrong. Since it never actually made it to HSA account and was presumably not reflected on the Form 5498-SA (yet to be verified) and not included the code-W amount in box 12 of your W-2, I can't see how the $166.66 can possibly be treated as a HSA contribution, even though it was withheld from your pay with the intent that it be contributed to your HSA. However, it doesn't matter since you already paid taxes on this money with your 2016 tax return and it's too late to do anything about that. Because you paid taxes on it, it's not HSA money and you can use it for whatever you like.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

I had a chat with my payroll. According to her there were no anomalies in pay stubs or w-2. So basically, all contributions in 2016 were taken out of paycheck as expected. So it seems like, the whole thing is hanging on 5498-SA.

1. If 5498-SA really agrees with Box 12 code W in W-2 then refund from CYC is a total error.

2. If 5498-SA is short of $166.66 from whats in W2, then the situation is as CYC says i.e. a contribution was taken but not deposited into HSA.

In scenario #1, the whole $257 I should report as income.

In scenario #2, the interest part and apology money i.e. $86 is to be reported as income and the $166.66 is pre-tax money, I did not pay interest in 2016 for that. So, has to be reported as such or use it as tax deductible HSA money for medical expenses.

I think the person that you spoke to that indicated that the $166.66 could be treated as if it had been contributed to the HSA is completely wrong. Since it never actually made it to HSA account and was presumably not reflected on the Form 5498-SA (yet to be verified) and not included the code-W amount in box 12 of your W-2

So far it seems a little bit off from what you are thinking, i.e., $166.66 IS reflected in Box 12, code W but NOT in 5498-SA(yet to be verified).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

march142005

New Member

superlyc

Level 3

AndrewA87

Level 4

Bluepatty

New Member

jayduran

New Member