- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2016 HSA contribution refunded in 2019 due to insurance error

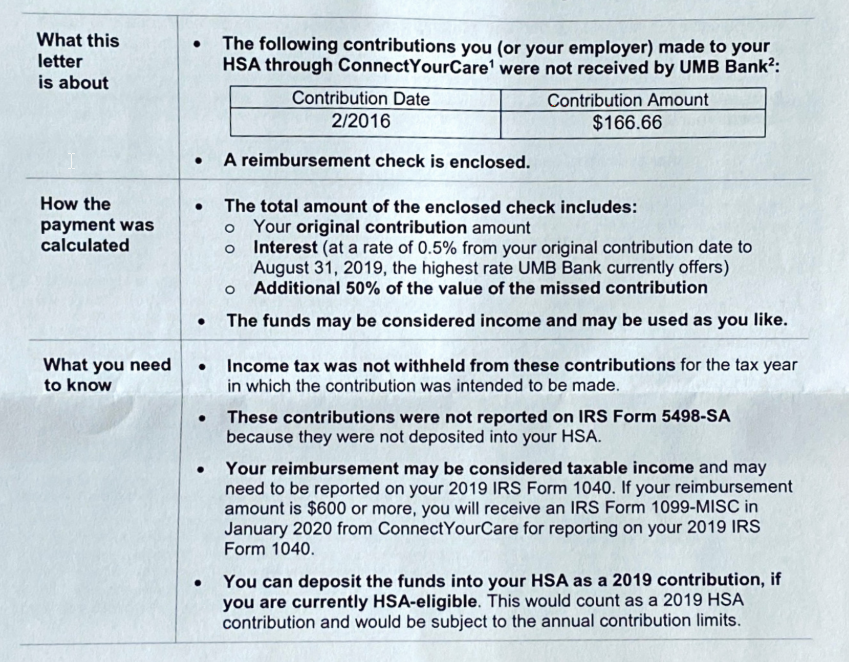

I had HSA account in 2016. Due to insurance error one contribution did not go thru.. Just last year August 2019, I received a check. Check is actual contribution amount + interest calculated for the last few years + 50% of the contribution money.

How do I handle this?

Back then, I received my 5498-SA without accounting for this error because the Insurance company realized the error in 2019. The insurance mail says, they took out the money from my pay check but never deposited into HSA account. So that money was lingering all these years. Also, refunded amount is <$600, so they do not want to give me a 1099-MISC. Do I amend my 2016 tax or should account this in my 2019 tax? Please help.

See attached picture of the mail from insurance.

Below is the text in the mail: