- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1099R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

On the input screen "Where is this distribution from?", there are 3 boxes as follows:

1. Pension rollover account

2. Other IRA distribution

3. Neither of the above

The screen does not allow me to change to box 3. It always kicks back to box 2. What's the problem?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

Where do you see this screen? Is it in the 1099-R interview, or is it on a state return? If so, which state?

Remember that we on the Community cannot see your tax return nor the screen you are on.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

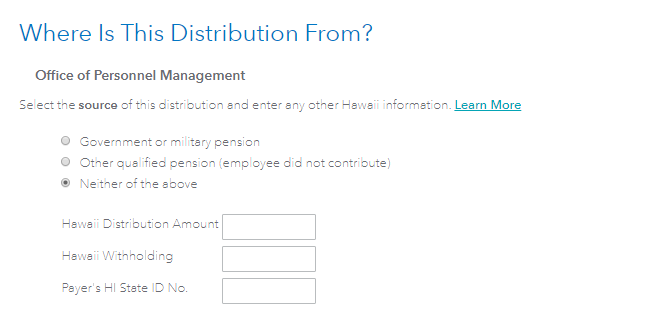

Under section Federal Taxes, Form 1099-R payments where you have to input the tax info. In my case, the payments (or distributions) are from personal IRAs, not pensions so therefore are subject to Hawaii state taxes. Turbo excludes them from the state returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

Go back to the Federal section of the program.

- Select Income & Expenses

- Select "IRA,401(k), Pension Plan Withdrawals (1099-R)

- Select "Edit" under the appropriate 1099-R form

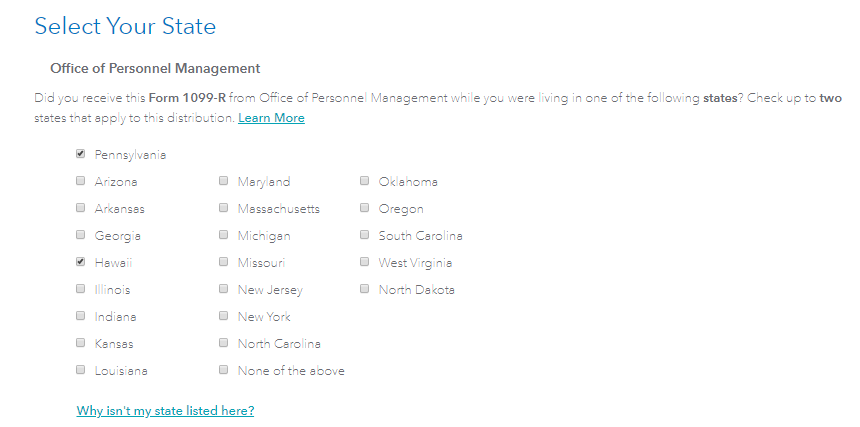

- Proceed to answer through the screens until you see "Select Your State". (You should see this after enter your details from the 1099-R, and the question asking if you are a public safety officer.

Select Hawaii here since you have referred to Hawaii above. Select Continue

The next screen will now allow you to enter your information needed to ensure the 1099-R is treated correctly for Hawaii purposes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

Thanks so much for the information! Very helpful!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

I do not see anything wrong with the 1099 s I have submitted what is the problem?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

Can you be more specific as to the problem you are experiencing?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jlomicka

New Member

DANMAN3

Level 2

Koshinsr

New Member

luis-gomez1970

New Member

reic0756

Level 1