- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1099misc for legal services plan benefit don't know where to put it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099misc for legal services dont know where to put it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099misc for legal services dont know where to put it?

If you receive a form 1099-NEC for a legal service plan, then you are not considered as self-employed and do not need to file a Schedule C.

In TurboTax, enter your form 1099-NEC and follow the interview until you arrive at the page titled Did this involve an intent to earn money?. Answer that this did not involve an intent to earn money. The amount will be reported as Miscellaneous income and will not be subject to Self-employment tax.

In TurboTax, there is a work-around. Although you may receive this income every year, say that you only receive the 1099-NEC only in 2020, not in previous years and not in 2021, you will then have the screen where you can say that it did not involve an intent to earn money.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099misc for legal services dont know where to put it?

I followed the instructions for entering the 1099 I received from General Motors exactly but when I get to the review I have 2 errors:

1- enter accounting method

2- enter business code

i did not have a problem last year?

Margo

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099misc for legal services dont know where to put it?

To enter a 1099-MISC in TurboTax:

- Open or continue your return, if you're not already in it.

- Search for 1099-misc and select the Jump-to link.

- Answer Yes to Did you get a 1099-MISC?

- If you already entered a 1099-MISC, you'll be on the 1099-MISC Summary screen, in which case select Add Another 1099-MISC.

- If you need to edit or delete a previously-entered 1099-MISC, select the appropriate button.

- Enter the info from your form into the corresponding boxes.

- If you need to enter boxes 4–6 or 8–17, check My form has other info in boxes 1–17 to expand the form.

A new form 1099NEC was re-created this year. The 1099MISC is for Other Income. Please try the instructions above.

If you received a 1099-MISC for 2020 with only box 7 information, it’s most likely because,

- The issuer is using an old 1099-MISC form (not for 2020) and is reporting your nonemployment compensation in box 7. Or,

- The issuer sent you the 1099-MISC form with only box 7 checked and sent you a 1099-NEC separately that reports the actual income amount.

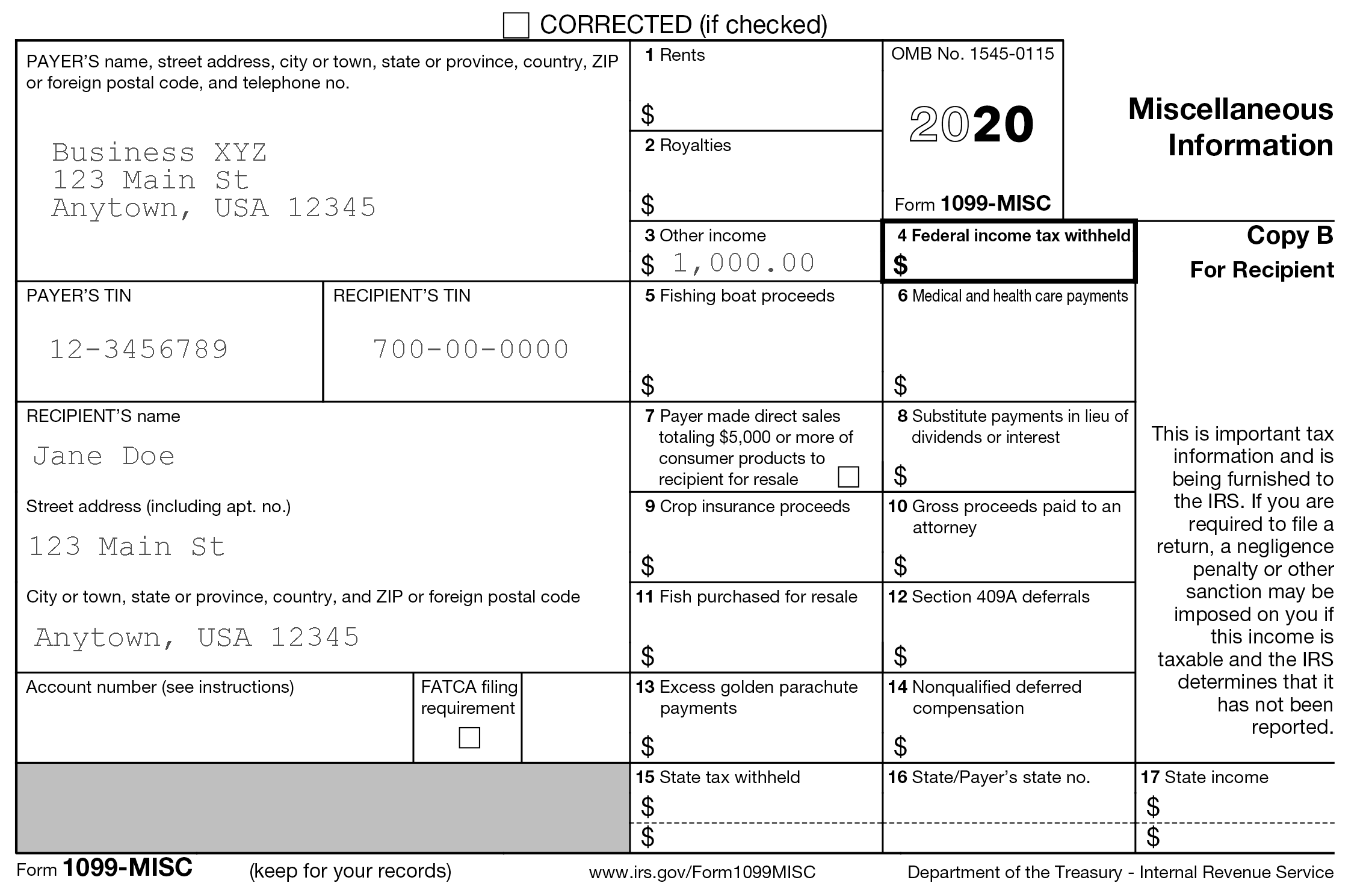

Take a look at the year on your 1099-MISC form. If it doesn’t say 2020 like the example below, then the issuer is using an old, incorrect, version of the form. You should contact them directly and ask them to send you a Form 1099-NEC that reports your payments.

If your 1099-MISC is from 2020 and box 7 is checked, but there is no other information on the form, then the issuer most likely also sent you a 1099-NEC that reports your payments. Just enter your 1099-NEC as you would normally, there’s nothing you need to do with this blank 1099-MISC.

And if the issuer sent you a 1099-MISC with your payment listed in another box, that’s ok. You can enter your form in TurboTax just as it appears. We’ll ask you questions along the way and guide you through entering all of your self-employment income and expenses.

[edited 2/11/21 | 12:53 pst]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

charlyjr1144

New Member

retr506822

New Member

ocelotjoy

Returning Member

trissy716

New Member

dcrago

Returning Member