- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1099-R administrator sent with double the amount of pension distribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R administrator sent with double the amount of pension distribution

On going problem with pension administrator. They have corrected the distribution code in box 7 but, now have doubled the amount of my distribution for the year. Assuming they will send a corrected 1099-R...do I need to include both whe I file or just the correct one. Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R administrator sent with double the amount of pension distribution

Provided you have not already filed your return, you will only have to post and file the final corrected copy.I understand that you are having trouble posting your 1099-R

- Get to the main menu that shows Wages & Income?

- Open the next screen that lists multiple types of income.

- Select: IRA, 401(k), Pension Plan Withdrawals (1099-R).

- If you see it can you open it

- Did you get a 1099-R in 2023? - Yes

- Let's import your tax info

- At the bottom select [Change the way I enter my form]

- How would you like to upload your 1099-R? [Type it myself]

- If Married, Who does this 1099-R belong to?

After entering the new set of data you must continue through the entire interview.

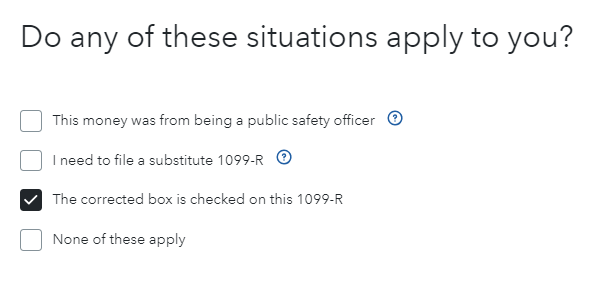

You will finally come to a question: Do any of these situations apply to you? -

Select The corrected box is checked on this 1099-R

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Lukas1994

Level 2

JQ6

Level 3

kejjp00

Returning Member

Smithy4

Level 2

rbucking4

New Member