- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Provided you have not already filed your return, you will only have to post and file the final corrected copy.I understand that you are having trouble posting your 1099-R

- Get to the main menu that shows Wages & Income?

- Open the next screen that lists multiple types of income.

- Select: IRA, 401(k), Pension Plan Withdrawals (1099-R).

- If you see it can you open it

- Did you get a 1099-R in 2023? - Yes

- Let's import your tax info

- At the bottom select [Change the way I enter my form]

- How would you like to upload your 1099-R? [Type it myself]

- If Married, Who does this 1099-R belong to?

After entering the new set of data you must continue through the entire interview.

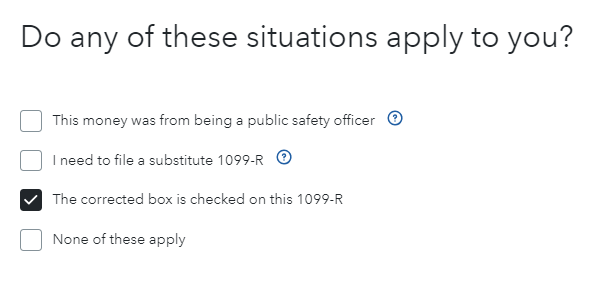

You will finally come to a question: Do any of these situations apply to you? -

Select The corrected box is checked on this 1099-R

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 5, 2024

6:26 AM

329 Views