- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1099-NEC - Software issue?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

same thing happened to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

The issue has been submitted and is currently under investigation. Please click on the following link and sign up for an email notification when it's fixed.

Why am I not able to link my 1099-NEC

Thank You for your patience

Beginning with the 2020 tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractor. This was done to help clarify the separate filing deadlines on Form 1099-MISC and the new 1099-NEC form will be used starting with the 2020 tax year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

For what it's worth, I deleted all my 1099-NECs, then added them back in through the different Businesses. I did not enter them in the "Did you have any 1099-NECs" section on the main Wages & Income page.

In fact, that section still shows $0 for me on the summary page until I click through and see the two 1099-NECs that are linked to my Businesses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

Thanks for the reply. Your solution sounds similar to what solved my issue. I sent a message for help. I received a message that a rep would call me in 5 minutes. I received a call within 5 minutes. My wife has a W2 Job and I am self employed. Before the call, I filled out the information for 1099-NEC. Rep reviewed and all appeared filled out properly. Asked to click on "review" on left of screen. Noticed that there were 2 1099-NEC but 1 showed different than what I filled out for this year's taxes. Appears that 1 was created using last year's information (same company). Deleted it leaving the 1 I created this year. That solved the problem and I was able to e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

I signed up for the email notices as I have multiple 1099-NECs to enter and would rather not have to do the posted workaround. Has anyone received any emails yet providing any update on this major software issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

I can confirm this has been fixed in TurboTax deluxe for PC in recent updates.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

No updates yet. We are waiting for the Self Employed version to be corrected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

Entering the Form 1099-NEC directly through a specific Schedule C will match the ownership of that Form 1099-NEC to the taxpayer who runs the Schedule C business and solve the issue of trying link a Form 1099-NEC to a specific Schedule C business.

Try going back to the section where you entered the Form 1099-NEC if you entered it on its own and delete that entry. Use these steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1099-NEC” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1099-NEC”

- Click on the blue “Jump to 1099-NEC” link

This will bring you to the summary of all Form 1099-NEC that you have entered. Click Delete or the trash can icon next to each one.

Next, you will re-enter the Form 1099-NEC as part of the Schedule C so that the income is reported directly as part of the Business Income and Expenses and within the correct form and section of your return.

Use these steps to go to the Schedule C section of your return.

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “schedule c” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to schedule c”

- Click on the blue “Jump to schedule c” link

If you already have a Schedule C in your return, edit it and go to the section to Add Income. This is where you will re-enter the Form 1099-NEC.

If you do not already have a Schedule C in your return, follow the prompts and enter the information about your work/business for which you received the Form 1099-NEC. Then continue through that section to Add Income and enter the Form 1099-NEC plus any other income you received for that self-employed business.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

I am experiencing the same problem with the 1099-NEC. I will try the response provided 2 weeks ago. I think TurboTax should have corrected this by now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

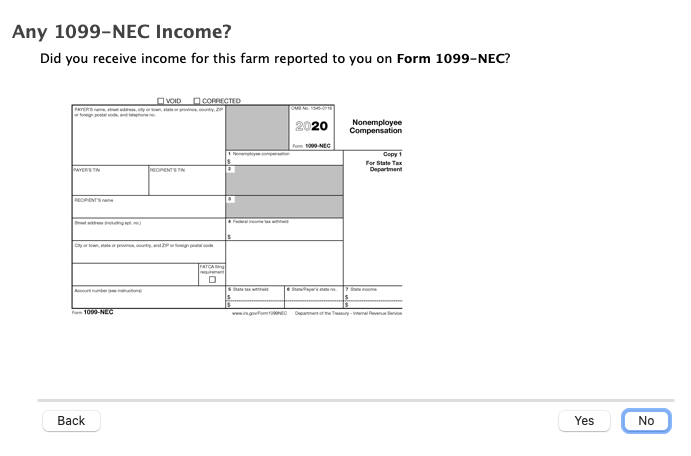

I believe my issue is related to this, but hadn't seen any say that the 1099-NEC was tied to a farm when nothing about the business description or coding is a farm ("Did you receive income for this farm reported..."). See screenshot, so if TurboTax isn't aware of this portion of the software bug, please contact me. I am using the TurboTax Home Business 2020 for Mac software...By the way, as of today (2/15/2021), the problem still exists in my version of the software which I updated this morning.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

There are some issue with the 1099-NEC linking to the correct spouse. Click here for more information and adding your name to email list.. Your best opportunity to link it correctly is entering the 1099-NEC through the Sch C business section of TurboTax. The business will already be tied to the husband or spouse owner.

The pandemic has affected your taxes in many ways. Including reporting in TurboTax the amount of stimulus money you received. Click Here for more information on how the Pandemic affected your 2020 taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

This issue needs to be resolved. It's been a couple weeks since I first experienced the 'unable to link 1099-NEC' through the web version of Turbotax. Turbotax accepted my payment, then kicked back my return when I attempted to efile. So now I'm somewhat pot-committed or I'm throwing away money. This is way too long for a software bug to be in production. The impact not only affects the ability to file, receive refund, but with potential 3rd Stimulus, will impact money received as finances changed drastically from 2019 vs 2020. @Turbotax - fix the issue!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

Shortly after I posted my last comment and after signing up for a notification once a resolution was provided, I received an email from Turbo Tax Customer Solutions ([email address removed]). The email informed me that an update had been applied to the Turbotax web version.

I can confirm that I was able to link my form 1099-NEC to my Schedule C and e-file my taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

Clicking the search icon does not reveal a search box, it's a link that takes me to a page with a customer service phone number (https://freefile.intuit.com/contact-us).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC - Software issue?

Your link does not link to an email list signup, the link now links to instructions for how to resolve the issue, but the instructions don't work:

"Click on the Review tab and proceed through the screens until you see a screen titled "Delete Confirmation" for Form 1099-NEC."

I did this and I never saw a screen that said, "Delete Confirmation for Form 1099-NEC."

Also, I don't see information anywhere in the Turbo Tax web app for how to access Schedule C directly. Even if I could access Schedule C directly, I have no idea how to fix this problem.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chsu02

New Member

gazeldais

New Member

DesertDenizen

New Member

pamoores

New Member

ro050408

Level 1