- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1099 misc received as reimbursement for health program by former companies benefit program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 misc received as reimbursement for health program by former companies benefit program.

The box #3 of the 1099 misc lists the amount for the reimburse , I have entered this in turbotax premier.

ON final check of my turn an error occurs - I need a link to schedule c, schedule f form 4835.

This is on 1040-SR , bypass the error and tax return prints out form 8995.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 misc received as reimbursement for health program by former companies benefit program.

OH crap ! Don't know why after entering multiple times it didn't work BUT

now it works . YES - I now feel foolish.

THANKS TO THE experts who guided me to a resolution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 misc received as reimbursement for health program by former companies benefit program.

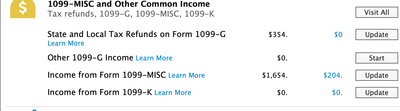

Where did you enter the information? If entered as below, using Box 3, you should not get a Schedule C message. As you go through the questions, be careful how you answer them.

In the search box, type "other income" and then jump to other income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 misc received as reimbursement for health program by former companies benefit program.

Thank you for the quick reply, my tax form does not look like the post.

Just to clarify - usage Turbotax Premier for Mac and the tax form it produces is 1040-SR.

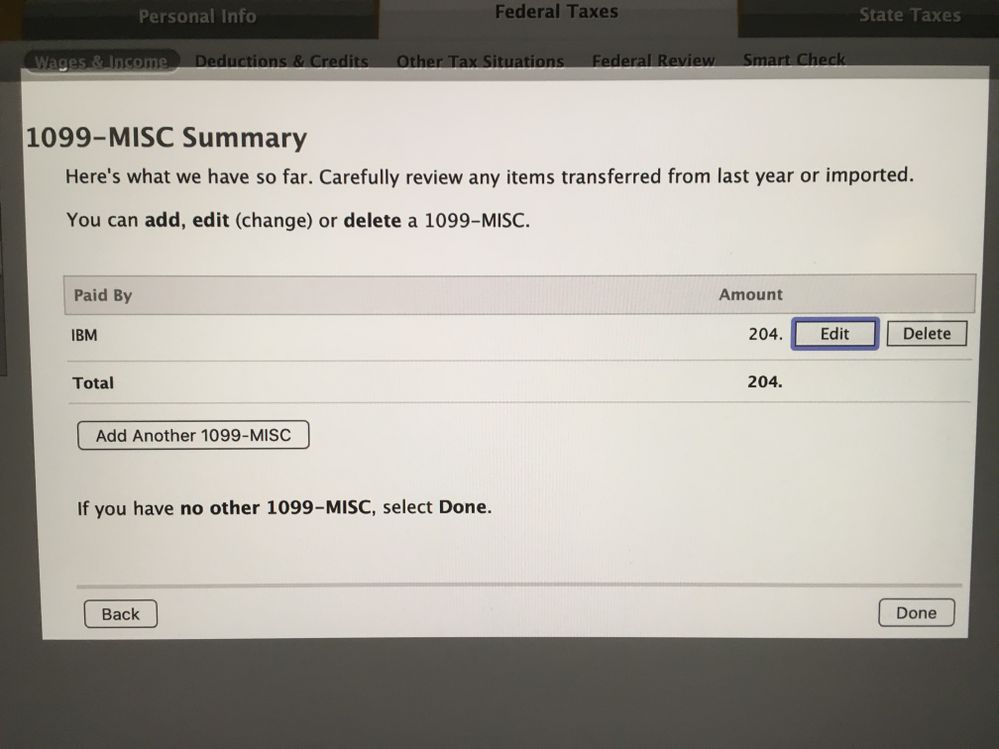

The 1099- misc is the $204 item , Last years return had me enter health as an option, this year there is no option. There is only box #3 with any data entered on the 1099 , of course the payers name, etc is filled in.

Thanks again for your Help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 misc received as reimbursement for health program by former companies benefit program.

You may need to go back through the interview for this 1099-MISC. Be sure you select "No, it was not to make money" and select that this was the first year you received it, even if you received it last year as well.

The program asks this to determine if this is Self-Employment income and if so, will generate a Schedule C.

The reimburse is not Self-Employment, so you should answer "No".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 misc received as reimbursement for health program by former companies benefit program.

There are no choices, I have gone Back to the beginning and deleted my entry and reentered and have the same result .

Here is a picture of what I am seeing , there is no place to select or enter any other data. If necessary I can send or upload the entry of the actual 1099 misc , I little concerned though for confidential data.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 misc received as reimbursement for health program by former companies benefit program.

Remembering last years Turbotax , there was an extra step that allowed you to state what the

1099misc was for , However I don't see it anywhere in this years version. Could it be that

this is senior version of the 1040 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 misc received as reimbursement for health program by former companies benefit program.

I cannot test on a Mac, but the programs are similar.

There are several sections to enter a 1099-MISC.

I think you entered it under Self-Employment, but you need to scroll down past that to "Other Common Income"

Please follow these directions carefully. They should take you to a different set of screens to enter the 1099-MISC.

Afterwords, you will need to delete the original entry.

It's confusing, but I think you'll find it, be sure to click "Show all income" if needed to open all the options.

You might needs to answer a bunch of Yes/No questions first, so try not to get side-tracked with those.

Click Federal

Click Wages & Income

Click “See All Income” if needed

Scroll down (PAST SELF-EMPLOYMENT) to “Other Common Income”

Click “Show more”

Scroll down to “Form 1099-MISC”

Click Start

Enter the 1099-MISC and Continue

On the “Describe the reason for this 1099-MISC” screen type in something like “Re-reimbursement” and Continue

Select “None of these apply” and Continue

Select “No, it didn’t involve work like main job” and continue through the interview selecting the appropriate answers for a one-time payment.

The amount from the 1099-MISC will be reported as Other income on the 1040 line 7a, not as Self-employment

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 misc received as reimbursement for health program by former companies benefit program.

Kris

I really appreciate your patience with me, and your technical advice.

I followed your instructions until not finding the option "describe

the reason for the 1099. also don't have "past self employment"

But the option to " Describe the reason for the 1099-misc" screen does not appear after entering my 1099.

When I hit continue it takes me to enter another 1099.

AS I said , it was in last years turbo tax and did add some confusion for me, but I don't find that same

option in this years turbotax.

And looking at this years completed return , there is no entry on line 7a. I'm more convinced this is a bug

with Mac version and 1040-SR.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 misc received as reimbursement for health program by former companies benefit program.

OH crap ! Don't know why after entering multiple times it didn't work BUT

now it works . YES - I now feel foolish.

THANKS TO THE experts who guided me to a resolution.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DFH

Level 3

Japtrupusz

Level 2

q1williams

New Member

Arieshilan321

Returning Member

user17519301369

New Member