- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1099-Div Box 9

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div Box 9

I closed my business this year and received a 1099-DIV with 10000 in box 3 and 25075.34 in box 9. TurboTax tells me to handle it later, but iI don't see what to do.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div Box 9

You don't need to worry about Box 3, that is really just informational.

For Box 9: Liquidating distributions are distributions you receive during a partial or complete liquidation of a corporation.

These distributions are considered a return of capital.

Liquidating distributions are not taxable to you until you have recovered the basis of your stock.

After the basis of your stock has been reduced to zero, you must report the liquidating distribution as a capital gain.

Whether you report the gain as a long-term or short-term capital gain depends on how long you have held the stock.

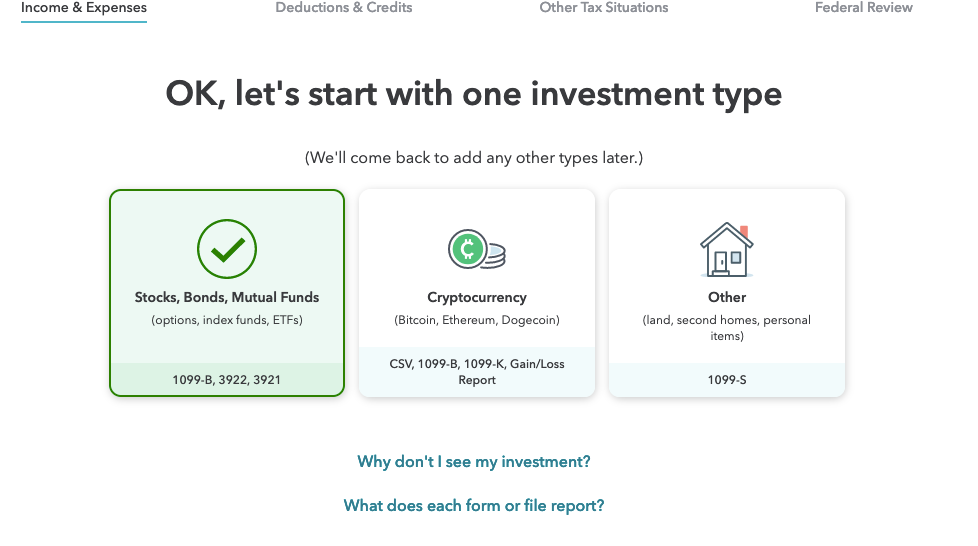

If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then report the amount in Box 8 or 9 on the stock sale screen as a stock sale. You will report it in the Investment Income section under Stocks, Mutual Funds, Bonds and Other.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div Box 9

You don't need to worry about Box 3, that is really just informational.

For Box 9: Liquidating distributions are distributions you receive during a partial or complete liquidation of a corporation.

These distributions are considered a return of capital.

Liquidating distributions are not taxable to you until you have recovered the basis of your stock.

After the basis of your stock has been reduced to zero, you must report the liquidating distribution as a capital gain.

Whether you report the gain as a long-term or short-term capital gain depends on how long you have held the stock.

If the liquidating distribution shown in Box 8 or 9 is a complete liquidation, then report the amount in Box 8 or 9 on the stock sale screen as a stock sale. You will report it in the Investment Income section under Stocks, Mutual Funds, Bonds and Other.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div Box 9

If the liquidation is not complete yet, besides entering the 1099-Div Box 9 amount on the TurboTax 1099-DIV, where else would I go to capture so that amount is not taxed as gain if I haven’t received all my basis back? Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div Box 9

If you enter an amount in Box 9, this does not add to your taxable income when you enter this information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div Box 9

You failed to respond to the question completely.

The question again:

If the 1099 DIV includes an amount in Box 9, which is a partial liquidation, which is not a full liquidation (so can not be recorded as a sale) however the partial liquidation is greater than basis. How do you report the capital gain? Turbo Tax does not appear to permit you to enter it any where.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div Box 9

Your capital gain can only be reported in the Investment Income section of TurboTax under Stocks, Cryptocurrency, Mutual Funds, etc. Because it appears you have recovered your basis, upon entering your sales information your cost basis will be zero. Whether the liquidation resulted in a short-term gain or a long-term gain will depend on how long you have held the stock prior to the partial liquidation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div Box 9

I have a similar issue. I received a 1099-DIV with Box-9 filled out only. This is a jointly held literal paper stock certificate held between my sister and I. I listed it in the 1099-DIV area with a 1/2 adjustment for my sister. Will be filing the new 1099 and 1096 forms when I receive them in the next two weeks.

We have only held the certificate for 2 years, so there is very little capital gains.

The below area where you mentioned he should add the form in as income doesn't apply to me. None of these scenarios apply. What do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div Box 9

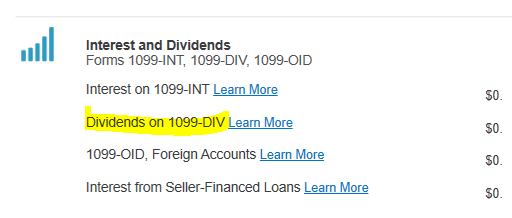

You are not in the correct area. The screen you are in is for entering a 1099-B. According to your question, you are looking to enter a 1099-DIV. Go back to the Income and Expense section and go to Dividends on 1099-DIV. This is where you enter the 1099-DIV.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div Box 9

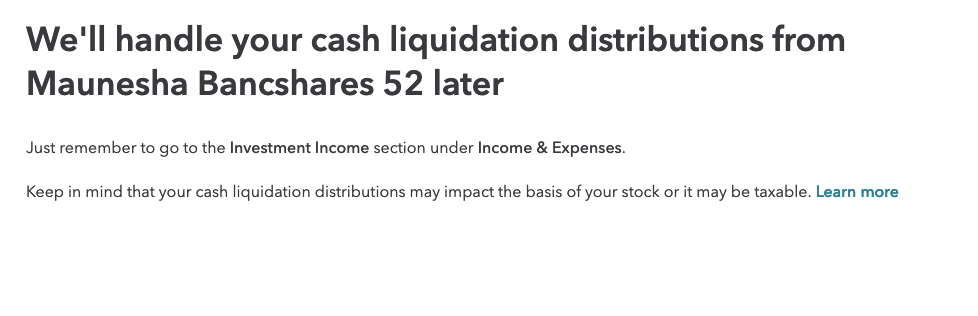

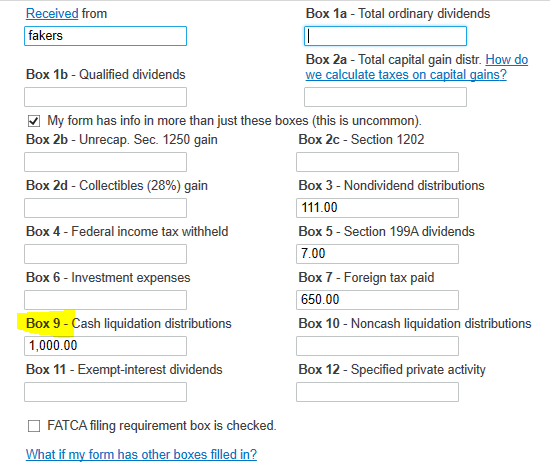

Yes, I did enter it in the 1099-DIV area yesterday. This is the screenshot below that I got yesterday after entering it there.

There is no where else to enter additional information under Investment Income - Income & Expenses. That is the screenshot above. None of those options apply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Div Box 9

Enter in the dividends section, enter your box 9 in box 9

@wendykru

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dennis-vallefuoco

New Member

agomstyn

New Member

love-the-irs

Level 2

Penniless

New Member

user17714450184

New Member