- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I have a similar issue. I received a 1099-DIV with Box-9 filled out only. This is a jointly held literal paper stock certificate held between my sister and I. I listed it in the 1099-DIV area with a 1/2 adjustment for my sister. Will be filing the new 1099 and 1096 forms when I receive them in the next two weeks.

We have only held the certificate for 2 years, so there is very little capital gains.

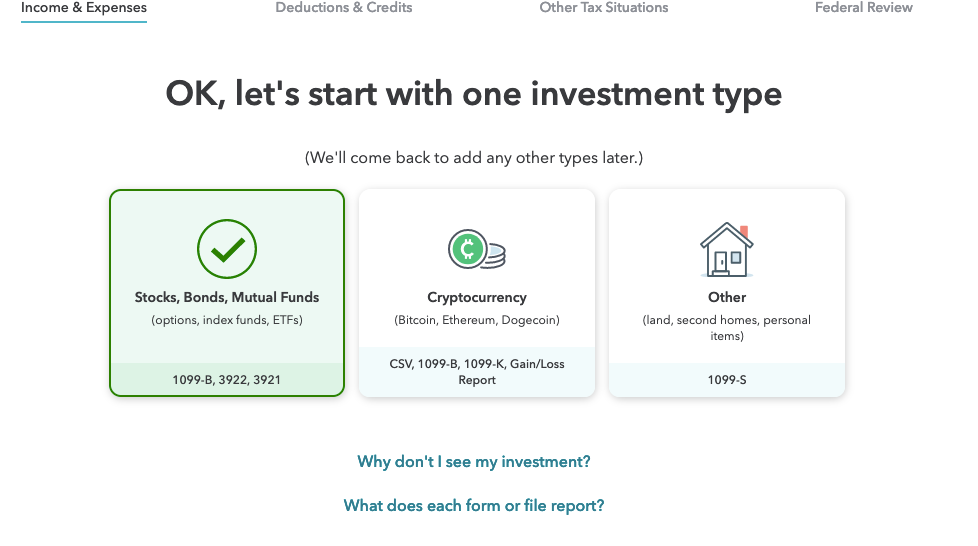

The below area where you mentioned he should add the form in as income doesn't apply to me. None of these scenarios apply. What do I do?

April 18, 2022

4:34 PM