- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1095-A Entry

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

There were a number of issues listed above. Which one do you find to be frustrating?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

I finally found a way on my own. I had previously entered some 1095-A data but Turbo Tax would not let me open up the 1095 interview to make a correction. None of the directions above worked for me. There was no "jump to" option in the search results and there was no "federal" button in the upper left. After much frustration and many attempts, I clicked on "Tools" in the upper left and then "My Tax Data." I then scrolled down to the 1095-A form and clicked on "jump to interview." I could then make any corrections necessary. I don't know if this would work for the initial entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

Medicare or Tri-Care does not need to be reported. Only the 1095-A needs to be entered on your return from insurance purchased through the marketplace. If you received a different 1095 form, such as one from employer benefits, you do not need to enter anything on your return. It is for your records only.

If you purchased insurance through the marketplace and received a 1095-A, that must still be reported on your return.This will calculate the Net Premium Tax Credit on Form 8962. This form reconciles the amount of the credit available to you with the amount already received as an Advance Premium Tax Credit. The result could be additional credit owed to you, or you may have to repay any amount already received in advance. Because of either of these results, it is important for taxpayers to include the information from Form 1095-A on their return.

Follow these steps:

- Click on Deductions & Credits under Federal

- Under the menu for Medical, click Start/Revisit next to Affordable Care Act (Form 1095-A)

- Answer Yes indicating that you have the form to enter

- Complete the information on the next screen to match your form and click continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

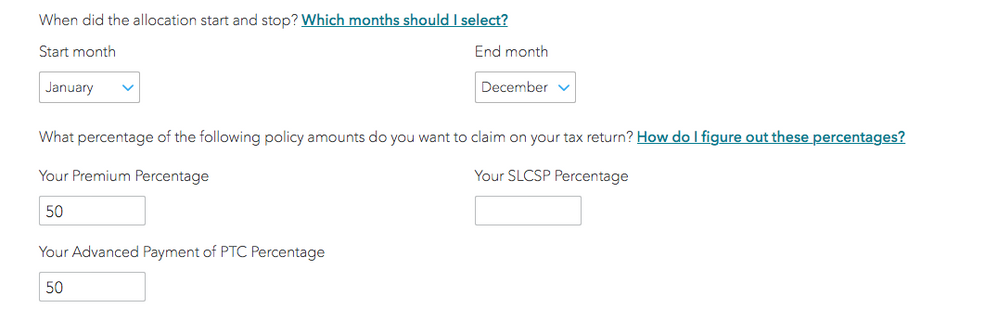

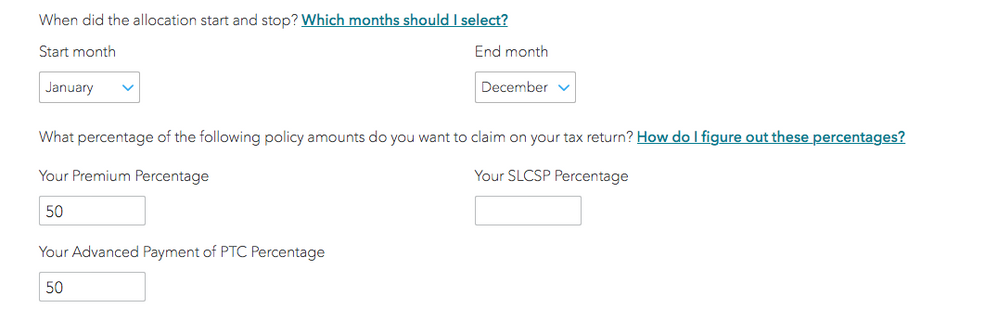

I read that you should leave the one box empty?... see attachment of that page on the turbotax filing page... Is this correct? (the other 50% will be on a separate tax return of shared health insurance)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

Hello does anyone have an answer to this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

Everytime I call the help line, it keeps me on hold for a few minutes and then hangs up on me! Then somehow, I was able to leave a call back number... someone called me back, I explained my questions, she didn't seem to understand my question, and then asked me if I preferred to talk to a tax representative!! I thought that was who I was talking to?!?! She she said she was transferring me, and the line hung up! I've been hung up on at least 5 time today!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

@Denise77 If you are trying to get the 1095-A entered, let me see if I can help. I am posting instructions and a screenshot below.

If you purchased health insurance through Healthcare.gov or your state's health insurance marketplace, you should receive your 1095-A by mid-February.

Your 1095-A should include info for everybody on your return who was enrolled in a Marketplace plan, and is required to calculate the Premium Tax Credit.

Here's how to enter your 1095-A in TurboTax:

- Open (continue) your return if you don't already have it open.

- Search for 1095-A and select the Jump to link at the top of the search results.

- Answer Yes on the Did you receive Form 1095-A for your health insurance plan? screen and Continue.

- Enter your 1095-A info on the next screen and select Continue. We don't need all the info from your 1095-A, so we'll only ask about the info that affects your return.

If you have Form 8962 and a 1095-A, and aren't sure what to do with them, go here for info on how to file them with your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

I am trying to complete 1095-B form. It is asking for payment amounts. I have not made payment amounts as I am covered by medicare and medicaid. What can I do to move forward?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

You do not need to enter any information from your 1095-B. The health insurance section only requires information from Form 1095-A to be entered there. Delete the 1095-A you started and answer NO to the ''Did you receive a 1095-A or have insurance through the Marketplace?'' question. Keep the 1095-B with your tax records but don't enter that information on your federal tax return.

If you purchased health insurance through Healthcare.gov or your state's health insurance marketplace, you should receive your 1095-A by mid-February. Your 1095-A should include info for everybody on your return who was enrolled in a Marketplace plan, and is required to calculate the Premium Tax Credit. However, if you did not have this type of insurance and do not have a 1095-A, you can skip the health insurance section in TurboTax as you do not qualify for the credit. @Gvaughn

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

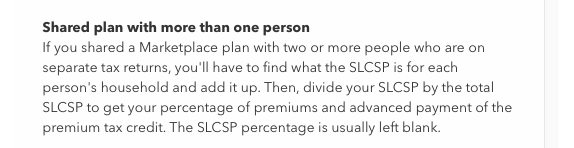

Thanks. I had no problems filling out the screen asking for the 1095-A info. It is the next screen that I am questioning where they want percentages (see screen shot attached). The second screen shot is of the help box on that screen. They give you different scenarios as examples to use. When I actually got someone on the phone, they said I should put 50 in all three boxes, yet the help box says to leave the one empty.... I am not sure why.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

When you share the allocation between 2 or more persons, you can allocate it any way that all parties agree upon. It can be 50/50 or 100/0 or any other combination. The only rules is that all parties must agree and that the amounts must add up to 100.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

Thank you. I know the amounts between the two people need to equal 100%. My question is specific to the online turbo tax screen that I posted in my question.... There are three boxes 1. Your Premium Percentage, 2. Your SLCSP Percentage, 3. Your advanced payment of PTC Percentage.... There is a hyperlink "How do I figure out these percentages?"... I posted a screen shot of the multiple people scenario which the last sentence says "The SLCSP percentage is usually left blank"

~Why would that block be left blank?

~When I test the outcome of putting 50% in and then going back and leaving it blank, the refund amount changes.

Can anyone answer if that block should be left blank or if the block should have 50% like the other two blocks?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

You will use 50% in the PTC box. The refund amount will change by the amount of the advanced premium that you will be paying back.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

HELP BOX says..."The SLCSP percentage is usually left blank"

Why would that block be left blank?

Should the SLCSP block should have 50% like the other two blocks?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A Entry

You can leave the SLCSP field blank because TurboTax software does not use that number in its calculations. But I would advice to fill it in with the 50% just for your own records.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

keefer-o-p

New Member

TTsucksthisyear25

New Member

nite_mech

New Member

zhiyuewang

New Member

ejtrotta

New Member