- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1095-A and Entering Health Care Costs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A and Entering Health Care Costs

We received a 1095-A for March through December showing no premium credits due to us having too much income from March to December. Can I enter these premium costs under medical expenses? Also, I assume that I will receive another 1095-A for January and February when I did receive some tax credits?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A and Entering Health Care Costs

Yes, you can list the health insurance premiums that you paid, out of pocket, as medical expenses. You should receive Form 1095-A for all the months that you had a Marketplace health insurance plan. You can log onto your heathcare.gov account and print Form(s) 1095-A.

The Premium Tax Credit (PTC) is based on your total income that you report on your income tax return. If your income situation changed during the year, it may affect your PTC.

- If you underestimated your income and the government paid out more than your actual credit value, you'll need to repay the difference when you file your taxes.

For additional information, please see What is the Premium Tax Credit (PTC) and What is Tax Form 8962?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A and Entering Health Care Costs

So, I thought I was all set but maybe not. When I went in to enter the premiums, the program says that if you are self-employed or if you got a 1095-A form, you cannot enter what you spent on premiums. I received two 1095-A's. One for two months that show me getting some credit and one for 10 months showing no credit at all. Thoughts?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1095-A and Entering Health Care Costs

If you received an Advanced Premium Tax Credit to cover the cost of the premiums, you would not be eligible for a deduction in addition to the Premium Tax Credit.

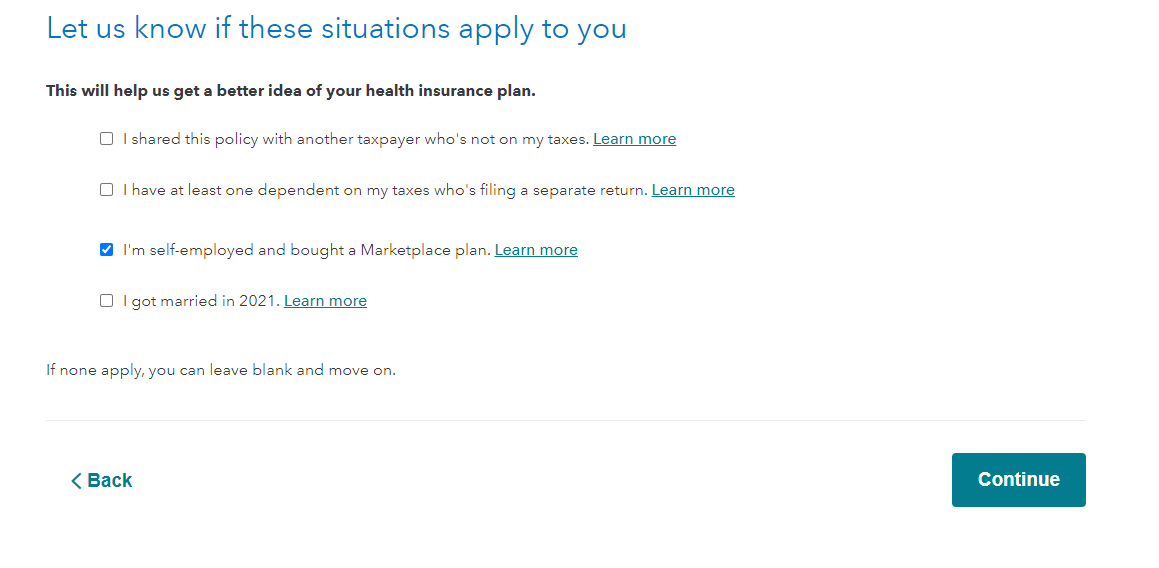

If you did not receive a Premium Tax Credit, after you entered your 1095-A's you should check the box that says "I'm self-employed and bought a Marketplace plan." This will give you the deduction for your health insurance premiums if you qualify. If you did not check that box, you can go back to your 1095-A, click edit then go through and click the box.

Also, if your business did not operate at a profit, you would not be eligible for the deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

flin92

New Member

lrwilcox

New Member

onelovelylavi

New Member

SterlingSoul

New Member

kfrodcrafts

New Member