- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1040X - Amended Return 2020 - Federal Rejected Claim with Letter 105C

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040X - Amended Return 2020 - Federal Rejected Claim with Letter 105C

Hi,

Below is my case:

1. 1040 regular tax filed on time in Year 2020 (Jan-Mar) as Filing Status = Single

2. Later in order to generate ITIN for spouse, I was suggested to file amended return for Year-2020. This action we took in and applied for Amended in Year Nov-2021. The filing status was changed to = Married Filing Jointly.

3. Within 1 month from date of amended return filling, I got the ITIN delivered for my spouse.

4. Within 4-5 month received letter from State, they cannot process the claim upfront, since Federal Amended return was not yet processed.

5. Now, in Sep/2022, which almost after 9months, I received the letter from IRS, which states they denied the claim with letter LTR 105C.

Why can't allow claim: "The taxpayer identification number assigned to you, your spouse, your qualifying child was issued after the return due date (including extensions). You cannot retroactively claim the Married Filing Joint, RRC."

This was mentioned in the letter.

Queries: Since, I am allowed to amend my previous 3years return, my claim should not have been rejected.

Are they right about the rejection? Can you please share some insights on this.

Thanks,

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040X - Amended Return 2020 - Federal Rejected Claim with Letter 105C

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040X - Amended Return 2020 - Federal Rejected Claim with Letter 105C

Read that notice again carefully ... you CAN amend to add the spouse (in fact you should NOT have filed single on the original return instead it should have been MFS on a mailed in return) HOWEVER you cannot get any of the tax credits on the kids OR the RRC (stimulus payment) when the spouse had an ITIN issued after the original due date of that return. So did they deny the joint filing or the extra credits ? The TT program may have given you credits you were not allowed because the interview doesn't take late ITIN applications into consideration.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040X - Amended Return 2020 - Federal Rejected Claim with Letter 105C

a. Filing Status=Single vs MFS. Initially I was not aware, so I selected Single. This was mistake from my end. So filing amendment should have fixed that mistake, and should not be a reason for claim decline (I hope so).

b. RRC : I cross checked the amended tax return and I see the RRC(Recovery Rebate Credit=$1800) was claimed which is stimulus payment credit based on the questions I responded at TurboTax(TT) on time of amendment. So, if we consider into account that RRC is not payable as refund since ITIN was issued after the due date, still based on the standard deduction calculation I am still eligible for refund excluding the $1800 amount. (Note No Child Tax Credit was claimed.)

Am I right on this part? And if yes, What option do I have now to claim the extra credit (excluding RRC amount).

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040X - Amended Return 2020 - Federal Rejected Claim with Letter 105C

"Can you please share some insights on this."

Just because your rebate credit was denied, does not mean your 1040-X was denied.

IRS will continue to process the other changes on your amendment.

What does "Amended Return Status " Button on IRS.gov say?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040X - Amended Return 2020 - Federal Rejected Claim with Letter 105C

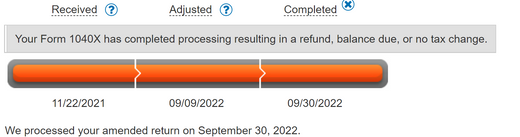

I see it has been now updated on the site IRS.gov. It displays below info now.

"The processing of your Form 1040X results in an "Adjustment" to your account. An adjustment may result in a refund, balance due, or no tax change. Your account was adjusted on September 09, 2022. Within three weeks, you will receive a notice that explains the adjustment"

Also, checking the letter 105C, under section "What to do if you disagree": It is written as "If we don't hear from you within 30days from the date of this letter, we will process your case with the information we have now"

So, based on this detail I think I do not have to take any action for now and should wait for the notice which will detailed out the adjustment details. (Hoping, the notice will deduct the RRC credit from the overall refund and will refund the remaining amount.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040X - Amended Return 2020 - Federal Rejected Claim with Letter 105C

I see the status is now completed as below. I haven't received anything yet in my mailbox w.r.t refund. Do I need to wait more, or should I call the IRS office to check, if there was any refund issued or not? I checked the return transcript too, but I don't see any update there yet.

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040X - Amended Return 2020 - Federal Rejected Claim with Letter 105C

amended results don't appear in your online transcript.

IRS is taking a long time to issue checks. Your completion is only a few days old.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040X - Amended Return 2020 - Federal Rejected Claim with Letter 105C

If you are getting a refund your status will soon change to read as follows:

"The adjustment on your account resulted in a refund. "

You will continue to wait.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cj5

Level 2

easytrak2002

New Member

dabbsj58

New Member

Omar80

Level 3

doubleO7

Level 4