- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Questions for "Wages and Salaries" Line Item...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions for "Wages and Salaries" Line Item...

Hi Team,

New tax filer here - typically my parents have done them for me but I thought I'd give it a go this year.

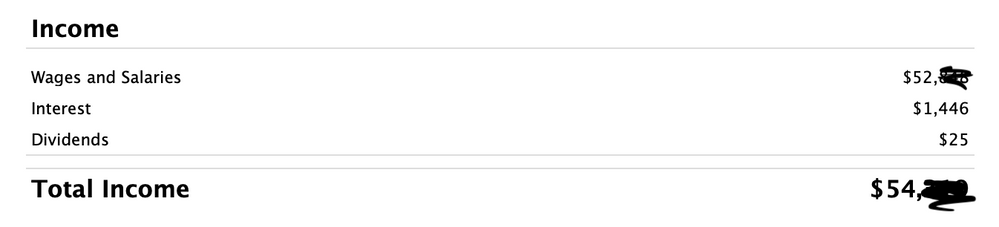

After completing the Federal Tab's "Income Section" I was alarmed as I looked at the summary page. After clicking done with income, my "Here's a Picture of your 2019 Income" page that shows Total Income seems to be messed up. In the Summary, it lists Wages and Salaries + Interest + Dividends = Total Income, and everything looks correct except for the line time of wages and salaries. They are higher than the total of all of my W-2's.

What is going on here? Hope you can help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions for "Wages and Salaries" Line Item...

Type 'w2' in the Search area, then click on 'Jump to w2'.

At the W-2 Summary page, see if you have duplicated any W-2 entries.

You can Delete or Edit from this page (screenshot).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions for "Wages and Salaries" Line Item...

I checked, and there is no extra or duplicate information.

When I click into the "Easy Step" tab called Federal and select Wages and Income, my "total" wages are reported correctly from my W-2 as $48K. See the photo below:

Later, if I finish the "Wages & Income" section and click "done," then on the Summary page, my "wages and salaries" line item a much higher number ($52K).

Is there a way to break down what the wages and salary are coming from? I deleted all financial info and re-entered my W-2's by hand just to be sure I haven't missed a thing...

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions for "Wages and Salaries" Line Item...

If you are looking at a summary screen or review screen those show the full amount as income and lump a lot of stuff together. You need to check the actual 1040 and make sure it’s right.

Check the actual 1040. Do you have any letters by line 1?

SCH by 1040 line 1Wages is taxable scholarship income and the amount

HSH is for Household Help

DCB means Dependent Care Benefit

Or do you have any 1099R forms with code 3 in box 7?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions for "Wages and Salaries" Line Item...

I checked my W-2 and the $54K number is not correct. It should be lower.

I don't have any extra letters next the Box 1 on my W-2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions for "Wages and Salaries" Line Item...

The letters would be on your 1040 tax return by line 1 not on your W2. Is your W2 box 1 less than 54,000? Do you only have one W2? Delete it and re-enter it. That may clear something out. Are you a student? Did you get any 1098 forms? Those can add a taxable amount to the wages line.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Questions for "Wages and Salaries" Line Item...

That was it! My 1098 had a scholarship on it, and this was the missing number that wasn't showing on the summary but counted as Wages/Salary. Turns out the $54,000 was right. Thank you for all of your help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

fellynbal

Level 3

hojosverdes64

New Member

jenniferbannon2

New Member

ilenearg

Level 2

Naren_Realtor

New Member