- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Pell Grant Surplus Question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pell Grant Surplus Question

I am having trouble reporting the taxable portion of my Pell Grant.

I received a Pell Grant of around $11,000 for the 2022-2023 year. Only around $500 of it was used for the qualified education expenses. A little more than half of rest of the grant (~$6,000) was used for other expenses that do not fit the qualified education expenses description, and the other half has not been used(~$5,500).

I believe I should report the $10,500, but I'm not sure how to report it correctly.

One way might be by putting it under as miscellaneous income in the "Wages and Income" section. It seems to work. Another way seems to be putting it under as expenses for room and board in the "deduction and credits" sections. Which one would be more efficient and suitable?

Additionally, I have a problem that asks me to enter information for Form 3800: Line 10 and Line 6 of the year 2022 that I do not know or have. It also askes me to enter information for Form 8615: Line 6 of the year 2022 that I do not know or have. Can this information be found in my parents 2021 tax return documents?

I would really appreciate some help with these problems.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pell Grant Surplus Question

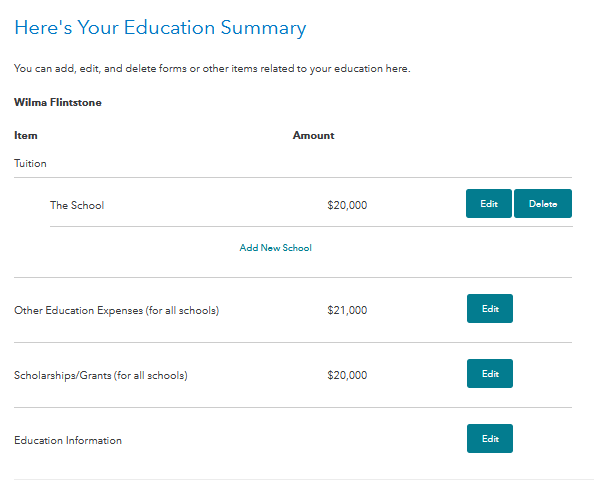

Here are directions to the Education area where the 1098-T is entered. Your 1098-T will provide information for the areas of the return looking at the American Opportunity Credit or the Lifetime Learning Credit . If you qualify, Turbo Tax will recommend which will help the most for your return, as you are allowed only one of them per year.

- To enter your Form 1098-T, please click on Deductions and Credits, on the side menu bar

- Scroll down to Education and select See More

- Click on Start or Revisit next to Expenses and Scholarships

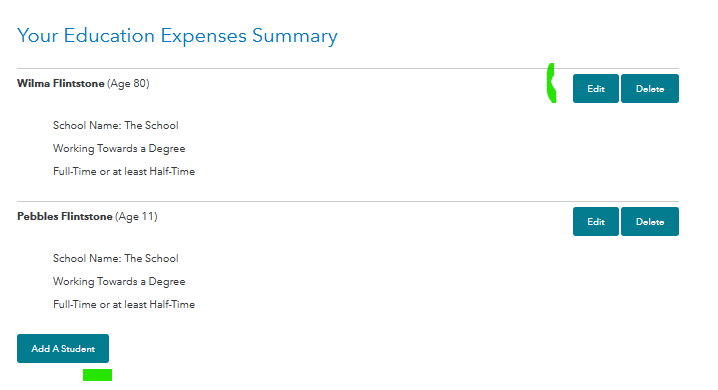

- Select to Edit the student or if you have not been added yet, Add a Student

Turbo Tax will walk you through entering your tuition paid and education expenses.

You will want to enter the Form 1098-T. Any scholarship that is listed there and not reconciled with Box 1, or other qualified expenses will automatically be treated as taxable income and you will not have to enter in another section of the return.

Note: If you "copy and paste" to enter some of the information, it might have spaces or other invisible formatting characters that are cause errors. Please be sure there are no extra spaces before the entries or after your entries.

Your parents should know if you filed a Form 8615 Tax for Certain Children Who Have Unearned Income last year for any investment income.

Form 3800 Line 10b is to enter the total allowable credit, if any, from your individual tax return as follows.

Enter the amount from Form 1040 and Schedule 3 (Form 1040), lines 2 through 5 and 7. Don't include any general business credit claimed on Form 3800, any prior year minimum tax, or any credit claimed on Form 8912, Credit to Holders of Tax Credit Bonds. This may be prompted because you had a Form 3800 in your return last year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

renguomin

Returning Member

jason805sm

New Member

in Education

shance-ordell

New Member

A_N_Consultant

Level 1

riveroceanandearth

New Member

in Education