- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Passive loss carryover (Box 2 income ONLY) from prior years split between Box 1 and Box 2a automatically, why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

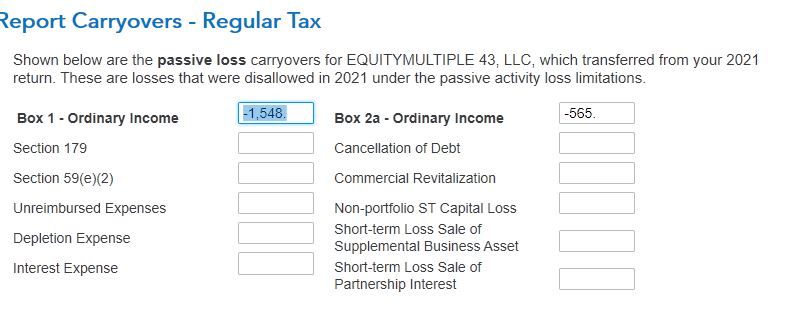

Passive loss carryover (Box 2 income ONLY) from prior years split between Box 1 and Box 2a automatically, why?

I have passive loss carryover from the past 3 consecutive years (19,20,21) from SAME entity K-1 reported on Box 2 Only. I've noticed that Turbo tax has split this amount between Box 1 and Box 2a each year (seemingly arbitrarily) and again in 2022 return when partnership was dissolved with GAIN large enough to offset all accumulated losses. Without EVER having any Box 1 income reported from this partnership, why does turbo tax split the amounts btwn box 1 and 2?

I have several other non-PTP real estate rental K-1's with losses and it also splints passive loss carryovers in the same manner....as they roll from year to year.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Passive loss carryover (Box 2 income ONLY) from prior years split between Box 1 and Box 2a automatically, why?

I'll page @Mike9241 but those losses are treated differently (passive losses and passive losses from PTPs).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Passive loss carryover (Box 2 income ONLY) from prior years split between Box 1 and Box 2a automatically, why?

PTP's don't get reported on the 8582

real estate with active participation gets reported on line 1

real estate with no active participation gets reported on line 2

there are worksheets that detail what is getting entered on those lines - review them because I have no access to your returns or documents.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Passive loss carryover (Box 2 income ONLY) from prior years split between Box 1 and Box 2a automatically, why?

I suspected 'glitch' in TT software, because all these particular K-1's are non-PTP and NONE are active participation. AND they are all being treated the same way with the SPLIT.

I thought MAYBE there is an accounting rule (for tax purposes, not GAAP) that allows certain rental real estate losses to be 're-characterized' from rental income (Box 2) to ordinary business income (Box 1), as paradoxical as that sound to me!, as they roll over from year to year.

Tax savvy enough to understand it doesn't make sense logically.

Going back through the worksheets, AGAIN, but they don't break down when/where the Box 1/2 SPLIT is occurring.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Passive loss carryover (Box 2 income ONLY) from prior years split between Box 1 and Box 2a automatically, why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Passive loss carryover (Box 2 income ONLY) from prior years split between Box 1 and Box 2a automatically, why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Passive loss carryover (Box 2 income ONLY) from prior years split between Box 1 and Box 2a automatically, why?

The link above explains the process behind my original question, for anyone reviewing this in the future.

Turbo tax automatically splits the "suspended loss carryover from prior year" into "Ordinary income (loss) for Schedule E" and "Ordinary income (loss) for Form 1040".

Look at worksheets for Section A and B "Passive Activity Adjustment to...." to see how the number break out. You wont be able to figure it out looking at the return pages by themselves.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DallasHoosFan

New Member

garne2t2

Level 1

user17524160027

Level 1

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

user17524121432

Level 1

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

andyeg3

New Member