- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Partnership Terminated in 2021 - TurboTax Looking For it in 2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partnership Terminated in 2021 - TurboTax Looking For it in 2022

I cannot go forward with my federal and state return. I had a K-1 from a partnership in 2021 for which I reported income. It is the last K-1 I received from this partnership (I retired). TurboTax is assuming I still have this partnership for 2022 and is asking for the information. It is not allowing me to move forward and complete the return. I have not found a way to eliminate it from the input screens. Any suggestions? Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partnership Terminated in 2021 - TurboTax Looking For it in 2022

You can delete the K-1 entry completely from your return.

To delete a specific form in TurboTax Online you can follow these steps:

- Within your return, click on Tax Tools in the black menu on the left side of the screen.

- Click on Tools.

- Click on Delete a Form.

- Scroll down to your form and click Delete.

- Under Federal in the black menu bar click Wages & Income to get back into your tax returns.

- Proceed entering/reviewing your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partnership Terminated in 2021 - TurboTax Looking For it in 2022

There is nothing on Schedule E other than income from a trust, which I do have. Because I have a K-1 from a trust, I can't just delete the form. The partnership section of Schedule E shows zero and there are no partnerships listed (probably because I had already tried deleting the names from the input screen). The problem is, I can't get past the partnership input screen without eventually getting an error message.

Please note that I am using the desktop version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partnership Terminated in 2021 - TurboTax Looking For it in 2022

The K1 for the terminated partnership is no longer needed for your return beginning in 2022. The following links show how to delete a form in both versions of TurboTax.

You may need to delete this form using the information below by clicking the link (the second one if for your version).

- If you're using TurboTax Online software and need to delete a form, click here.

- If you're using TurboTax CD\Download (TurboTax Desktop) software and need to delete a form, click here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partnership Terminated in 2021 - TurboTax Looking For it in 2022

I went to the screen "Tell Us About Your Schedules K-1" where one can select K-1 from Partnerships, S Corporations or Estates and Trusts. I clicked on Partnerships which takes me to the screen to enter the K-1 data. As I said, in my case I no longer have partnership K-1s. In your answer, I think you suggested to click the "Trash" icon. Where is that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partnership Terminated in 2021 - TurboTax Looking For it in 2022

To delete the K-1, you can follow these instructions:

- Click Wage and Income

- Scroll down to S-corps, Partnerships, and Trusts

- Click Revisit next to Schedule k-1

- choose Update next to Partnerships/LLC

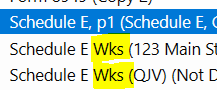

- Click delete (trashcan) next to K-1 (See screenshot below)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partnership Terminated in 2021 - TurboTax Looking For it in 2022

I'm not seeing that. It must be different for my version, which is Home and Business, Download.

I don't get to K-1s by starting on W-2 screen and scrolling down. I see no options to delete on the K-1 input screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partnership Terminated in 2021 - TurboTax Looking For it in 2022

You can delete the K-1, using the home and business download by following these steps:

- Click Forms in the upper left hand corner

- Scroll down to K-1

- Click Delete

- Confirm Deletion

- Click Step-by-Step to return to the data entry screen

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partnership Terminated in 2021 - TurboTax Looking For it in 2022

The only K-1 that's listed in Forms is the one from the trust, which is needed. The only other listed form I see that can be related to this is Schedule E, page 2. But I can't delete that form either as, of course, it includes income from the trust.

I assume the partnership forms are not listed because the input for those k-1s are blank.

As I'm writing this, I may have an idea. Suppose I enter "dummy" information for a partnership K-1 (I may need to do for both partnerships). I would think this (these) would now appear on the Forms list. Then, I could delete the partnership K-1s from the Forms list.

What do you think?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partnership Terminated in 2021 - TurboTax Looking For it in 2022

The sch E has worksheets for each entity feeding into it. You just need to delete the worksheet. You may have to enter the information as you suggest to populate the worksheet.

If you are using:

- Online: see How do I view and delete forms in TTO?

- Desktop: If you are working in the cd/download TurboTax program:

- On the top right, there is a FORMS button.

- Click on FORMS.

- Locate the form you want to delete.

- Click on the form name.

- Below the form, bottom left, select DELETE FORM button.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chrisgilbert1962

New Member

admin10

New Member

j_pgoode

Level 1

CShell85

Level 1

esewing

New Member