- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Partial rental of personal home

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

TurboTax online is not giving me an option for % of home rental. How do I reduce expenses related to that %?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

In TurboTax Premium Online, within the rental activity, at the screen Here's rental property info, select the pencil icon to the right of Rental property info.

At the screen Review your rental property info, select Days rented.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

To clarify my issue, we only rented 10% of our property (it’s a carriage house next to our main house where we live, but all considered homestead). I’ve entered number of days used personally, but the software never provides a place to put % rented. What am I missing?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

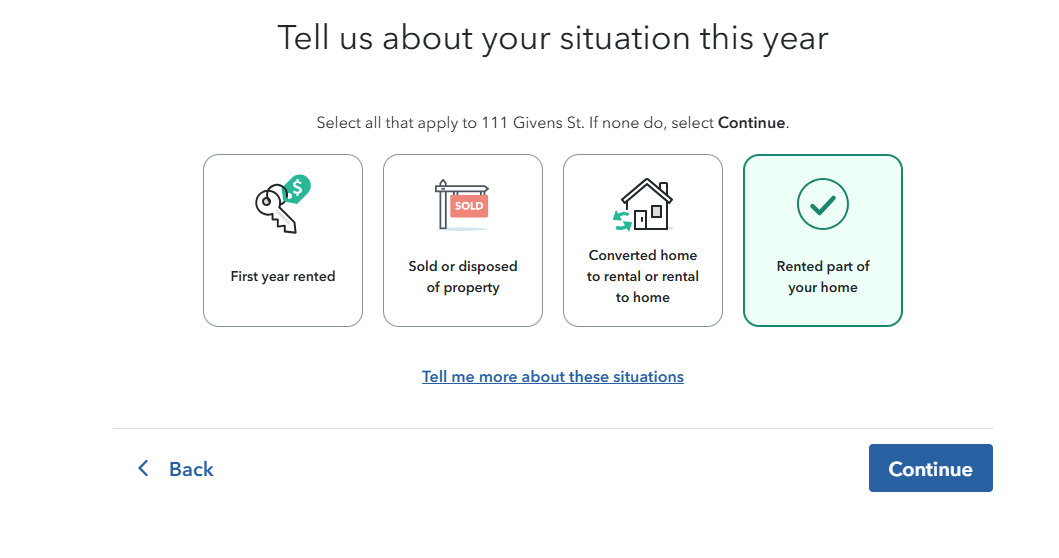

You need to edit the Rental Property Info and then edit the Situations under the property info. Then choose Rented Part of Your Home. This will let you indicate that only a portion of your home was being rented.

Also, be careful about entering personal use days. The time before and/or after the carriage house was considered a rental property does not count as personal use. It is only a personal use day if you use it during the period of time that the property is considered to be a rental property.

For anyone using a desktop version of TurboTax, the situations can be found in the Property Profile section of the Rental Income and Expenses section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

Ok, I did that. It still never asked for % rented vs personal. So I have to enter 100% of all expenses related to the house (taxes, insurance, HOA, etc) then turn around and enter in deductions the % that is personal? So it’s really manual? And how does it calculate Mtg interest in Sch B deductions? I have to manually adjust that also?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

The percentage allocation should appear in your return, especially if you are using TurboTax Premier. If you are using Deluxe, the allocation screen may not appear correctly in this version. Here are the steps on how to enter as a rental expense.

- Go to Wages and Income

- Rental properties and Royalties

- Rental Properties and Royalties

- Answer the questions until it asks what type of rental, indicate it's a multi-family dwelling.

- Next question asks, do any of these situations apply to this property, check I rent out part of my home..

- Answer the next few questions until you reach a screen labeled Let us Calculate Your Expense Deductions For You

- When you select this, there will be a drop-down that asks for the rental use percentage. Here you will enter the percentage of your home occupied by your renter. See the screenshot included below.

- Finish the remainder of the interview until you reach the rental summary screen. Here you will report the income and expenses. When you enter the expenses, you will report 100% of the expenses and TurboTax will automatically allocate expenses to your rental portion of your home and report the remainder in Schedule A.

Here is the screenshot I mentioned earlier about how to report the percentage.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

I am using the online version which is called Premium. Is there a way to do it using this version? I am not able to find any questions related to % used. Does this mean I have to switch to a Desktop version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

To enter TurboTax Online, follow these steps:

- Click Wages & Income

- Click Rental Properties & Royalties

- Answer Interview questions until you get to "What type of rental is this property?"

- Select Show More and Click Other

- Enter multi-family dwelling for type

- Select the rented part of your home selection

- Continue until you get to "Want us to divide the rental-related portion.", Select Yes, I will enter total amounts and let TurboTax do the math

- Enter Area of home rented %

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

I followed all the steps listed, and I do not get the questions that ask “Want us to divide the rental related portion”. The FAQs say to divide yourself. Can you continue your screens so that I can see where you are getting that? Do I need a different version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

If you are using TurboTax Premium, you should not need a different version, as I am running the test through this one. The location of the question is shown in the remaining screenshots.

- Answer the questions about whether the property was rented every day in 2024

- Answer whether you had office space in the home.

- The next question is the one for "Want us to divide the rental related portion", select yes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

My screen is different from yours. It only has the question about number of days rented. Period. The next screen asks if we owned it for the entire year. Then it takes me back to the Review Rental Info Screen. Why would my version be different? So frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

I get the same results as BrittanyS when I answer as she did that it was rented every single day in 2024 and that it was always rented at a fair price.

This can be confusing, but if you click the question What if I only owned the property part of the year? the message reads:

We’re asking if you rented the property “all year” meaning, during the time that you owned the property during the year. If you only owned the property part of the year, then let us know if it was rented the entire time you owned it.

If you go back through the rental property section and edit days rented, you should see the same screens that we do.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

Yes, I finally got that screen. I had to uncheck converted home to rental (although we did that part). And I changed fair rental days to 366. Thanks for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

I am experiencing the same problem as the OP, but I have not been able to resolve it. I am also using the desktop Premium version of turbotax. @IsabellaG or @BrittanyS , are you able to assist?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial rental of personal home

This is how you would report part of your home used as a rental, and choosing to enter your total expenses and having TurboTax compute the percentage allocated to rental expenses:

- After you enter the property address, under What Type of Rental is This? choose Single family (home or unit where a single family lives) if that's what it is.

- Under Do Any of These Situations Apply to This Property? check I rent out part of my home.

- Was This Property Rented for All of 2024? Yes

- During the time this was a rental, was it always rented at a fair rental price? Yes

- Do You Have an Office in Your Home? No (assuming that's true)

- Let Us Calculate Your Expense Deductions For You. Choose yes or no. See the screenshot.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kudoqs

Returning Member

moumourocks

Returning Member

ajleaveamark

New Member

user17652182014

New Member

lasq90

Returning Member