- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- NY State Filing Status for NJ Resident

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State Filing Status for NJ Resident

Hi,

My wife and I are both NJ resident. She works in NJ but I works in NY. We’re planning to file jointly for Federal tax and NJ tax. But before filing for NJ tax, can I file non-resident NY tax separately? Does my wife need to file non-resident NY even though she doesn’t earn NY income? I’m asking because when I tried to file NY jointly, TurboTax counts my wife’s NJ income and showed we owe NY tax.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State Filing Status for NJ Resident

First, do your federal data entry, then your NY data entry, then your NJ data entry last. The rule is to do the non-resident state(s), then the resident. You will be filing jointly federal and states.

Then, when you go through the NJ interview, if you are using the TurboTax online product, you will see the following helpful screen:

This addresses your issue: you will (both) report your income to New York, get taxed on it, BUT the New York taxes (City, too) will carry to the NJ return as a "credit for taxes paid to other jurisdictions". In other words, the taxes on your spouse's NJ income will go to reduce the NJ taxes for both of you.

Later, in the NJ interview, you will see a screen called "Summary of Taxes Paid to Other States". Click on Edit (although you probably won't have to change anything here), to see TurboTax's explanation.

This is how many states address the issue of duplicate taxation between states.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State Filing Status for NJ Resident

Does this way means we need to make a payment to NY state? Will we be penalized for owing NY tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State Filing Status for NJ Resident

Yes, you would file a return in both states.

If you’re a New Jersey resident and work in New York State, you’ll need to file a New Jersey resident return and a New York State nonresident return. Your New York income will be entered on your New York state tax return. If you owe New York state taxes, it'll be calculated by TurboTax and you will follow the prompts for paying any tax owed when filing your return.

To help ensure accurate calculations, always complete the nonresident return first if filing in multiple states because your resident state will give you a credit for any taxes paid in your nonresident state.

Once you've determined that you need to file a nonresident state return, the first thing you want to do is make sure you've filled out the Personal Info section correctly:

- With your return open, select My Info in the left-hand menu.

- Then, on the Personal info summary screen, scroll down to Other State Income, and select Edit.

- At the Did you make any money in any other states? Question, answer Yes and make sure your nonresident state(s) are selected from the dropdown.

- Select Continue to return to your Personal info summary

In general, New Jersey and New York state both require that married couples use the same filing status for their New Jersey and New York state tax returns, as they used for their federal return.

After you finish your federal return, you'll automatically be moved to the State tab, where you'll see your nonresident state(s) listed in addition to your resident state.

Although it appears that you may be paying tax on your income twice because New Jersey requires you to pay taxes on all of your income, regardless of where it's earned, and New York collects taxes on the income you earned while working in the state, this income won’t be double-taxed because New Jersey gives you a tax credit for taxes paid to other jurisdictions.

This credit reduces your New Jersey Income Tax liability so that you don't pay taxes twice on the same income.

However, this isn’t a dollar-for-dollar refund of the taxes you paid to New York. Per the State of New Jersey, your credit can't be more than the amount you would’ve paid if you earned the income in New Jersey (rather than New York).

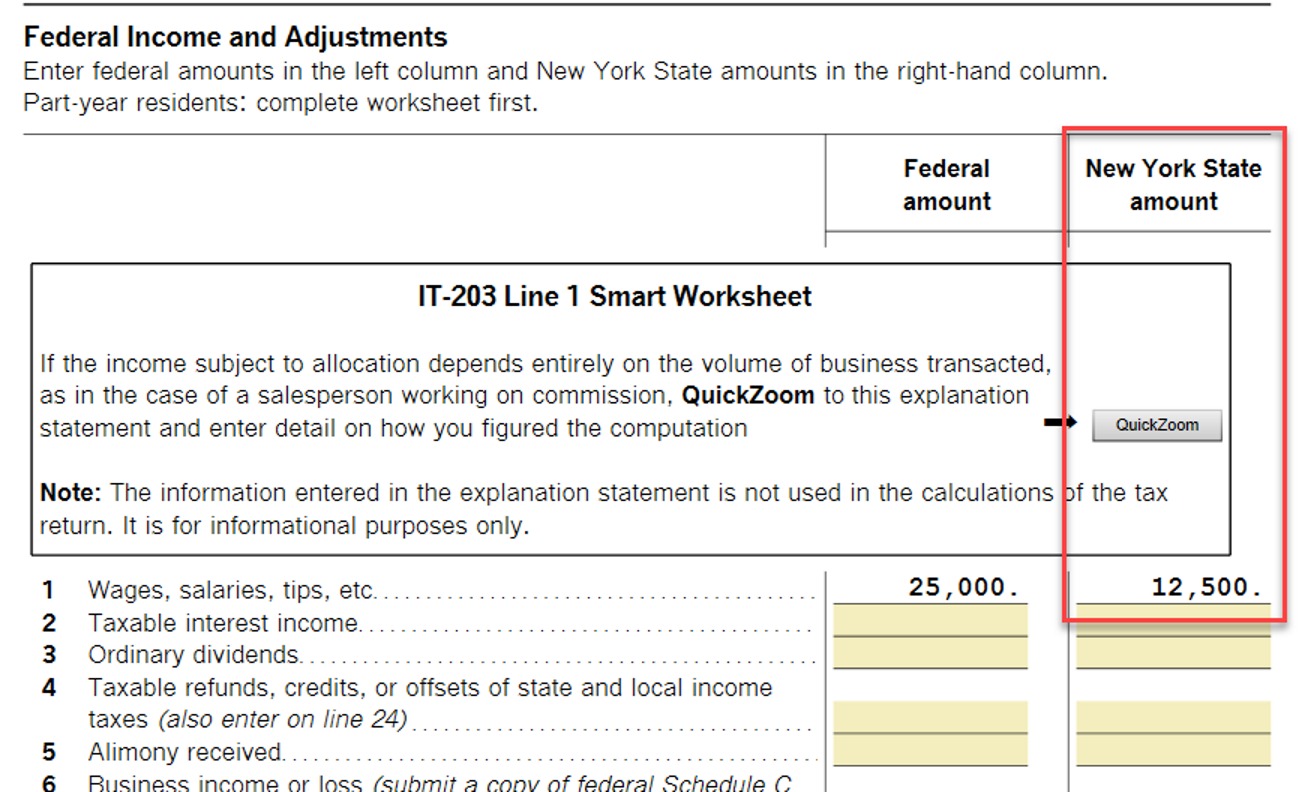

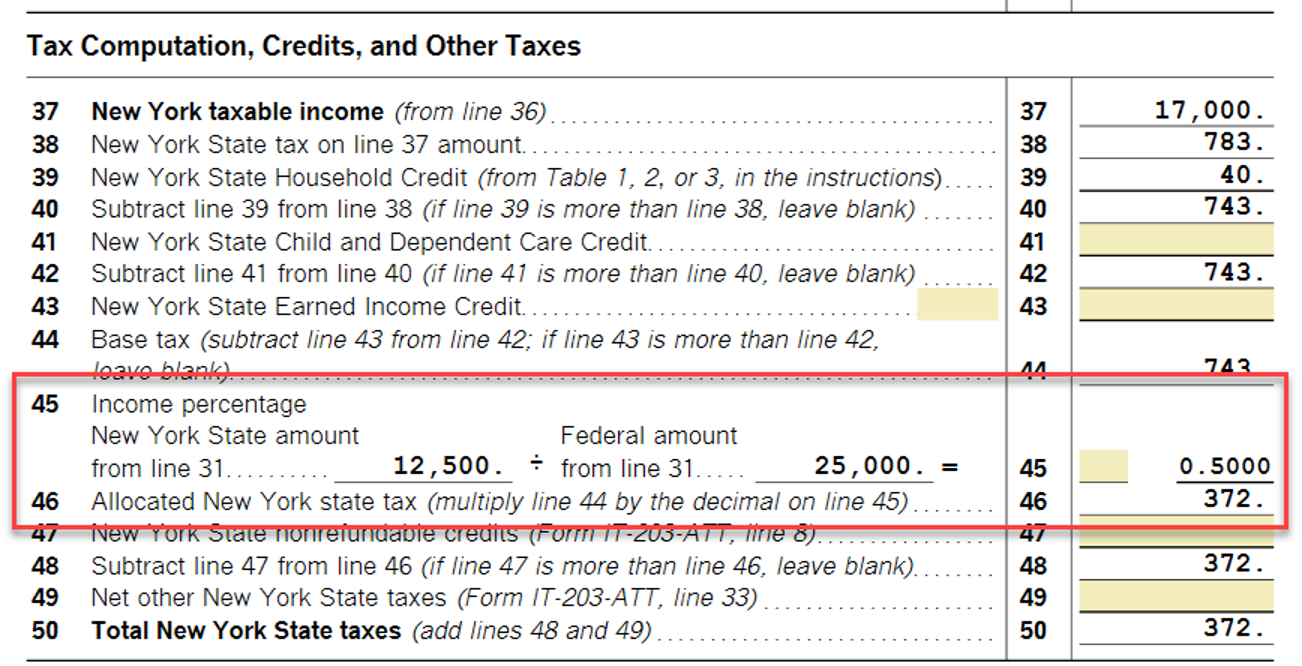

Additionally, New York isn't taxing your overall adjusted gross income. NY uses your total income to set the base tax rate.

You then pay tax on the NY percentage of what the total tax would have been if all you income was NY income.

For example, if you earned $100,000 total and $30,000 in NY, your tax rate would be based on $100,000. Say the NY tax on $100,000 is $10,000. Then your tax would be 30% ($30,000/$100,000) of $10,000 or $3,000.

You can preview your NY Tax summary to see what portion of the total taxes for NY you are paying

To preview NY Tax Summary:

- Sign in to your TurboTax account.

- Open or continue your return.

- Select Tax Tools from the menu (if you don't see this, select the menu icon in the upper-left corner).

- With the Tax Tools menu open, you can then:

- Preview your entire return: Select Print Center and then Print, save or preview this year's return (you may be asked to register or pay first).

- View only your New York state return: Select Tools. Next, select View NY Tax Summary.

Click here for additional information on filing when multiple states are involved.

Click here for information on how to file a nonresident state return.

Click here for additional information on filing status for New Jersey state tax returns.

Click here for additional information on filing status requirements in New York state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State Filing Status for NJ Resident

@LindaS5247 @Thank you for replying. Does NY penalize people for owing taxes? I don’t think I can change how much to withhold for NY tax, and my wife can’t withhold NY tax because she only works in NJ.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State Filing Status for NJ Resident

You won't be penalized by New York state for simply owing taxes.

However, you may encounter penalties from New York state on the amount of estimated tax that you didn't pay or paid late during the year (either through estimated tax payments, withholding tax, or a combination of the two).

If the tax you report on your return is less than the correct tax by more than 10% or $2,000, whichever is greater, you may have to pay a penalty. The penalty charge is: 10% of the difference between the tax you reported and the tax you actually owe.

If you do get a tax withholding penalty, you can change your withholdings for next year (2024) with your employer.

Click here for more information on New York state tax penalties.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State Filing Status for NJ Resident

@LindaS5247 Do you think it would be better that we file separately for both federal and state? This way I don’t have to include her NJ income in my NY return (I only work in NY), and vice versa. So there’s no potentially owing taxes to either state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY State Filing Status for NJ Resident

In general, it isn't beneficial to file separately. However, there are limited circumstances where it would be better. See the links indicated below for more information on such circumstances.

You can try preparing them separately and see if it makes a difference before actually filing your returns.

To help ensure accurate calculations, always complete the nonresident return first if filing in multiple states because your resident state will give you a credit for any taxes paid in your nonresident state. Did you prepare your nonresident state return (New York) first when you input your information? This is important to get the credit on your New Jersey Tax return for taxes paid in New York.

Also, you can preview your state's tax returns to see if you are getting the proper credit:

To preview your state tax returns, "Tax Summary":

- Sign in to your TurboTax account.

- Open or continue your return.

- Select Tax Tools from the menu (if you don't see this, select the menu icon in the upper-left corner).

- With the Tax Tools menu open, you can then:

- Preview your entire return: Select Print Center and then Print, save or preview this year's return (you may be asked to register or pay first).

- View only your New York (New Jersey) state return: Select Tools. Next, select View NY (NJ) Tax Summary.

Click here for additional information regarding whether to file jointly or separately.

Click here for information regarding when Married Filing Separately will save you taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kruthika

Level 3

Danielvaneker93

New Member

yingmin

Level 1

Propeller2127

Returning Member

balld386

New Member