- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Non qualified annuity taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non qualified annuity taxes

I have non qualified annuity 2 yrs old put in 100,000 cash do to reason had to take early withdrawal 50,000 I'm 55 so they took 10% early withdrawal plus surrender charge received 42,000

Received 1099

Box 1 42,000

Box2 taxable is blank

Box 2b taxable not determined is checked

Box 7 codes 2 of them D and 1

If I plug numbers in turbo they saying I still owe 10% when it was already with held plus tax on 42,000

I was told by the community to enter 0 in taxable amount just want to see if it is correct

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Non qualified annuity taxes

No, this is not correct. Your taxable amount of your annuity will be determined by your age, plan cost etc. As you proceed during the interview, you will be asked a series of questions that will determine your taxable amount.

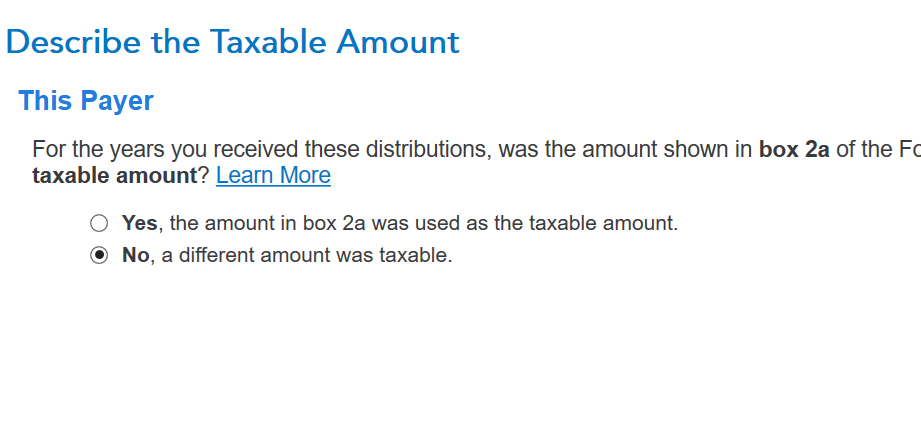

- There will be a question that will ask your taxable amount. Here you will say, "no" a different taxable amount was taxable. See Screenshot 1.

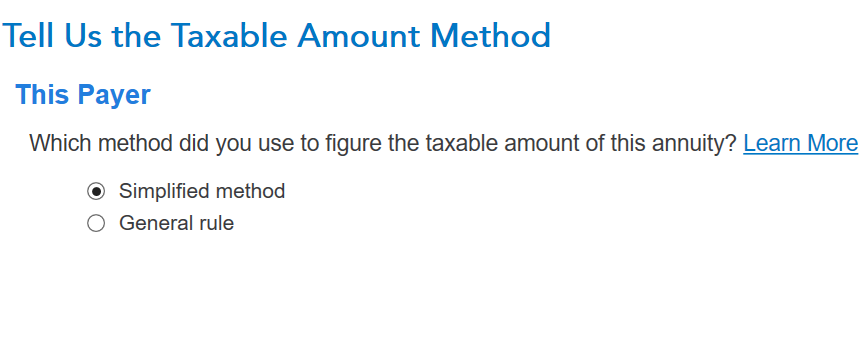

- Tell us the Taxable Amount. Choose simplified method. Screenshot two.

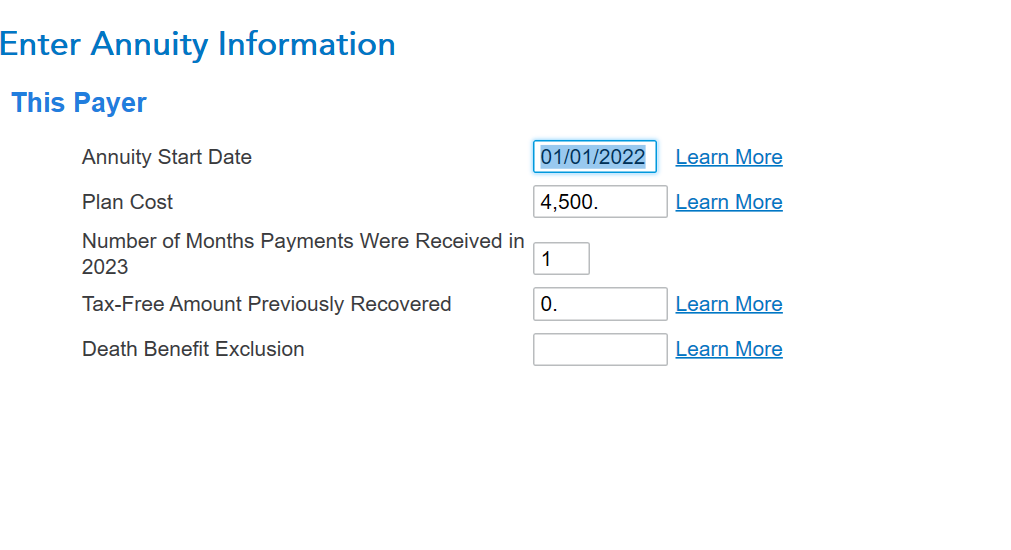

- Enter annuity information. This will determine what part of the distribution is taxable. See Screenshot 3. Don't use the number I placed here as this are for illustrative purposes only. Use your own information from your annuity.

- There will be follow-up questions you will need to answer.

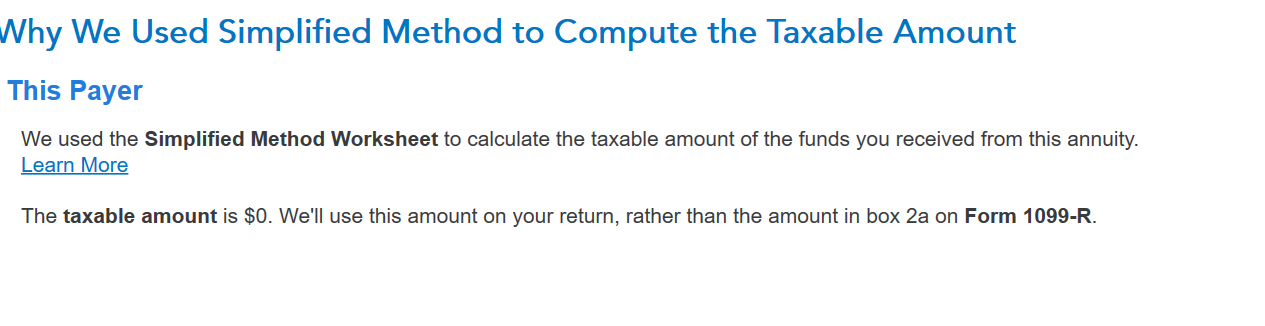

- if you get a message stating how much is taxable, you may need to go back to the 1099R to record this taxable amount. If it is a 0, record it as zero.

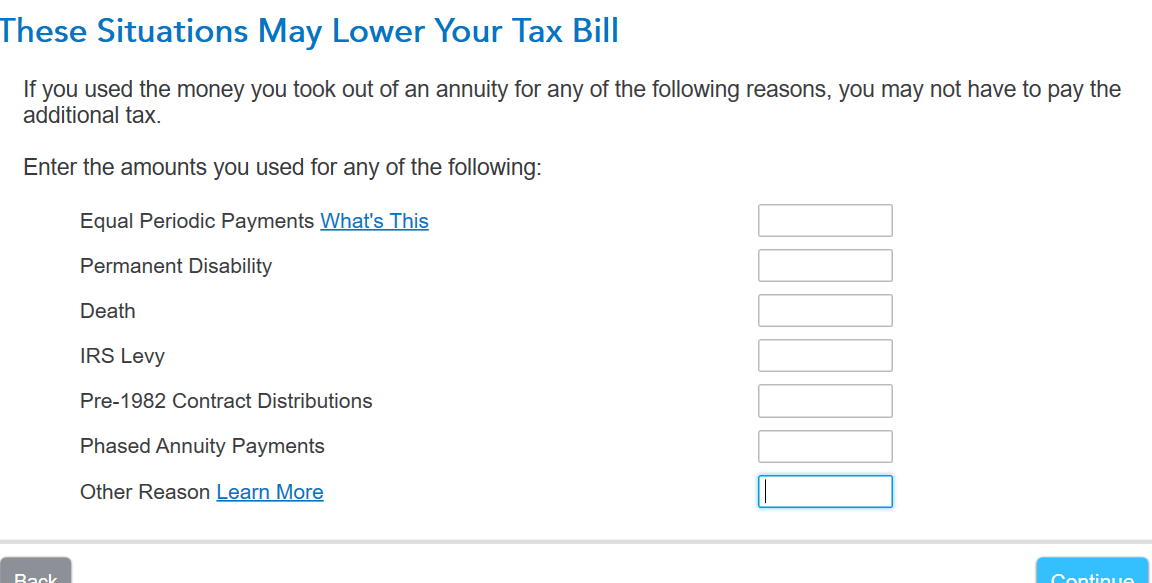

- For the early withdrawal penalty, you may be able to waive it also. See the 4th screenshot on the screen where you would list the exception to be waived.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gstoner65

New Member

jen36888

New Member

MikeMcCII

New Member

emmakoller2004

New Member

M103

Returning Member