- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

No, this is not correct. Your taxable amount of your annuity will be determined by your age, plan cost etc. As you proceed during the interview, you will be asked a series of questions that will determine your taxable amount.

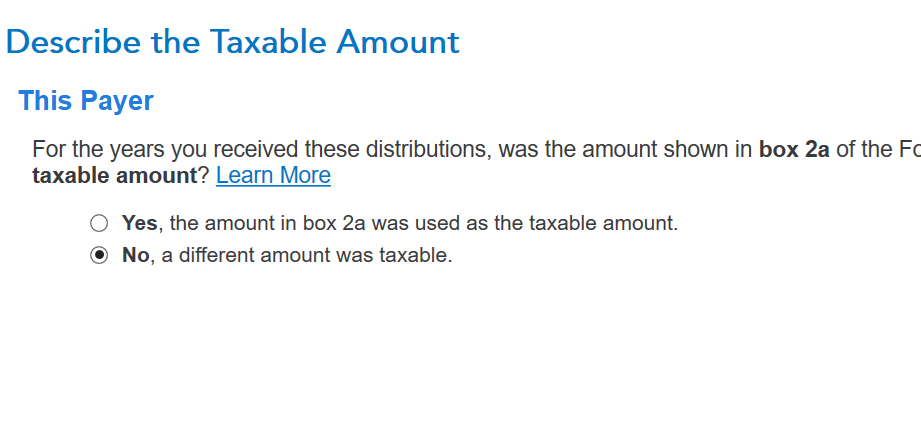

- There will be a question that will ask your taxable amount. Here you will say, "no" a different taxable amount was taxable. See Screenshot 1.

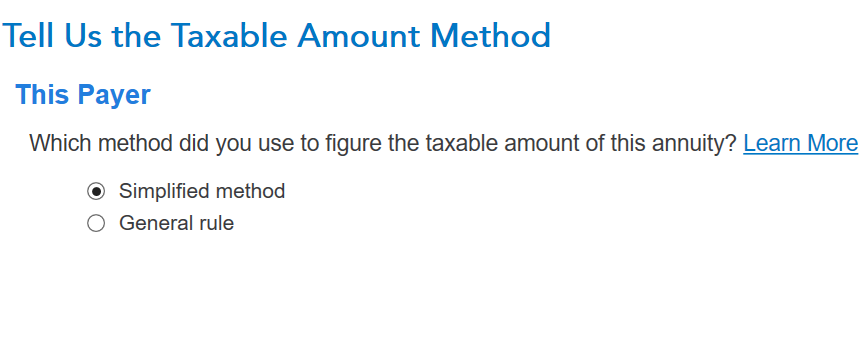

- Tell us the Taxable Amount. Choose simplified method. Screenshot two.

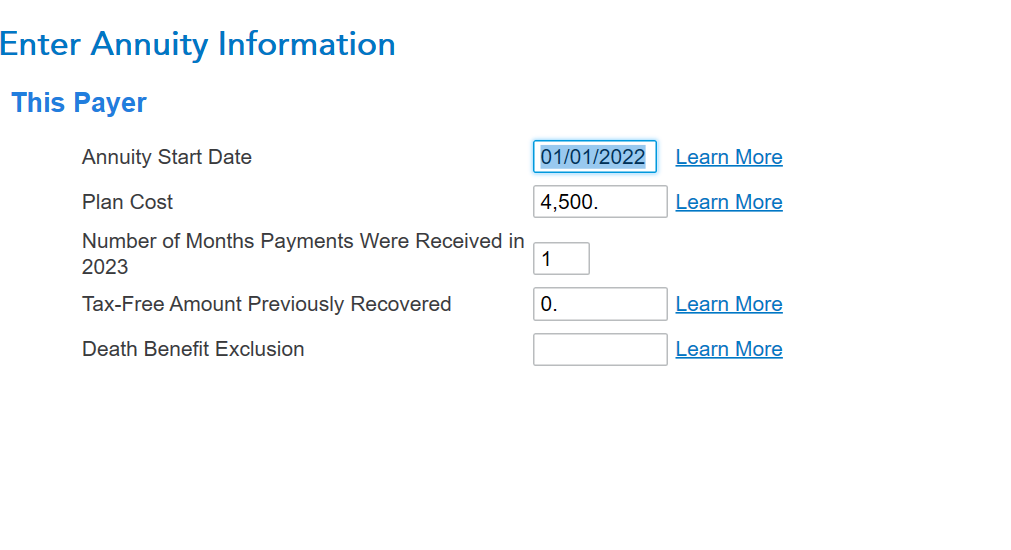

- Enter annuity information. This will determine what part of the distribution is taxable. See Screenshot 3. Don't use the number I placed here as this are for illustrative purposes only. Use your own information from your annuity.

- There will be follow-up questions you will need to answer.

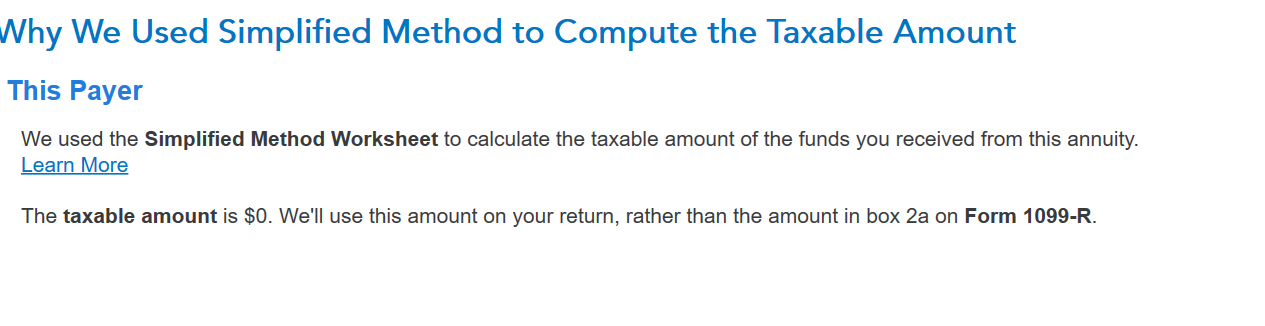

- if you get a message stating how much is taxable, you may need to go back to the 1099R to record this taxable amount. If it is a 0, record it as zero.

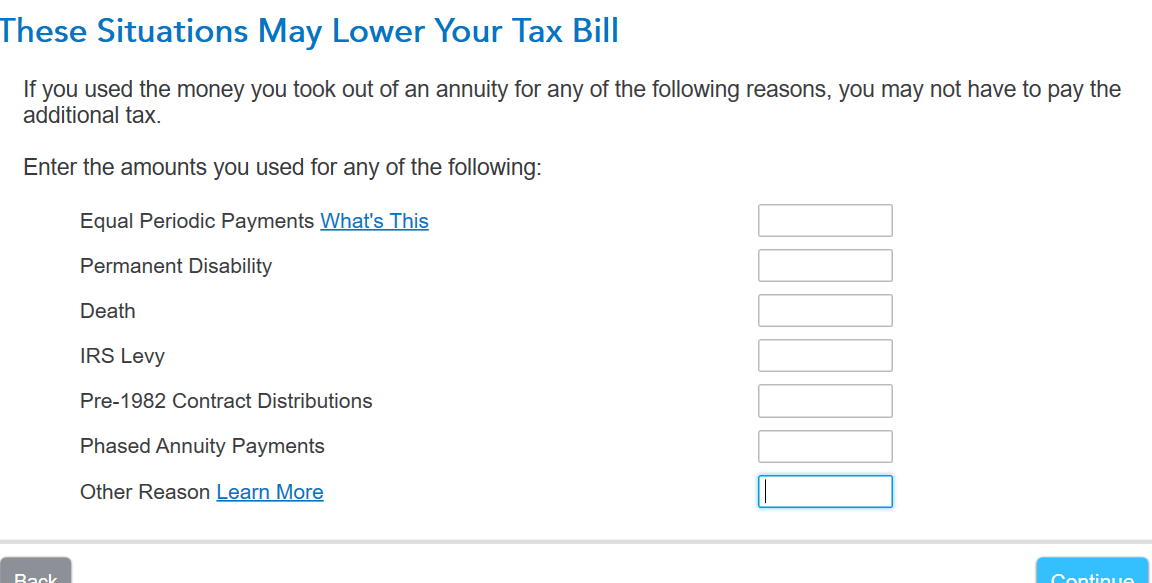

- For the early withdrawal penalty, you may be able to waive it also. See the 4th screenshot on the screen where you would list the exception to be waived.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 22, 2024

9:18 AM