- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- No income. Why return third stimulus payment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No income. Why return third stimulus payment?

I am amending 2021 1040 with TurboTax desktop. I originally received the third stimulus of $1,400.

In both original filing and amended, I had zero income from all sources. My original AGI was 0 and my amended AGI is negative $23,000. I'm even carrying a capital loss, and had no capital gains whatsoever.

With amendment, TurboTax concludes that I must return the $1,400 stimulus!

Why? What am I doing wrong?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No income. Why return third stimulus payment?

Why are you amending the 2021 tax return if you had no income from any source in 2021? The EIP3 does not have to be returned if you were not a dependent on someone else's tax return in 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No income. Why return third stimulus payment?

I have a startup business in an SMLLC that I intend to close. It has accumulated NOLs, and has never made revenue. I need to file amendments to stay current in order to close the LLC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No income. Why return third stimulus payment?

You should not be completing the Recovery Rebate Credit section of the amended return since you have already received EIP3.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No income. Why return third stimulus payment?

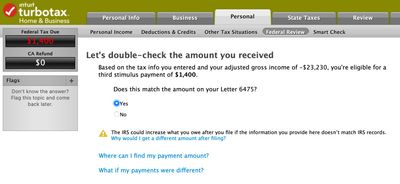

Thank you @DoninGA and agreed! I've been trying to override the section below in TurboTax Home & Business 2021. Is this possible, or is there a better solution?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No income. Why return third stimulus payment?

I'll page one of our members who may be able to assist @Anonymous_

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No income. Why return third stimulus payment?

Really not anywhere up to speed on the recovery rebates and the like, so I'll page @Mike9241.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No income. Why return third stimulus payment?

What did you have on the original 1040 return line 30 for the Recovery Rebate Credit? It should have been 0 or blank. Did you have any refund or tax due on the original return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No income. Why return third stimulus payment?

Thank you @VolvoGirl ! It was blank. And there was no refund, or tax due on the original.

My original 1040 was prepared using a free web-based, non-TurboTax, program. That program did not allow me to amend, so I switched to TurboTax desktop 2021 and, according to threads in this community, recreated the original in order to amend with TurboTax desktop.

In either case, line 30 was blank, and there was no refund, or tax due on the original.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

psberg0306

Level 2

black1761

Level 1

teamely5

New Member

borenbears

New Member

janaly304

New Member