- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- New Jersey Renter Deduction No Impact

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey Renter Deduction No Impact

Hi

I saw I have a $6000 property tax deduction but in the end, it didn't change my refund number. It shows my NJ income tax and none credit.

My NJ tax didn't change regardless of my rent. Is that normal? Does my property tax need to be higher than a certain amount to impact my NJ tax?

Customer reps told me that if I owed tax that would have reduced it but doesn't quite make sense to me.

I use standard deduction for federal

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Jersey Renter Deduction No Impact

It's possible that your property tax deduction has no impact on your refund. The customer rep you spoke to was also correct -- if you owed tax, the property tax deduction would have reduced it.

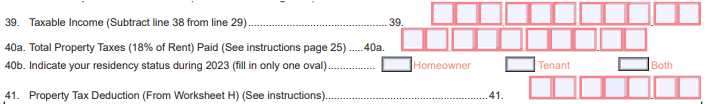

You'll note that your Taxable Income is computed on Line 39 of Form NJ-1040.

Your Property Tax Deduction (which includes your rent calculation) is entered on Line 41. Your Line 41 amount is then subtracted from your Line 39 amount, resulting in your New Jersey Taxable Income on Line 42.

So, if Line 39 (Taxable Income) was zero, any property tax deduction you might be eligible for on line 41 wouldn't lower your taxable income below zero.

It doesn't matter whether you itemized or claimed the standard deduction on your federal return. If this doesn't address your situation, feel free to post back.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

NETOLICKY71

Level 2

vbolkhov

Returning Member

dave-eggleston

New Member

dawnstampfel32

New Member

tjcookies2009

New Member