- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It's possible that your property tax deduction has no impact on your refund. The customer rep you spoke to was also correct -- if you owed tax, the property tax deduction would have reduced it.

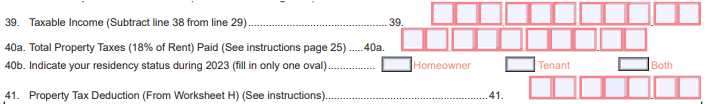

You'll note that your Taxable Income is computed on Line 39 of Form NJ-1040.

Your Property Tax Deduction (which includes your rent calculation) is entered on Line 41. Your Line 41 amount is then subtracted from your Line 39 amount, resulting in your New Jersey Taxable Income on Line 42.

So, if Line 39 (Taxable Income) was zero, any property tax deduction you might be eligible for on line 41 wouldn't lower your taxable income below zero.

It doesn't matter whether you itemized or claimed the standard deduction on your federal return. If this doesn't address your situation, feel free to post back.