- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

My wife and I file as married, filing jointly. We claim one allowance each and we each make $39k. Why on earth do we owe over $400 after filing our 2019 return? We have no other income and the only additional form we have is regarding $540 of student loan interest paid in 2019.

Why are we not seeing the appropriate amount of money withheld from our paychecks?

We got married in 2018 and saw a significant drop in our refund the next year. We'd both been used to getting refunds of over $1k when we were single but that first refund was less than $750. We don't understand why things have changed so much now that we're married and why it's so much worse in this second year. Everything our families told us before getting married was that we'd see even better refunds.

None of this makes sense and we cannot afford this.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

As part of the Tax Cuts and Jobs Act, the IRS and Treasury adjusted the tax withholding tables, which affects the amount of income taxes withheld from your pay. You may want to check with your employer to adjust your withholdings from your paycheck.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

As part of the Tax Cuts and Jobs Act, the IRS and Treasury adjusted the tax withholding tables, which affects the amount of income taxes withheld from your pay. You may want to check with your employer to adjust your withholdings from your paycheck.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

Your refund or underpayment is not relevant, since it is a function of how much you have deducted from you paycheck. You need to look at the total federal tax paid for the year and then compare it to the previous year. You should also look at the percentage of you adjusted gross income was paid in federal taxes and also compare that to the previous year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

If you want more money in your refund as opposed to in your paycheck, one or both of you should claim zero allowances.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

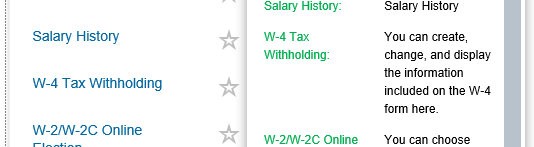

Thanks, Regina. Is that different from our allowances? The page on my company website where you can modify your W-4 is described as tax withholding. From viewing the form below, would you expect different language regarding withholding vs. allowances? Should I be looking for something else?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

Thanks, Jack. If I'm following you, you're saying to compare box 2 on 2018 and 2019's W-2s, as well as box 3?

Box 2

2018 Fed. income tax withheld: $3,825 (8.9% of gross)

2019 Fed. income tax withheld: $3,243 (7.63% of gross)

Box 3

2018 SS wages: $42,982

2019 SS wages: $42,523

If I've not made any voluntary changes since mid-2018 to my W-4, would the decrease from 8.9% to 7.63% be due to the Tax Cuts and Jobs Act mentioned earlier by Regina? Is the W-4 the relevant form to my issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

Thanks, Coleen. I've seen other posts where married couples have claimed zero allowances and still owed money. They were told that they needed to file new W-4s marked as "withhold at a higher single rate," because not doing so indicates you're the only person in the household making money, therefore having less money taken from each paycheck resulting in underpayment. I've also seen it said that withholding at a higher single rate is beneficial when spouses are making similar incomes. Is either of these statements correct?

Why would the difference in zero allowances and one allowance be so great as to (theoretically) result in us getting a refund or owing hundreds of dollars?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

W4's have been completely redesigned for 2020 due to the changes from the Tax Cuts and Jobs Act. Exemptions or Allowances are no longer applicable.

My suggestion is to use the IRS Tax Withholding Estimator here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

Thanks, Catina. I've used the withholding estimator but I'm not sure I understand the results. I've input the necessary info and the results show a substantial refund estimate of $6k if we make no changes to our withholding for 2020. Why do we currently owe over $400 after 2019 if we haven't updated our W-4 since July of 2018?

How can there be such a wildly different estimate from year to year when our behavior has not changed at all?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

You are looking in the correct spot. You can change your allowances from 1 to 0, and/or select additional amount you want withheld in the box next to the allowances.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

Thanks, Regina. I assume it's not realistic the change from one allowance to zero will suddenly get us to nothing owed on our 2020 return, much less a refund, so why has this change impacted us so greatly? Why do we now have to opt to have additional money withheld in order to avoid paying every year? Where is the logic in that?

I don't imagine we're supposed to get political on here, but is this the current administration's idea of a tax cut? People get an extra $40 per month but then have to pay it back in the spring, or opt to continue paying it upfront and then break even when you file? Am I misunderstanding something?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

You are correct in your assumptions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

Nuts. Thank you for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Wife and I Claim One Allowance Each; Why Do We Still Owe Money?

You are welcome!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

waynelandry1

Returning Member

hannahcastellano15

New Member

vbesschetnov

New Member

anonymouse1

Level 5

in Education

mtgguy

New Member