- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My mother moved to another state while I was in college so I moved into a dorm and was supporting myself. I got a new job because my current one wasn't doing enough. I started making more and wasn't e

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My mother moved to another state while I was in college so I moved into a dorm and was supporting myself. I got a new job because my current one wasn't doing enough. I started making more and wasn't e

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My mother moved to another state while I was in college so I moved into a dorm and was supporting myself. I got a new job because my current one wasn't doing enough. I started making more and wasn't e

If your question is whether or not you would still qualify as a dependent of your mother's, the answer is no. In order for her to qualify to claim you as a dependent, you cannot provide more than half of your own support the year. From your question, which unfortunately got cut off, it sounds like you are fully supporting yourself. In this case, you are no longer considered her dependent.

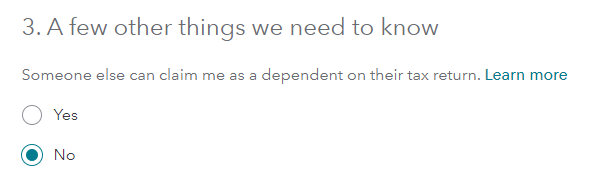

If you have determined you are no longer her dependent, make sure when you are filling out your return this year to answer no to the statement Someone else can claim me as a dependent on their tax return. I have attached a picture for additional reference. You will see this when you first start your return, under Your personal info.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jonvanarkel

Level 1

krishk24

Returning Member

kashifned

Level 2

simone-m-brooks

New Member

djake6

New Member