- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

If your question is whether or not you would still qualify as a dependent of your mother's, the answer is no. In order for her to qualify to claim you as a dependent, you cannot provide more than half of your own support the year. From your question, which unfortunately got cut off, it sounds like you are fully supporting yourself. In this case, you are no longer considered her dependent.

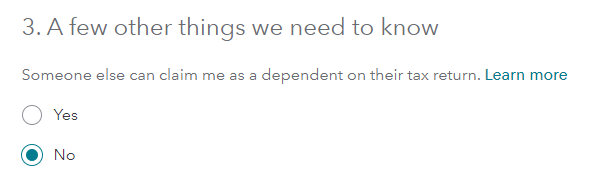

If you have determined you are no longer her dependent, make sure when you are filling out your return this year to answer no to the statement Someone else can claim me as a dependent on their tax return. I have attached a picture for additional reference. You will see this when you first start your return, under Your personal info.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 27, 2021

7:20 AM