- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My 1099-NEC does not have an EIN number, it has a SS number, which I entered using the SS option. But now I'm getting a "Needs review" that insists I provide an EIN.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-NEC does not have an EIN number, it has a SS number, which I entered using the SS option. But now I'm getting a "Needs review" that insists I provide an EIN.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-NEC does not have an EIN number, it has a SS number, which I entered using the SS option. But now I'm getting a "Needs review" that insists I provide an EIN.

But whose SSN is it? It's supposed to be the Payer's (not yours). It may also be that the name doesn't match. For example, is the name Smith Landscaping Service, but the SSN corresponds to John Smith, the owner.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-NEC does not have an EIN number, it has a SS number, which I entered using the SS option. But now I'm getting a "Needs review" that insists I provide an EIN.

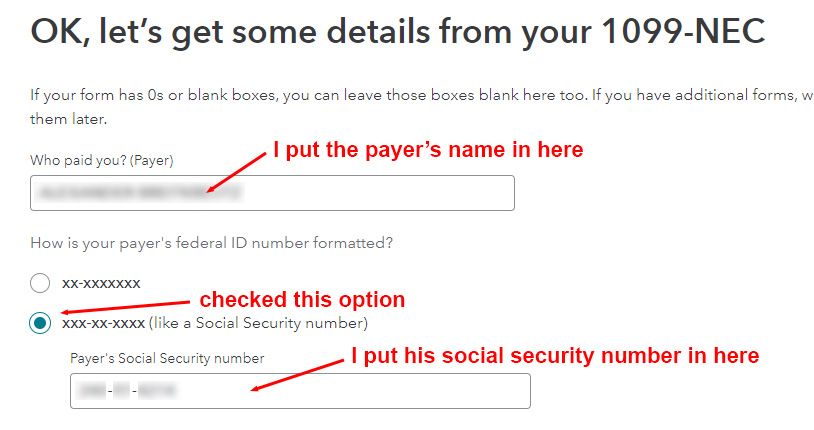

Yes I'm talking about the payer's social security number. His name & his social security number is all that's on my paper 1099-NEC that he mailed to me. He does not have an EIN number. So here's what I entered in TurboTax...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-NEC does not have an EIN number, it has a SS number, which I entered using the SS option. But now I'm getting a "Needs review" that insists I provide an EIN.

I am having the same issue. Were you able to resolve?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-NEC does not have an EIN number, it has a SS number, which I entered using the SS option. But now I'm getting a "Needs review" that insists I provide an EIN.

Unfortunately I was not able to resolve this issue. But I did find a workaround of sorts...

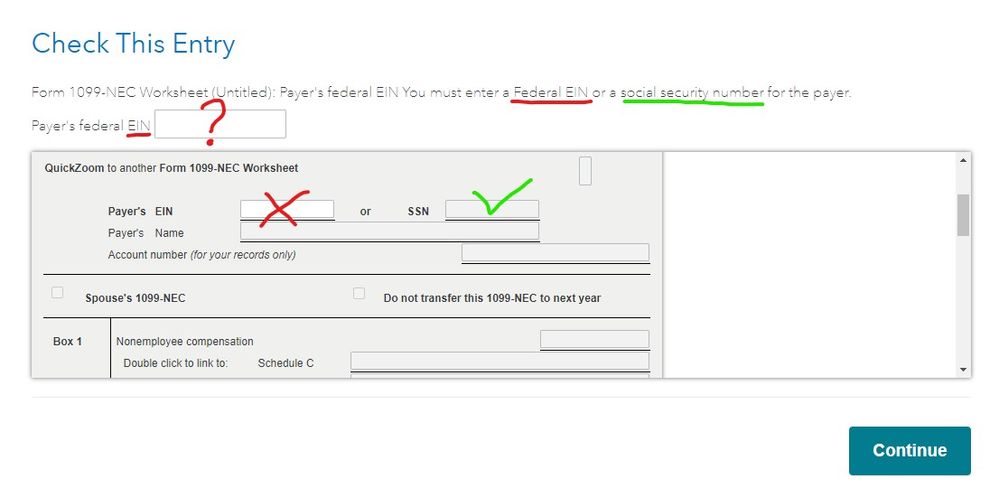

So as a recap... I entered the info from my 1099-NEC using the name & social security provided by my payer. Later in the process I was presented with a "Needs review" which insists I also provide a EIN number from my payer (which he doesn't have). So I posted my issue here & also contacted TurboTax's "free tier" technical help. After a computer screen sharing session a TurboTax tech he told me I would need to obtain an EIN number from my payer which wasn't very helpful.

In the end I just ignored the "Needs review/EIN number" thing. Turns out the "Continue" button on that screen does still work even though its grayed out. From there I was taken to the billing part of the TurboTax process where they happily took my money. But then I discovered doing an e-file wasn't going to be an option, again because of the "Needs review/EIN number" issue. So instead I chose the file by mail method which allowed me to download a PDF file which I could then print & mail to the IRS/State. I have low expectations for this to go well, we'll have to see.

Anyway it's good to hear I'm not the only one having this 1099-NEC SS Vs EIN number issue. Best of luck.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-NEC does not have an EIN number, it has a SS number, which I entered using the SS option. But now I'm getting a "Needs review" that insists I provide an EIN.

Thank you. It's years later, and I'm having the exact same problem. It worked fine last year 😕

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-NEC does not have an EIN number, it has a SS number, which I entered using the SS option. But now I'm getting a "Needs review" that insists I provide an EIN.

FIXED!! I had to delete the 1099-NEC information, and re-enter it. Then it was fine, and I was able to e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-NEC does not have an EIN number, it has a SS number, which I entered using the SS option. But now I'm getting a "Needs review" that insists I provide an EIN.

The Social Security Number is associated with a person not a business, so the name of the business owner (who the SSN is associated with) will have to be entered in place of the business' name. Asked one of Turbo Tax's customers to enter the business owner's name (who the SSN was associated with) and the error went away.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

elizabethelmoreesq

Level 2

Raph

Community Manager

in Events

fletcherrachel27

New Member

user17629853763

New Member

in [Event] Ask the Experts: Biz Recordkeeping & 1099-NEC Filing

Spinner010

Level 1

in [Event] Ask the Experts: Biz Recordkeeping & 1099-NEC Filing