- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Multiple W-2, Multiple work state, Same company

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple W-2, Multiple work state, Same company

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple W-2, Multiple work state, Same company

The answers are below with the questions asked.

Questions & Answers:

1. After I imported W2 to TurboTax, State taxes (box 15 - 17) only showing CA Taxes so I added Another State and manually added Box 15-17 per the W2 New York version. Please let me know if this is what I am supposed to do.

- Yes, that is exactly what you needed to do with the W2 entry. Each state must be included in the same W2 when you have two or more state tax withholding for the same employer.

2. Box 14 in TurboTax has NY PFL (Paid Family Leave) but blank Box 14 - Category. However, there is no Paid Family Leave in the pull down option so I am not sure which one to use. Please help.

- Select 'Other deductible State and Local Tax' - this will flow to Schedule A as an itemized deduction.

3. Box 14 in TurboTax has RSU. But Category is blank. What do I choose? Other (not classified)?

- Yes, select 'Other (not classified)' - Keep track of all RSU information for future use.

4. Do I need to indicate anywhere in TurboTax that I work for x days in CA and y days in NY? If so, where in TurboTax?

- Possibly but not necessarily. As a part year resident in each state you will enter the dates you lived in each state.

5. It seems like I was double taxed in Dec. Do I have to do anything to fix this or is TurboTax smart enough to only deduct CA up to Nov and NY for Dec? I can't figure out this one in TurboTax.

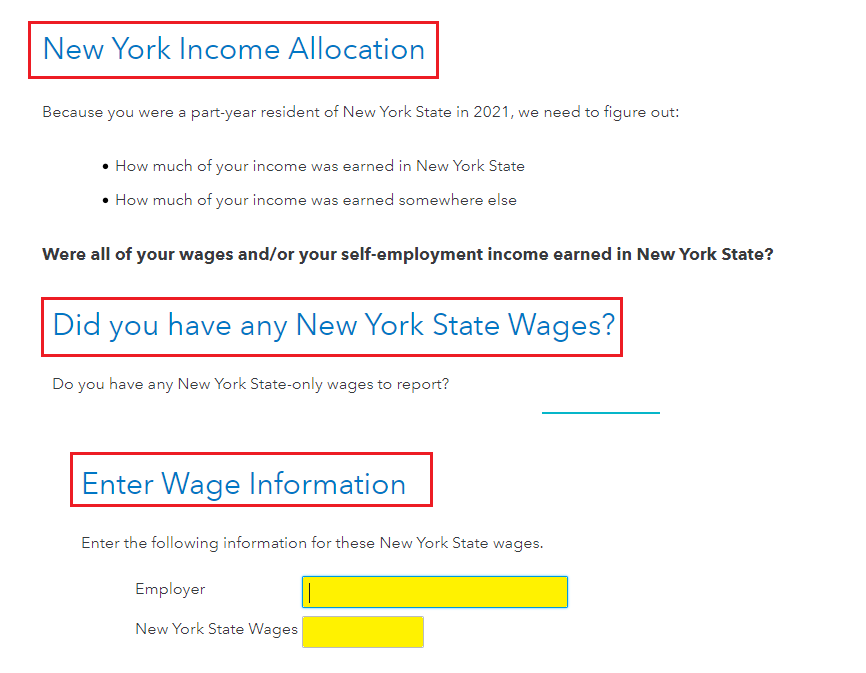

- Make sure you have only the wages taxable to NY in box 16 for this state. Do not put all of your wages in both state boxes when entering the W2. Answer the questions in the NY state interview and pay specific attention to the images below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple W-2, Multiple work state, Same company

Hi DianeW777,

I would like to first thank you very much for taking the time to respond.

Regarding box 16, I hesitate to put in only NY income as I remember that I saw this in my company W2 notes. "The State of New York requires that the Form W2 Box 16 must be equal to Box 1. I also saw below article below that mentioned the same. It seems like this is unique to New York only.

https://www.completepayroll.com/reporting-mult[product key removed]ngs-on-the-w-2

It seems like I have no choice but to put in my full year income in box 16 for NY.

I now have an additional question regarding box 16 for CA. In my paper W2, box 15 is blank with only comment "Total State" with no amount on box 16. When I imported W2 to Turbotax, 100% of my income for both CA and NY are auto populated. Do I put in 100% of my CA + NY in box 16 for CA or only CA income?

In my CA state return, I entered the double tax income in California Schedule S and got the full credit in my CA return. However, it seems like CA is still taxing me for my NY income since my pay stub had CA and NY deduction. I feel like I should not pay any CA taxes for my NY income. Does my explanation make sense to you? Can I just enter my CA total income in W2 box 16 and remove California Schedule S?

Still need to start for NY return. Not happy that I have to pay $45 to Turbotax for another state return.

Again, thank you very much for your help.

Ttandun

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Multiple W-2, Multiple work state, Same company

@standun In your original post you state that you received two different W2s, one for California and one for NY. But when you did the import they were combined into one W2. Seems to me the easiest solution to this whole thing is to enter them into the computer as two W2s with the state tax information separated. That will solve the matching box 1 and 16 problem for New York and you can still get the tax deduction for California.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pownallra

New Member

gksd777

New Member

pogopogo

Returning Member

pogopogo

Returning Member

tyclark98

New Member