- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

The answers are below with the questions asked.

Questions & Answers:

1. After I imported W2 to TurboTax, State taxes (box 15 - 17) only showing CA Taxes so I added Another State and manually added Box 15-17 per the W2 New York version. Please let me know if this is what I am supposed to do.

- Yes, that is exactly what you needed to do with the W2 entry. Each state must be included in the same W2 when you have two or more state tax withholding for the same employer.

2. Box 14 in TurboTax has NY PFL (Paid Family Leave) but blank Box 14 - Category. However, there is no Paid Family Leave in the pull down option so I am not sure which one to use. Please help.

- Select 'Other deductible State and Local Tax' - this will flow to Schedule A as an itemized deduction.

3. Box 14 in TurboTax has RSU. But Category is blank. What do I choose? Other (not classified)?

- Yes, select 'Other (not classified)' - Keep track of all RSU information for future use.

4. Do I need to indicate anywhere in TurboTax that I work for x days in CA and y days in NY? If so, where in TurboTax?

- Possibly but not necessarily. As a part year resident in each state you will enter the dates you lived in each state.

5. It seems like I was double taxed in Dec. Do I have to do anything to fix this or is TurboTax smart enough to only deduct CA up to Nov and NY for Dec? I can't figure out this one in TurboTax.

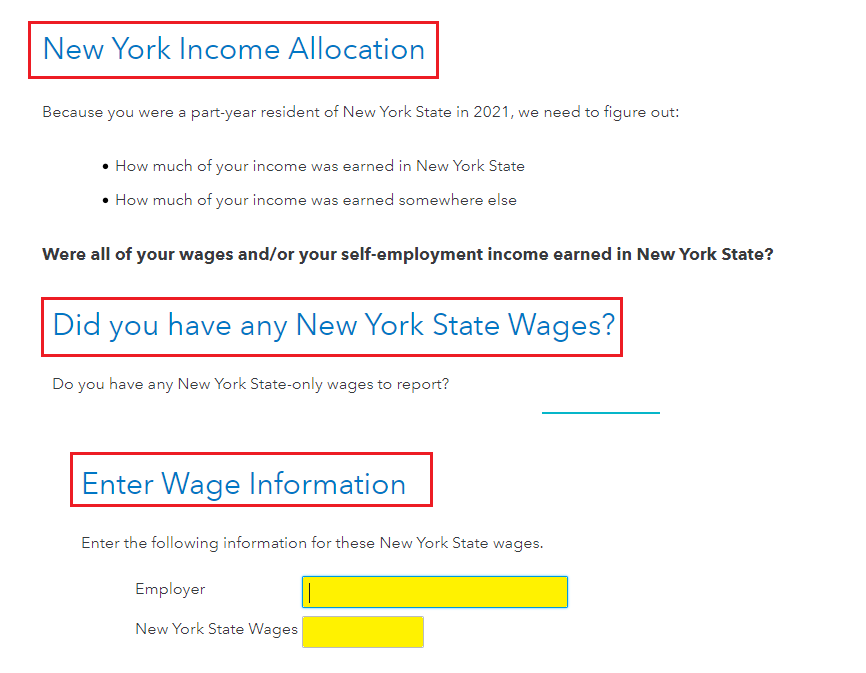

- Make sure you have only the wages taxable to NY in box 16 for this state. Do not put all of your wages in both state boxes when entering the W2. Answer the questions in the NY state interview and pay specific attention to the images below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"