- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Mileage deduction for one car used for multiple rentals question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mileage deduction for one car used for multiple rentals question

I have been confused about how I should use turbotax to handle mileage deduction for one car used for multiple rentals.

For example:

the total miles used on the car in 2023 was 1,746 miles

Among them, 61 miles were used for rental property 1, and 241 miles were used for rental property 2.

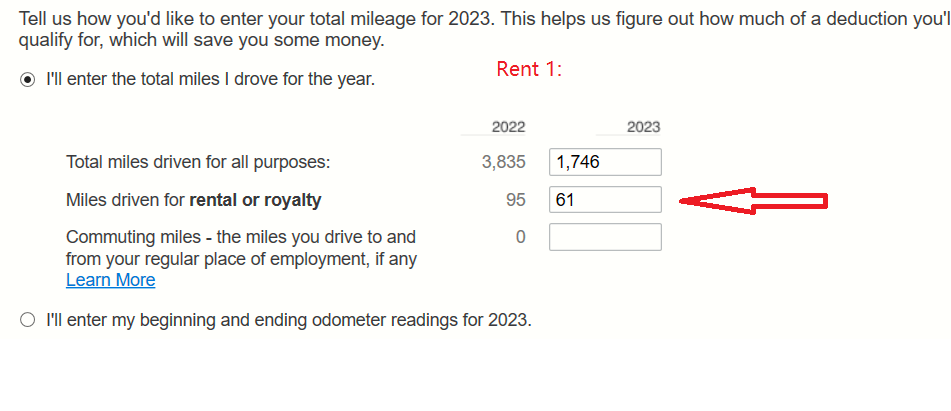

In the rental 1 interview, I entered 1,746 for 'Total miles driven for all purpose', and 61 for 'miles driven for rental or royalty'

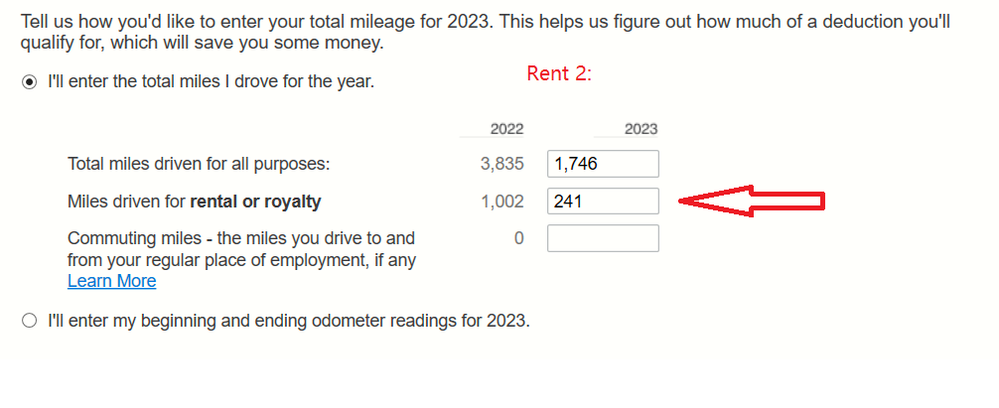

In the rental 2 interview, I entered 1,746 for 'Total miles driven for all purpose', and 241 for 'miles driven for rental and royalty'

Thus Turbotax calculated 3.49% (61/1746) business use for rent 1, and 13.8% business use for rent 2, but this is wrong, right? Because 1,746 miles include two business uses ( 61 and 241).

In this case, how should I handle it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mileage deduction for one car used for multiple rentals question

Yes, as long as you aren't duplicating the miles in the numerator (in this case 61), the proper denominator is the total miles for the year driven on that vehicle for all purposes (including other business, personal, medical, and charitable.)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mileage deduction for one car used for multiple rentals question

It appears that you've handled it correctly. The percentage of business use shown here is the percent of total miles used by each rental. These entries can be pretty complicated at times, but it appears you did it just right from the start!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mileage deduction for one car used for multiple rentals question

so even though the total miles driven (1,746 miles) include two rental properties business driven miles. To calculate the miles portion for the rental property 1, i should still use 61/1746 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mileage deduction for one car used for multiple rentals question

Yes, as long as you aren't duplicating the miles in the numerator (in this case 61), the proper denominator is the total miles for the year driven on that vehicle for all purposes (including other business, personal, medical, and charitable.)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mileage deduction for one car used for multiple rentals question

@SusanY1 Thanks!

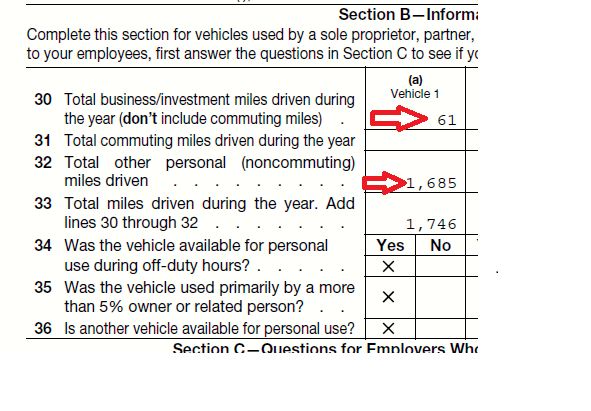

Miles I entered in the interview reflected on Schedule E for the rental property 1.

For example, the total other personal miles driven 1,685 = total miles 1,746 - total business miles driven 61

I am still a little confused here because it literally says 'total personal miles driven' , but these 1,685 miles did include business miles driven for the rental property 2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mileage deduction for one car used for multiple rentals question

It's not intuitive in your case, with two properties, and perhaps would be better worded as miles "not for this business" rather than "personal", but the calculation of the miles (for those taking standard mileage deductions) and percent (for those taking the actual expenses, prorated for use in this business or this rental) works out properly when you enter the total miles as the same for each property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Complexlocal

Level 1

Complexlocal

Level 1

emuehle

Level 2

Smithy4

New Member

Raph

Community Manager

in Events