- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Married Filing Jointly; One spouse Moved from VA to NC, other spouse remained in VA; VA Part-Year Resident Form Errors

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Jointly; One spouse Moved from VA to NC, other spouse remained in VA; VA Part-Year Resident Form Errors

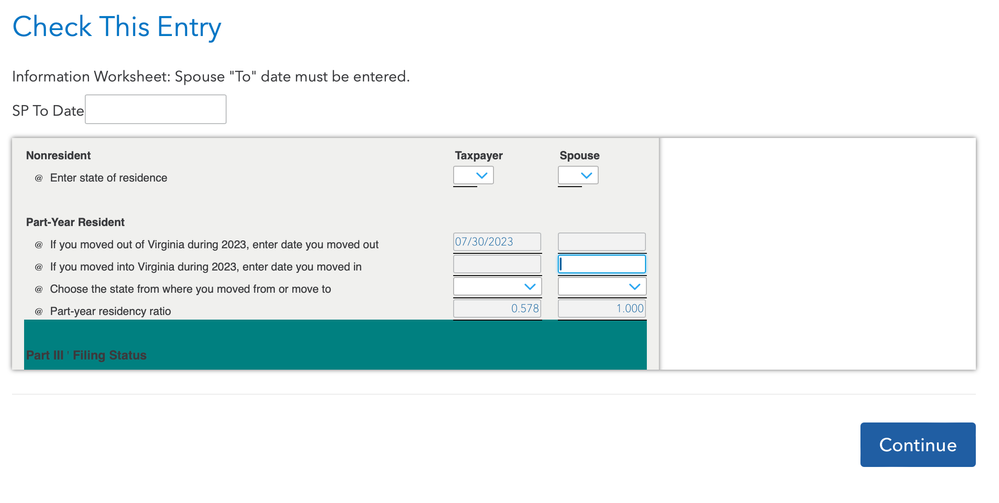

I am using TurboTax Deluxe Online. My spouse and I are married and filing jointly. At the beginning of 2023, we were both VA residents, however midyear, I moved to NC. I have reflected this in the My Info section of TurboTax. When attempting to e-file taxes, I receive a notice there are issues with my Virginia forms which need to be addressed.

Specifically, TurboTax Online is asking me to enter a date which my spouse moved into VA (SP To Date), or left VA (SP From Date). I have left both dates blank as my spouse was a VA resident for the all of 2023. Interestingly, the state to which I moved (NC), is blank on the worksheet and I am not asked about it or able to manually fill it in. I've attached a screenshot.

Please let me know if you need additional information to advise on the best way forward.

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Jointly; One spouse Moved from VA to NC, other spouse remained in VA; VA Part-Year Resident Form Errors

VA page 6 has the explanations and you probably need to file as a full year resident and claim a credit for NC tax paid. See 2023 Form 760PY - Part-Year Resident Individual Income Tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eborshch

New Member

shreyasburse1709

New Member

Navydrifter

Returning Member

Mel1113

Returning Member

bluejade2763

New Member