- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Late 1099-B w/ Section 1256

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late 1099-B w/ Section 1256

I completed & sent in my tax return several weeks ago. Then on March 15th, I received one more 1099-B from an institution that I didn't expect to receive anything from (especially considering it's already March, & every other institution sent their forms ages ago).

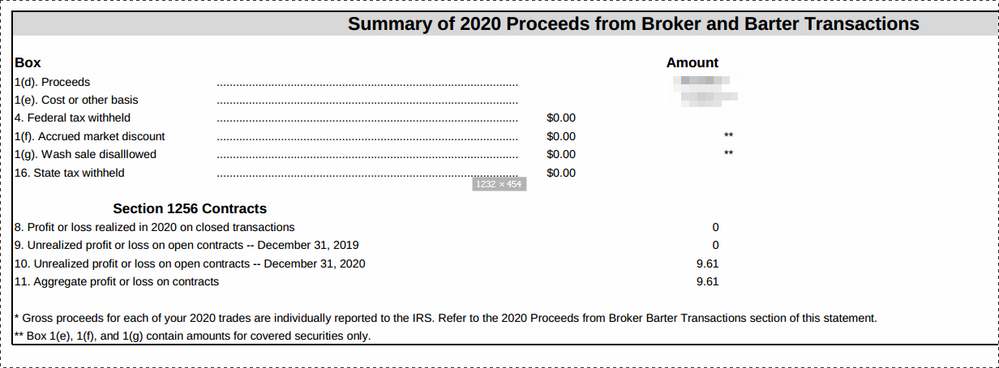

1) The form includes a small amount, ~$10, under "Section 1245 Contracts," as shown below. I did not report these on my 2020 return, because I didn't realize that opened options contracts (not yet realized) had to be reported in 2020 - I was going to report the gains in 2021, when the contracts expire. Question: Now that the company finally got around to sending me their 1099-B, do I need to file an amended return because of this $10 "1256 Contract?" Or should it not be necessary, since it's such a small amount & I'll report the gain in 2021, when the contract expires?

2) For the amounts at the top of the form below (blurred), I did report those on form 8949, with Box C checked ("Short-term transactions not reported to you on Form 1099-B") - because again, at that time, I hadn't received a 1099-B. Do I need to file an amended return, since it seems that now Box C is no longer correct, since they did eventually report it on a 1099-B? Or should I be fine as Box C, since ultimately the sale was reported - just with a different box checked?

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late 1099-B w/ Section 1256

I would advise not to file an amended return for less than $10. It's possible that it would change your tax by a very few dollars, however I would keep it for now with your tax records for future use. Hold off on any amendment for this change.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late 1099-B w/ Section 1256

My main concern was i.e. a computer auto-checks my forms against the 1099-B they receive, & they contact me saying something was wrong. So you think this isn't really an issue, either in the case of the 1256 or the wrong box being checked? With small mistakes like this, common practice is to just leave it be?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late 1099-B w/ Section 1256

I agree to not amend for $10.

But you will not report this on your 2021 tax return because Section1256 is Mark-to-Market at the end of the year.

If it bothers you ,

e-File of form 1040-X for e-Filed tax returns opens shortly.

You can try it out and see how smoothly (or not) it goes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late 1099-B w/ Section 1256

I definitely wouldn't say "it bothers me" - more like "I don't know the norm for what to do in this case, so I'm curious to get the opinion of the professionals." If I can at all avoid having to throw away even more time on taxes, then that's certainly what I prefer. As long as I'm not going to cause myself problems. Like most people, my preference is to be done with this & be able to move on with my life 😛

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Chilbig02

New Member

frusack

Level 1

tgcrozliczenie

New Member

sam992116

Level 3

lilylee

Level 3