- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late 1099-B w/ Section 1256

I completed & sent in my tax return several weeks ago. Then on March 15th, I received one more 1099-B from an institution that I didn't expect to receive anything from (especially considering it's already March, & every other institution sent their forms ages ago).

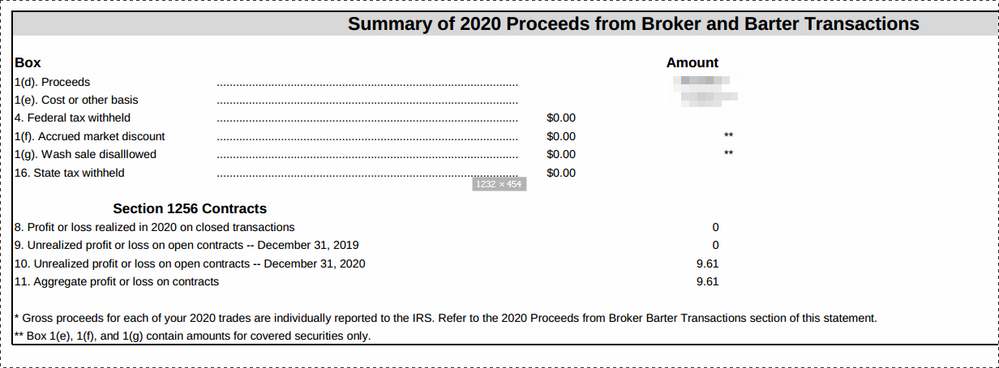

1) The form includes a small amount, ~$10, under "Section 1245 Contracts," as shown below. I did not report these on my 2020 return, because I didn't realize that opened options contracts (not yet realized) had to be reported in 2020 - I was going to report the gains in 2021, when the contracts expire. Question: Now that the company finally got around to sending me their 1099-B, do I need to file an amended return because of this $10 "1256 Contract?" Or should it not be necessary, since it's such a small amount & I'll report the gain in 2021, when the contract expires?

2) For the amounts at the top of the form below (blurred), I did report those on form 8949, with Box C checked ("Short-term transactions not reported to you on Form 1099-B") - because again, at that time, I hadn't received a 1099-B. Do I need to file an amended return, since it seems that now Box C is no longer correct, since they did eventually report it on a 1099-B? Or should I be fine as Box C, since ultimately the sale was reported - just with a different box checked?

Thanks!