- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- L-1 visa holder married to F-1 student. File taxes jointly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

L-1 visa holder married to F-1 student. File taxes jointly?

I'm in the US on an L-1 visa and have been here all of 2024. My wife was on F-1 STEM OPT last year and she has been on F-1 since 2021. She was my dependant on F-2 visa from 2019-2021 before switching over.

We are looking to file taxes jointly.

I'm not sure if she passes the substantial presence test since she hasn't been on F-1 for 5 years. I'd like to know if my understanding is correct in that, we cannot file jointly this year or am I to stand corrected?

Kindly help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

L-1 visa holder married to F-1 student. File taxes jointly?

No, you may file jointly on your return and make the election to treat your non-resident spouse as a resident for tax reporting purposes. Keep in mind, once she revokes her F-1 exemption status, she can't reclaim her exemption status later. This means she will need to pay FICA taxes on her W2 income if she is treated as a resident in 2024.

To claim your wife as a resident for tax reporting purposes:

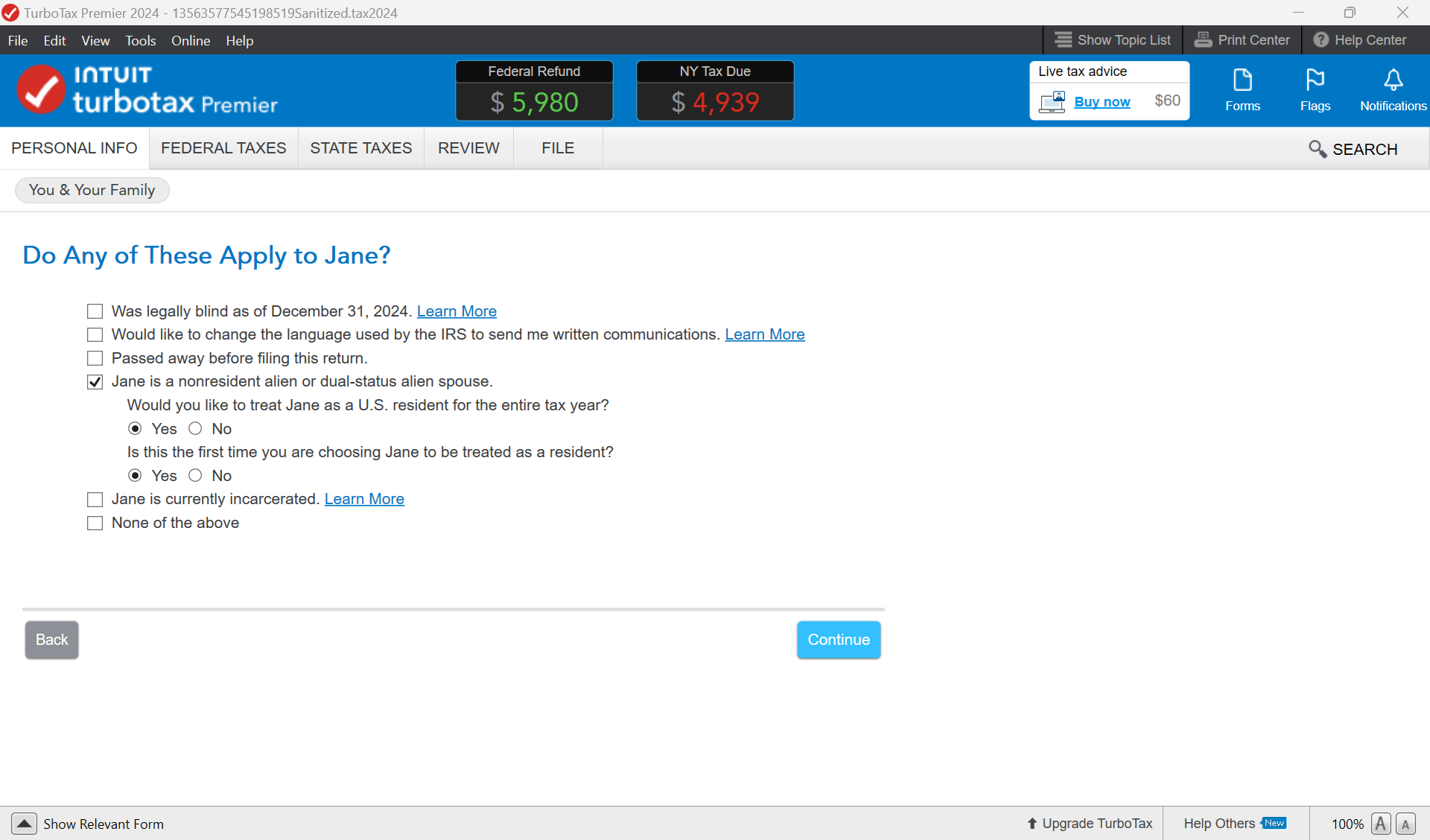

- Go to the Personal Info section of your return

- As you enter information about your wife, there will be a section labeled " Do Any of These Apply to XXXXX

- Select XXX is a non-resident or dual status resident and you would like to treat her as a resident for tax filing purposes

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

L-1 visa holder married to F-1 student. File taxes jointly?

Thank you!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17538710126

New Member

johntheretiree

Level 2

ekcowell

Level 1

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

user17524145008

Level 1

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

user17525140957

Level 2