- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

No, you may file jointly on your return and make the election to treat your non-resident spouse as a resident for tax reporting purposes. Keep in mind, once she revokes her F-1 exemption status, she can't reclaim her exemption status later. This means she will need to pay FICA taxes on her W2 income if she is treated as a resident in 2024.

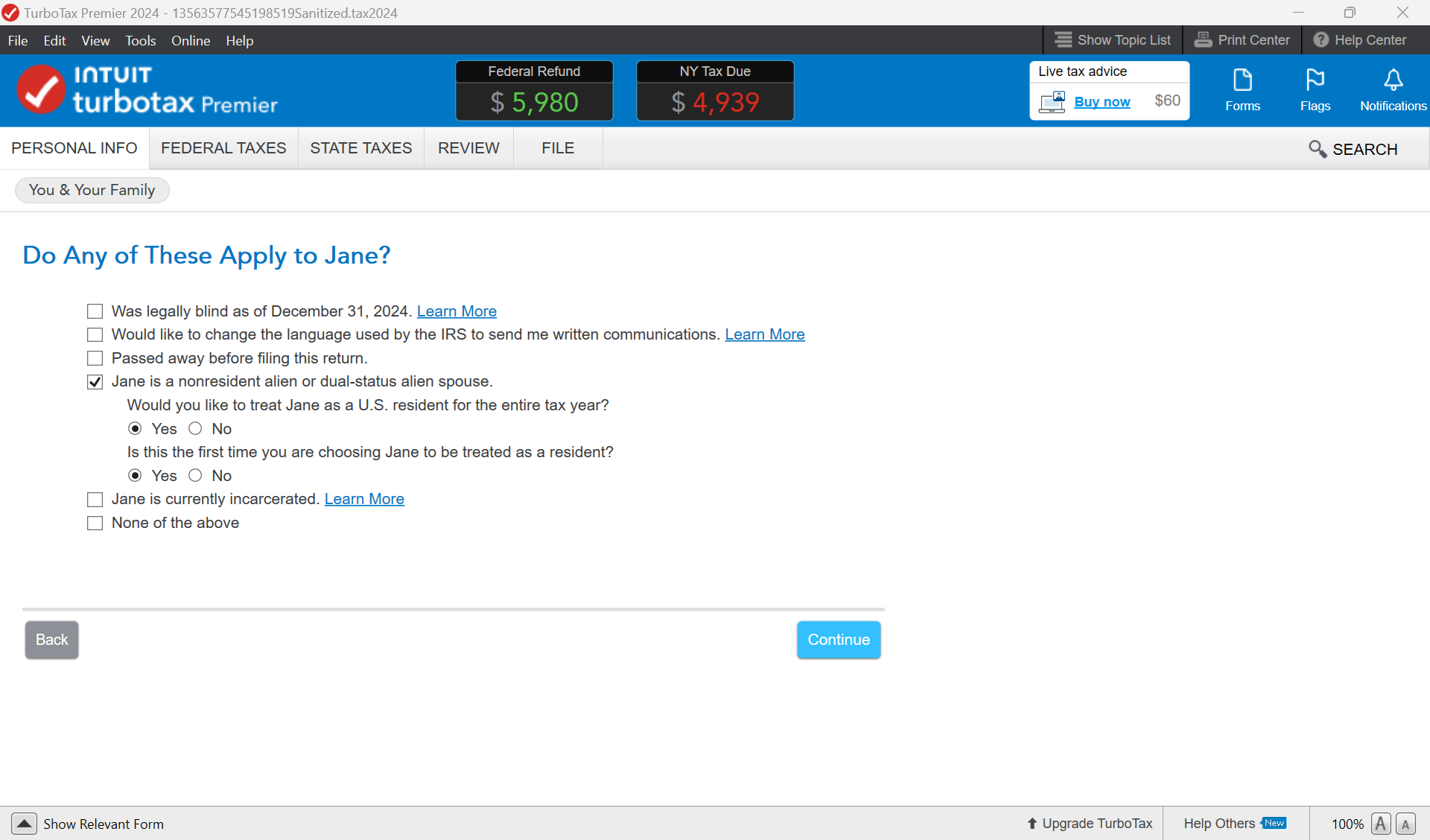

To claim your wife as a resident for tax reporting purposes:

- Go to the Personal Info section of your return

- As you enter information about your wife, there will be a section labeled " Do Any of These Apply to XXXXX

- Select XXX is a non-resident or dual status resident and you would like to treat her as a resident for tax filing purposes

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 1, 2025

1:56 PM