- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- J2 and then F1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

J2 and then F1

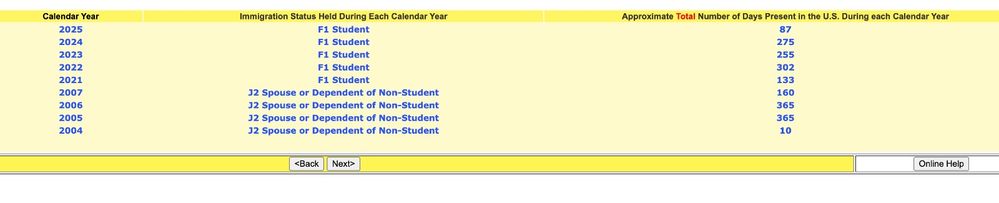

I was a J2 for 2004-2005-2006 and then F1 for 2021-2022-2023-2024.

Today, I got confused because I was told I am a Resident rather than a Nonresident.

But why, because if my older years were counted shouldn't I need to have been a Resident earlier?

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

J2 and then F1

You should not be a resident for tax filing purposes for tax year 2024 since you were exempt holding a F1 Visa.

"Do not count days for which you are an exempt individual. The term "exempt individual" does not refer to someone exempt from U.S. tax, but to anyone in the following categories:

- An individual temporarily present in the U.S. as a foreign government-related individual under an “A” or “G” visa, other than individuals holding “A-3” or “G-5” class visas.

- A teacher or trainee temporarily present in the U.S. under a "J" or "Q" visa, who substantially complies with the requirements of the visa.

- A student temporarily present in the U.S. under an "F," "J," "M," or "Q" visa, who substantially complies with the requirements of the visa.

- A professional athlete temporarily in the U.S. to compete in a charitable sports event."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ddi92234

New Member

user17573810876

New Member

Failte

New Member

elad100031

New Member

cynthiasanders519

New Member