- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Is sales tax paid to an independent contractor for goods included as non-employee compensation on a 1099? If so, where are the sales taxes deducted on the schedule C?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is sales tax paid to an independent contractor for goods included as non-employee compensation on a 1099? If so, where are the sales taxes deducted on the schedule C?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is sales tax paid to an independent contractor for goods included as non-employee compensation on a 1099? If so, where are the sales taxes deducted on the schedule C?

It depends. You can actually include just the flat amount that you paid the contractor, even if that amount includes "nontaxable" reimbursements such as sales tax or mileage reimbursements. Once you claim this amount, you don't need to enter anything else. Your contractor will have to deduct the sales tax on his/her Schedule C.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is sales tax paid to an independent contractor for goods included as non-employee compensation on a 1099? If so, where are the sales taxes deducted on the schedule C?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is sales tax paid to an independent contractor for goods included as non-employee compensation on a 1099? If so, where are the sales taxes deducted on the schedule C?

It depends. You can actually include just the flat amount that you paid the contractor, even if that amount includes "nontaxable" reimbursements such as sales tax or mileage reimbursements. Once you claim this amount, you don't need to enter anything else. Your contractor will have to deduct the sales tax on his/her Schedule C.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is sales tax paid to an independent contractor for goods included as non-employee compensation on a 1099? If so, where are the sales taxes deducted on the schedule C?

If the independent contractor/sole proprietor breaks out the sales tax on their invoice (listing the taxable items separately), should we be deducting that amount from their 1099 NEC amount? Our database 1099 report lists both the pre-sales tax totals and the net paid totals, so wondering if we should be backing out the sales tax amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is sales tax paid to an independent contractor for goods included as non-employee compensation on a 1099? If so, where are the sales taxes deducted on the schedule C?

No you report the total you paid them. The total is your expense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is sales tax paid to an independent contractor for goods included as non-employee compensation on a 1099? If so, where are the sales taxes deducted on the schedule C?

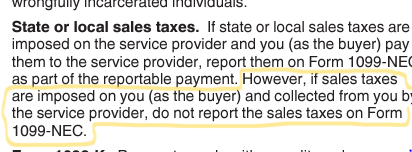

If the service provider is charging us sales tax and it is listed separately on our invoices, then the tax is imposed on us (as the buyer and end user of the product). This snip below is from the 1099-NEC instructions. It seems that we have conflicting views on who the sales tax is imposed on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is sales tax paid to an independent contractor for goods included as non-employee compensation on a 1099? If so, where are the sales taxes deducted on the schedule C?

The instructions have two different statements under State or local sales taxes.

If state or local sales taxes are imposed on the service provider and you (as the buyer) pay them to the service provider, report them on Form 1099-NEC as part of the reportable payment.

However, if sales taxes are imposed on you (as the buyer) and collected from you by the service provider, do not report the sales taxes on Form 1099-NEC.

The thought process is that if you include the sales tax, the person receiving the form will be claiming sales tax as a deduction, first statement.

If the service provider does not pay sales tax, it would not be included, second statement.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is sales tax paid to an independent contractor for goods included as non-employee compensation on a 1099? If so, where are the sales taxes deducted on the schedule C?

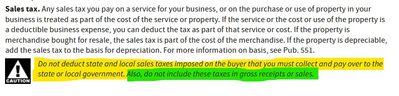

Okay, this is quite confusing. Per Publication 535 posted as of 2021, a business should NOT deduct state and local sales taxes they collect from the buyer to pay to the state AND they should not be including sales tax in gross receipts or sales.

So it seems that we should NOT be including the sales tax amounts that we (the buyer) paid to the independent contractor on the 1099 NEC forms, as those amounts are specifically reported to the CDTFA or the state government. Is that correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is sales tax paid to an independent contractor for goods included as non-employee compensation on a 1099? If so, where are the sales taxes deducted on the schedule C?

If your contractor is charging you $600 for a project, for example, but stopped at Home Depot and bought a $50 part and paid $5 Sales Tax on the part, and you gave him $655, put $655 on your 1099-NEC.

He will report the $655 1099-NEC income, report $600 revenue, $50 for supplies, and $5 Sales Tax as expenses against the income on his return.

Hope this helps!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is sales tax paid to an independent contractor for goods included as non-employee compensation on a 1099? If so, where are the sales taxes deducted on the schedule C?

If the contractor is charging you $600 for a project why would you pay him for the item he bought at home depot or the tax he paid on the item?, Did you mean to say "if the contractor is charging you $600 for time on the project plus cost and tax on materials".....? I am a contractor and when I am charging $600 for a project, well that is the total price. You should be a little more clear when giving advise as your example does not pay attention to the details.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tt40disme40

New Member

Kiki15

Returning Member

lily32

New Member

in Education

kitnkboodl

New Member

sbsvwa

Level 2