in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Is Massachusetts PFML tax deductible on line 5a of Schedule A? It is reported in box 14 on W-2. Turbo Tax has not included it in line 5a. How can I make it do it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Massachusetts PFML tax deductible on line 5a of Schedule A? It is reported in box 14 on W-2. Turbo Tax has not included it in line 5a. How can I make it do it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Massachusetts PFML tax deductible on line 5a of Schedule A? It is reported in box 14 on W-2. Turbo Tax has not included it in line 5a. How can I make it do it?

This Massachusetts webpage describes the PFML fee as a "tax", and furthermore that employees in Massachusetts cannot opt out of it, which makes it a Massachusetts tax.

When you entered this amount into Box 14, what Tax Category did you use? MA Paid Family Medical Leave? I would have though that that would have been enough to put it into line 5a on Schedule A.

Please let us know.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Massachusetts PFML tax deductible on line 5a of Schedule A? It is reported in box 14 on W-2. Turbo Tax has not included it in line 5a. How can I make it do it?

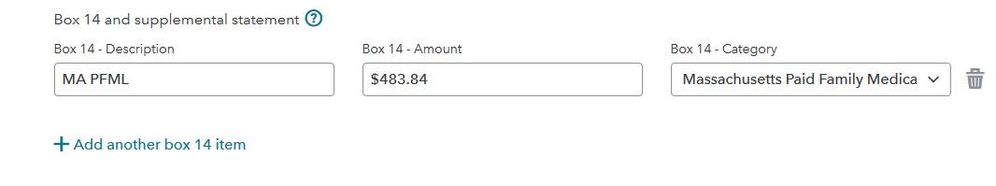

Yes, when editing the W-2, I did specify "Paid Massachusetts Medical Leave" (see screenshot), but when examining the final 1040 output, the amount on line 5a included only the total income tax.

Thanks for the response! This is exactly what I thought as well. So do I have to add this as an extra local tax in order to trick TurboTax into doing the right thing?

Yanko

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Massachusetts PFML tax deductible on line 5a of Schedule A? It is reported in box 14 on W-2. Turbo Tax has not included it in line 5a. How can I make it do it?

Your local tax paid could be entered as an additional line on the w2 or entered as additional local tax paid under other taxes.

I recommend: Go to federal > deductions and credits > estimates and other taxes paid > other income taxes > payments for 2018 or a prior year state or local income taxes paid in 2020. Then select locality (bottom selection is Not Listed) and enter the amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Massachusetts PFML tax deductible on line 5a of Schedule A? It is reported in box 14 on W-2. Turbo Tax has not included it in line 5a. How can I make it do it?

Yes, one can usually trick TT into doing things correctly, but it worked fine last year, so I wanted to know if something has changed since then, or in any case let TT know that there is a bug this year.

Thanks!

Yanko

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Massachusetts PFML tax deductible on line 5a of Schedule A? It is reported in box 14 on W-2. Turbo Tax has not included it in line 5a. How can I make it do it?

Hi - the category I entered was "Massachusetts PFML" which is what is showed as on my W-2.

Last year this was in fact enough for TT to put it in as a deductible tax, but this year it did not. Maybe it is a TT bug that can still be fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Massachusetts PFML tax deductible on line 5a of Schedule A? It is reported in box 14 on W-2. Turbo Tax has not included it in line 5a. How can I make it do it?

You will want to enter the amount you paid for Massachusetts Paid Family Medical Leave in Box 14 using the category "Other deductible state or local tax". This will correctly route it to the state tax forms and provide an additional state tax if you are itemizing deductions.

Entering it in Box 14 and using "Massachusetts PFML" does not work because the system considers that payment of medical leave to you is included in your wages, not a deductible state tax collected from you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Massachusetts PFML tax deductible on line 5a of Schedule A? It is reported in box 14 on W-2. Turbo Tax has not included it in line 5a. How can I make it do it?

Thank you, yes, i can do it manually. I wanted to flag the issue because the behavior of TT is different this year from last year. Last year it listed PFML as a deductible tax automatically.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Massachusetts PFML tax deductible on line 5a of Schedule A? It is reported in box 14 on W-2. Turbo Tax has not included it in line 5a. How can I make it do it?

This is still a thing. Had to go in to the W-2 form to override the Box 14 to "other deductible state or local tax" to appear correctly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Massachusetts PFML tax deductible on line 5a of Schedule A? It is reported in box 14 on W-2. Turbo Tax has not included it in line 5a. How can I make it do it?

I also encountered this problem and switched to different tax prep software to resolve it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Al2531

Level 2

Mbdarkhorse

New Member

bilmarmur

New Member

stacey9554

Level 2

anandmg

New Member